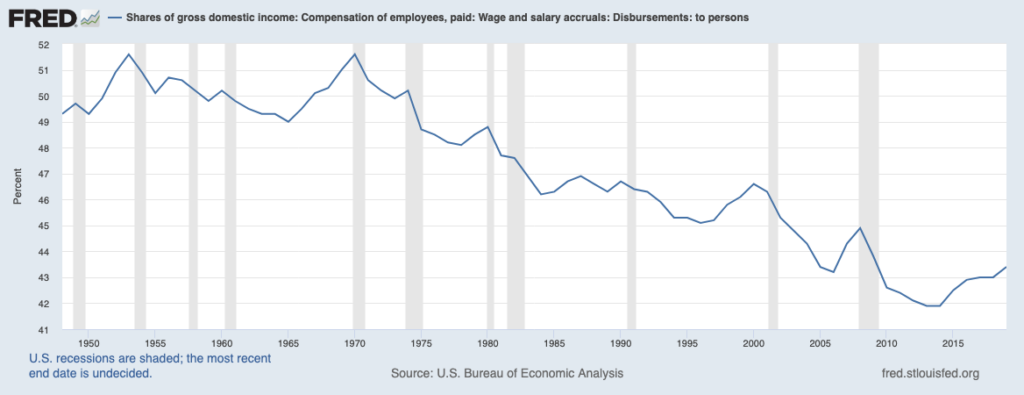

In her first statement as Treasury Secretary, Janet Yellen said that the United States faced “an economic crisis that has been building for fifty years.” The formulation is intriguing but enigmatic. The last half century is piled so high with economic wreckage that it is not obvious how to name the long crisis, much less how to pull the fragments together into a narrative. One place to start is with the distribution of national income between labor and capital (or, looked at another way, between the wage share and the profit share of national income).1 About fifty years ago, the share of income going to labor began to decline, forming a statistical record of the epochal collapse of working class power. Episodes of high employment in the 1990s and the late 2010s did not reverse the long-term pattern. Even today, with a combination of easy money and fiscal stimulus unprecedented since World War II, it is unclear what it would take to reverse the trend in distribution.

Few would seriously dispute that hawkish Federal Reserve policies have played a direct role in the decline of the labor share since the 1970s. This is the starting point for thinking about monetary policy and the income distribution, but many questions remain. Today’s expansionary program extends beyond monetary policy to include fiscal stimulus and even industrial policy, but the first sign of an elite rethinking was the Fed’s dovish turn around 2016. (The Fed chair then was Yellen, whose current tenure as Treasury Secretary has been marked by close coordination with her successor, Jerome Powell.) In a fundamental sense, the entire Biden program hangs on the Fed: low interest rates made possible a reevaluation of the cost of massive government debt, which has in turn opened new horizons for a would-be activist government.

If the age of inequality was the product of a hawkish Fed, could a dovish central bank reverse the damage? Today, there is more reason to speak of a “pro-labor turn” than perhaps at any time over the last half century. But history is not so easily reversed. The new policy regime is not a simple course correction to decades of misguided neoliberalism. There is evidence that the current experiment was made possible by a recognition that workers had suffered a secular defeat—specifically, that they had lost the ability to increase or even defend their share of the national income. What would happen if labor became stronger?

The distributional shift

For decades, decisionmakers at the Fed have carefully monitored labor relations. The attention has often resulted in contractionary monetary policy aimed at restraining ostensibly inflationary wage demands, particularly those made by major unions during collective bargaining. Such was the case with the recession of 1970–1971, which put an abrupt end to an extended period of tight labor markets that had resulted in a marked increase in the wage share. As Alfred Hayes, president of the New York Fed, told his colleagues on the Fed’s Open Market Committee (FOMC):

The outlook for major [contract] negotiations in 1970 is disturbing… some moderate rise in unemployment is a necessary condition to checking the inflationary spiral. This is another way of saying “The slowdown is what we have been trying desperately to achieve. Let’s not reverse it before it has had some results.2

In the story economists tell about the 1970s, the Fed recklessly ignored the need for monetary rigor because discipline was unpopular with politicians and voters. But in reality, hawkish views like Hayes’s guided policy throughout the decade. A glance at the data shows that aggressive rate hikes were underway throughout 1973 and continued for months during the deep mid-decade recession.

The rigor reached new heights with the ascent of Paul Volcker to Fed chair in late 1979. Volcker saw wage demands as a central cause of rising prices and hailed Reagan, with his anti-union interventions, as an exceptionally effective complement to tight money. He even carried an index card schedule of upcoming union contract negotiations in his pocket. Despite occasional tensions, the Volcker-Reagan two-step got both men what they wanted. Along with inflation, union density and strike activity plummeted. The decline was led by the goods-producing sectors, where unions were either broken or forced into concessions. And when productivity growth resumed, wages remained far behind.3

As wages fell behind productivity, a shift of income away from wages was inevitable. Was it intended? Volcker would have said that defeating inflation was necessary for any future economic progress, including wage growth. If inflation destroyed the value of the dollar, a union paycheck wouldn’t be worth the paper it was printed on. He might also point out that recessions squeeze profits as well as wages. Volcker was genuinely independent from narrowly defined special interests, as evidenced by his conflict with the finance-captured core of the Obama administration. And there have been episodes—most notably, the late 1990s—when wages have been allowed to grow. There is no reason to doubt that policymakers sincerely welcome wage growth as long as they believe it poses no threat of inflation.

But it does not take much for central bankers to conclude that wage growth poses a threat of inflation. This tendency reflects political commitments. (Even if one accepts the picture of a wage-price spiral, why emphasize union wage demands, rather than corporate pricing policy, as the cause of that spiral?) In theory, the state could have attacked the 1970s inflation in other ways: mandatory price controls on key inputs, public investment to relieve bottlenecks, nationalization of the noncompetitive and state-dependent oil and defense sectors. Initiatives like these, not infrequent in the history of modern capitalism, were commonsensical to many New Dealers. But in the 1970s, no coalition emerged to remake the concentrated, private core of American economic life. This absence left shock treatment as the only option.4When the downturn came, both banks and unions counted among the casualties. But neither the recession nor the recovery was evenhanded. Homeowners and international banks were sheltered from the worst effects of tight money. Growth, once it resumed, was also invidious. From 1981 to 1996, the Dow Jones more than quintupled; real wages in 1996 were lower than they had been since the Gulf of Tonkin.

No one could have predicted all of this. But redistribution was part of the plan. As Fed chair Arthur Burns reminded an audience in 1977, “ours is still predominantly a profit-motivated economy in which, to a very large extent, whatever happens—or doesn’t happen—depends on perceived profit opportunities.” At the very least, the profit share had to be protected from further erosion. Volcker (and many others) went further, declaring the need to reduce “unit labor costs”—a technical term for the ratio of labor compensation to output.5 It was not just on the shopfloor that labor threatened profits. US inflation weakened confidence in the dollar, threatening the value of dollar-denominated assets and the profits that US bankers derived from dealing in the world’s reserve currency. It was Chase Manhattan’s David Rockefeller who recommended that Carter appoint Volcker, a longtime Chase employee. Rockefeller himself had been offered the Fed post, but turned it down because a “wealthy Republican with a well-known name, and a banker to boot” was the wrong man to implement what he already knew would be “a set of draconian policies.” Better that the job should fall to Volcker, a Democrat unknown to the man on the street (even Carter had never heard of him) but well known to financiers in New York, Zurich, and Riyadh.

Writers sometimes refer to a “Volcker coup.” But the Chairman’s ability to reorient the world economy was possible because it was accepted as legitimate and necessary by a substantial bloc, including the leaders of both US political parties and central bankers around the world. Calls for tight money had always been heard in financial circles, but by the late 1970s the executives of large industrial corporations had joined the chorus. The coalition also encompassed tens of millions of homeowners and shareholders. Always relatively large in the United States, this rentier middle class was subsequently expanded and consolidated by decades of neoliberal policy. Parrying charges that black Americans would suffer most from a recession, Volcker even worked to get members of the Congressional Black Caucus in his corner.6 As important as such outreach may have been, it still required someone at the center, reaching out. As Antonio Gramsci recognized, a successful historic bloc requires alliances between social forces and leadership by a specific group. Looking at American history since the 1970s, who could possibly doubt which group has led?

A new policy regime

As Keynes knew, old ideas guide practical action long after circumstances—and the balance of forces—have changed. Central bankers and academic economists still struggle to shed patterns of thought formed during the Great Inflation and passed on through folklore disguised as professional expertise. In April 2008, when Timothy Geithner, then head of the New York Fed, told the FOMC: “I sat next to Paul Volcker when he gave his speech in New York the other day, and he said that the world today feels as it did in the 1970s.” Geithner complained: “I was alive in the 1970s, but only just. But I think it is better than that. It has to be better than that.” Confirmed inflation hawk Richard Fisher took the bait: “Somebody mentioned yesterday—it may have been Vice Chairman Geithner—that he wasn’t around in the 1970s. I actually sat by President Carter’s side” when he learned the hard lesson “that you cannot risk appearing to be complacent about inflation.”

As heads of the New York Fed, Geithner and Volcker were necessarily close to Wall Street. A map of their connections to the Rockefellers would be extensive. If they disagreed, it was not because they had different goals but because the younger man recognized a new situation. In 2008, Geithner located the crucial shift in the distribution of income: “It is very important that you have not seen any material pressure in broad measures of labor compensation. Profit margins are coming down, but they are still unusually high.” Yellen joined Geithner on the dovish side, arguing that labor statistics offered “further confirmation that at this point nothing is built into labor markets that suggests that we are developing a wage-price spiral of the type that was of such concern and really propelling the problems in the 1970s.” Yellen and Geithner had not become “more tolerant of inflation in the long run.” They simply asked why the Fed should tighten when all evidence pointed toward wage stagnation.

The stylized lessons of the 1970s were preserved not just in oral tradition but in formal economic models. In a 2014 FOMC meeting, John C. Williams noted that “that in many economic models, including FRB/US and most DSGE models, labor share is a key driver of marginal cost and inflationary pressures.”7 He pointed out that “since the late 1980s, we have seen a substantial downward trend in labor share. And the fact that it has been going on for so long—it’s not related to the current recession or recovery—suggests that there really are structural, rather than cyclical, factors driving this, or at least most of this.” Williams was making a policy intervention here. Traditionally, the Fed would raise rates if they expected the wage share to rise. If the wage share was in secular freefall, monetary policy could be looser.

In July 2015, FOMC considered a paper by two staff economists, Andrew Figura and David Ratner.8The paper argued that “the recent secular decline in the labor share,” if “driven by a reduction in worker bargaining power,” could mean that the natural rate of unemployment (the level consistent with price stability) was now lower than it had once been. This argument, explained staff economist David Wilcox, “casts greater doubt on one of the considerations that had been impeding us from marking down the natural rate.” At the time, Yellen and her colleagues believed the “natural rate” was 5 percent. This inclined them toward tightening despite the sluggish recovery.9 The decline of worker power provided one justification for letting the expansion continue.10 What if the balance were to shift? Figura and Ratner suggest that: “if further increases in labor demand eventually increase worker bargaining power and the labor share—bringing them back to historically normal levels… the economy may end up… with a natural rate above levels of a decade ago.” For any gains they made at the bargaining table, workers would pay with their jobs.

Can the wage share ever rise?

In 2016, J.W. Mason offered a still-illuminating demystification of economic ideology. His case study was a New York Times op-ed in which University of Michigan economist Justin Wolfers argued that the Fed should continue to push unemployment lower. How low? Wolfers answered:

It is only when nominal wage growth exceeds the sum of inflation (about 2 percent) and productivity growth (about 1.5 percent) that the Fed needs to be concerned that the labor market is generating cost pressures that might raise inflation.

This was a relatively dovish position. But the technical language conceals a distributional assumption: the labor share of income should never increase. Inequality between labor and capital income can only be reduced if money wages grow faster than the sum of inflation and productivity increases (if wages do not keep pace with inflation, real wages will fall; if wages keep up with inflation but do not outstrip productivity growth, the wage share will remain constant even as real wages increase). But it is just this situation that Wolfers says the Fed ought to forestall, as if redistribution per se were a violation of basic economic literacy.

During the 1960s, redistribution was confronted more frankly. According to a popular stylization of “the golden age of capitalism,” these years saw the substitution of growth politics for redistribution. In the ubiquitous image, the pie grew so that everyone got a bigger slice, without any fights about where to stick the knife in. In fact, the years between 1945 and 1973 saw significant push and pull between wages and profits depending on the shifting balance of forces. The Keynesians of the Kennedy-Johnson Council of Economic Advisors (CEA)—arguably the preeminent institutional expression of the politics of productivity—affirmed the legitimacy of such distributional struggles. Thus, in the 1962 Economic Report of the President we read:

The proportions in which labor and non-labor incomes share the product of industry have not been immutable throughout American history, nor can they be expected to stand forever where they are today. It is desirable that labor and management should bargain explicitly about the distribution of the income of particular firms or industries.

The problem, according to the report, came when bargaining became inflationary. Happily, the first five years of the 1960s expansion combined growth with stable prices. But this depended on a lingering margin of idle workers and unused industrial capacity. Unemployment remained above 4 percent (the CEA’s full employment benchmark) until December 1965. No sooner was this goal reached than inflation reappeared. Throughout 1966, the White House struggled to hold down prices by limiting wage increases to below 3.2 percent (a stylized proxy for the rate of productivity growth in the overall economy). With inflation approaching 3 percent, this guideline would have meant a de facto wage freeze. As real GDP and profits continued to grow rapidly, even some within the White House recognized that their call for wage restraint was unpersuasive.11

Encouraged by low unemployment, workers began to win concessions with clear redistributive and inflationary implications. Meanwhile, productivity growth and profits declined, making wage increases more painful to employers than usual. For a few years, the wage share rose. But the working class offensive depended on the war (in 1968, one American in ten worked in defense-related employment). As Nixon selectively deescalated, tight labor markets disappeared into the rearview mirror. The prospect of downward redistribution crumbled into history’s ashtray like one of Volcker’s cheap cigars.

Will today’s experiment in managed expansion approach the redistributive horizons of the 1960s? The evidence is mixed. Yellen and Powell have already demonstrated that they mean what they say about not jumping at the first rumor of inflation. This is a small step but given the distressing regularity with which the FOMC members have contemplated throwing people out of work on the basis of anecdotes, it constitutes real progress.12 Powell even accepts the possibility of a rise in the wage share, having mused in 2018 that “the late 1990s episode of low unemployment saw wages rise faster than inflation plus productivity growth without an appreciable rise in inflation.”13

In the press, discussions of inflation show a newly sophisticated appreciation of the fact that price increases have many causes, with sector-specific supply chain issues receiving more attention than recalcitrant workers. Some advocates of economic expansion have begun to translate this new interest in bottlenecks into a political argument: public investment, by addressing supply-side issues, should be seen as a form of anti-inflationary policy. To the extent that such ideas become influential, it will be harder to enlist popular opinion in favor of simplistic anti-labor solutions to price instability.

But even with the economy still millions of jobs shy of its pre-pandemic level, there is already an organized attempt to cut short the expansion and declare the experiment a mistake. So far, the major backlash constituencies are low-wage employers and scorned economists, but their complaints will find a bigger audience at some point in the next few years. Joe Biden, the most pro-labor president ever, is already doing his best to ensure that Michal Kalecki’s eighty-year-old writings on full employment remain relevant to the TikTok generation. Even the most dovish mainstream economists continue to see rate hikes (eventually) as the key anti-inflationary policy, revealing the limited spread of more creative thinking about how to manage the price level.

The economists Lance Taylor and Nelson Barbosa-Filho suggest that Biden faces a policy dilemma. Reducing inequality is one of his stated goals. But an increase in the wage share will lead firms to increase prices to an extent that will force the Fed to raise interest rates. This monetary tightening, in turn, will adversely affect asset markets and generate “political resistance from Wall Street and affluent households.” Though the authors do not emphasize it, this would represent a historic shift in political economy. From Marc Hanna to Paul Volcker, rentier spokesmen have traditionally favored tight money, while workers and debtors have longed for expansion. If asset owners now have their own reasons to resist tighter Fed policy, the cause of full employment may have gained an awkward but powerful ally.

But redistribution is difficult because someone always loses. Even in a virtuous circle of demand-led growth, social conflict is never far away. We can glimpse one version of this dynamic in the recent history of Brazil, where the Workers’ Party (Partido dos Trabalhadores, or PT) governed from 2003 to 2016. As a detailed analysis by Pedro Loureiro shows, the PT did oversee meaningful redistribution within labor market incomes, and this redistribution did initiate a demand-led growth cycle. But in time, inflation began to exceed official targets. Rising prices, driven largely by wage gains in the service sector, disproportionately hit middle class consumers. Inflation inhibited further demand stimulus, bringing both growth and redistribution to a halt. Meanwhile, large sectors of the middle class deserted the PT, lending support first to the judicial-parliamentary coup against Dilma Rousseff and then to the presidency of Jair Bolsonaro. You could write a book on the differences between Brazil and the United States, beginning with a long chapter on their relative positions in the world monetary order. But the experience reminds us that economic expansions can generate self-undermining social conflicts.

On these matters, FOMC transcripts contain moments of remarkable lucidity. In 1995, Lawrence Lindsey told his colleagues:

It is not hard to understand how we can get both lack of inflation and an improvement in the unemployment rate when in fact wages are being suppressed. The problem is that we cannot have wages that continue to be depressed and have a 3 percent expansion of the real private economy; it just does not add up. One of two things can happen: In one, workers get restless, wages go up, the profit share falls, and there is upward pressure on inflation. That is scenario “one” … Or we get scenario “two,” where the demand is not there, we do not in fact have 3 percent expansion ex-government in the economy, and we get slower growth than the Greenbook14 is forecasting. My own bet is that the second result is more likely than the first.

In plain language, Lindsey laid out a choice between stagnation and redistribution, and predicted stagnation. It was a smart wager. The subsequent decades of low growth have only now given way to a new willingness to experiment with expansion. While we await the results, we can remind ourselves that we live in an economic system defined by conflict, as well as cooperation, between groups of people with divergent interests. At the Fed at least, no one has ever forgotten this.

The basic idea of a labor share of income is simple, but several issues should be briefly noted. First, there are alternative ways to construct the series: the numerator might include all forms of compensation (including benefits and bonuses) or just wages and salaries; the denominator might be national income, nonfarm business income, gross value added, an so on. Different choices here may imply different turning points, but none alters the overall trend. Second, most measures of labor income includes income earned by the very wealthy (for example, executive salaries or bonuses). This means the labor share meaningfully overstates the income received by non-supervisory workers. Finally, in addition to secular trends, income shares display a cyclical pattern: over the course of an economic expansion, the wage share will generally fall and then rise, while the profit share will rise and then fall. This reflects a number of factors, only some of which can be interpreted as expressions of relative class power. While this makes the statistic a potentially poor guide to short-run developments, at the timescale considered in this essay the secular decline in the labor share clearly dominates any cyclical variation.

↩Quotes in Edwin Dickens, “The Federal Reserve’s Low Interest Rate Policy of 1970-72: Determinants and Constraints.” Review of Radical Political Economics (1996).

↩Tali Kristal, “The Capitalist Machine: Computerization, Workers’ Power, and the Decline in Labor’s Share within US Industries,” American Sociological Review (2013).

↩More radical alternatives received serious discussion in center-left circles at the time, suggesting that the failure was not primarily one of imagination. For example, a 1985 Brookings Institution volume could conclude that “the chapters in this book suggest that the problem of inflation is never resolved without tackling the broadest questions of political control of the economy.” The editors went on to recommend no less than the socialization of investment: “The alternatives of economic policy—how much investment, what sort of investment, what provisions for disinvestment—need to be placed before elected representatives.” Charles S. Maier and Leon N. Lindberg, “Alternatives for Future Crises,” in Lindberg and Maier, editors, The Politics of Inflation and Economic Stagnation (Washington DC: Brookings, 1985).

↩At the aggregate level, therefore, real unit labor cost is just another way of expressing the labor share of income. Depending on your persuasion, see Marc Linder, “From Surplus Value to Unit Labor Costs: The Bourgeoisification of a Communist Conspiracy” (1994)

↩One month before the shock, he told the FOMC: “It’s not every day that we get a letter from the leader of the Black Caucus exhorting us to show more restraint on the money supply side. So I‘m going to carry that letter close to my heart, whatever we decide today.” He appears to have been referring to Maryland’s Parren J. Mitchell, who was chair of the Subcommittee on Domestic Monetary Policy in addition to head of the CBC.

↩FRB = Federal Reserve Bank; DSGE = Dynamic Stochastic General Equilibrium.

↩The paper is also a point of reference in Anna Stansbury and Lawrence Summers, “The Declining Worker Power Hypothesis: An explanation for the recent evolution of the American economy” (2020).

↩Janet Yellen, “Inflation Dynamics and Monetary Policy” (speech at the University of Massachusetts, Amherst, September 24, 2015). In the published version of the speech, Yellen concludes that “movements in labor costs no longer appear to be an especially good guide to future price movements.” Among her citations is another Fed staff paper, Ekaterina V. Peneva and Jeremy B. Rudd. “The Passthrough of Labor Costs to Price Inflation,” Finance and Economics Discussion Series 2015-042. Washington: Board of Governors of the Federal Reserve System.

↩Lael Brainard, a leading FOMC dove, had already cited the then-forthcoming Figura and Ratner paper as evidence that “a reduction in worker bargaining power or perhaps reduced levels of labor market churning are putting downward pressure on the natural rate.” Brainard, “The U.S. Economic Outlook and Implications for Monetary Policy,” (speech at the Center for Strategic and International Studies, Washington, D.C., June 2, 2015).

↩In May 1966, CEA Chair Gardner Ackley warned business leaders that “labor cannot be expected to continue honoring the guidelines as well as it has when it sees prices and profit margins continually rising.” Dean Baker, Robert Pollin, and Elizabeth Zahrt, “The Vietnam War and the Political Economy of Full Employment,” Challenge (May-June 1996).

↩Examples from the FOMC transcripts abound. In September 1996, Yellen passed along a report from one of her contacts who “described the pressures that an inability to hire entry-level workers was placing on supervisors who were forced to work overtime. He explained that quit rates were rising among his supervisors as a consequence. I think this is precisely the type of anecdote that one would expect to hear at the onset of an inflationary episode. If widespread pressures of this type emerge, it seems likely that firms eventually will be forced to bid up wages to retain workers and then pass through higher unit labor costs to prices.” The same month, with unemployment above 5 percent, Yellen personally lobbied Greenspan to raise rates (luckily for workers, he resisted the appeal).

↩This is one case where it may be illuminating to disaggregate the labor share. In 1998, production and nonsupervisory workers in the private sector saw their average hourly earnings increase by 4 percent—an improvement over recent experience, but still below the sum of price and productivity increases that year.

↩“The Greenbook is produced before each meeting of the Federal Open Market Committee. Using an assumption about monetary policy, the Research staff at the Board of Governors prepares projections about how the economy will fare in the future. These projections are made available to the public after a lag of five years.”

↩

Filed Under