Amit Bhaduri was internationally selected professor at Pavia University and visiting Professor at the Council for Social Development, Delhi University. His six books and more than sixty journal articles have consistently scrutinized the foundations of neoclassical economic theory and presented theoretical and practical alternatives. Among his most widely cited contributions, co-authored with Stephen Marglin, is the Bhaduri-Marglin model. Distinguishing between wage-led and profit-led growth, the model has given way to a wealth of research on the relationship between the functional income distribution and effective demand. In other work, Bhaduri has studied technological change in agricultural societies, articulated and criticized the social consequences of finance-led growth, and developed just and equitable alternatives to standard models of development.

In anticipation of Bhaduri’s forthcoming guest-edited edition of PSL Quarterly Review on social democracy, and a Phenomenal World series on related topics, we begin this interview by discussing alternatives to financial liberalization, before turning to a discussion on the future of welfare politics, development strategy, and contemporary models of economic growth.

An interview with Amit Bhaduri

Maya Adereth: The occasion for this interview was a reflection on the breakdown of social democracy. Why don’t we start there?

Amit Bhaduri: In order to understand the breakdown of social democracy, we need to start with its prehistory. In the 1850s, Marx was convinced that if universal suffrage were granted it would spell the end of capitalism. He reasoned that as numerically the largest class in society, workers would dismantle it if given the chance. You also had members of the British Parliament like Lord Cecil, who argued that universal suffrage would mean the end of private property. We know, of course, that neither of these predictions came to pass—the proletariat never came to compose an absolute majority of the population, and private property persisted in spite of universal suffrage. The important inference to draw from this, and from the development of capitalism throughout the twentieth century, is that as a system, capitalism is far more capable of accommodating political change than economic change. General strikes, as powerful as they might be, have never been able to fundamentally alter the structure of property relations under capitalist society. Meanwhile political rights like suffrage were granted, and, progressively, expanded first across the Global North, and then gradually to many countries in the South.

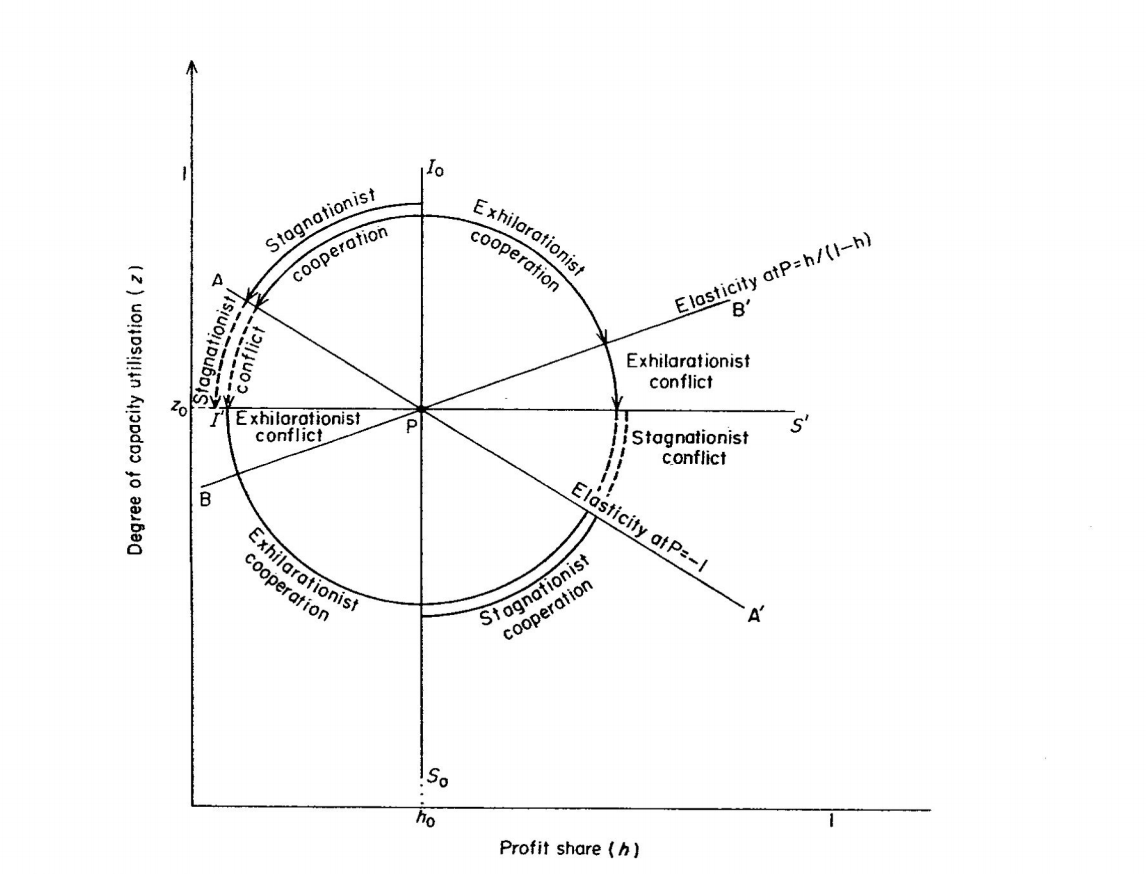

We are then faced with a question: why is there more flexibility on the political side than on the economic one? How is capitalist democracy possible? It’s the coexistence of one person, one vote in the political system and one dollar, one vote in the market system which makes both capitalist democracy viable and social democracy possible. Social democrats in Nordic countries focused generally on increasing social rather than private wage—things like health, education, and housing. This is a classical shorthand formulation of Social Democracy, and it’s what Stephen Marglin and I analyzed through the distinction between wage-led and profit-led regime in an economic framework inherited from Keynes and Kalecki. The former regime is strengthened through public investment, what we’re seeing with advocates of the Green New Deal, which generates effective demand in the short run, and also changes the composition of capital in the long run. But social democracy can also operate through profit-led growth with private profit motive strengthened by measures like privatization and deregulation rolling back the social wage component. This is what Third Way proponents were ambiguous about. The ambiguity blurring the distinction between wage-led and profit-led growth is one reason behind the breakdown of social democracy. The other reason is globalization, which meant that countries had to control wages in order to remain competitive on the international market by reducing labor cost. With globalization, both right and left parties began to converge around the importance of international competitiveness and wage discipline.

ma: What’s impressive about the shift of the 1980s is how consistent it was—you had Reagan and Thatcher of course, but you also had socialist leaders like Francois Mitterrand deregulating the financial sector, and India began transforming to a market-oriented mode under Rajiv Gandhi around the same time. The period is characterized by Thatcher’s infamous TINA: There Is No Alternative. To what degree is that assessment true?

ab: Stagflation, which drove this convergence, was caused by a combination of rising costs and stagnating output. Across countries, the late 1970s and early-1980s was a period of near full employment and rising wages without corresponding increases in production. For politicians, there was a short-term easy option in increasing international capital flows. Attracting capital through the monetary policy of higher interest rate and reducing public expenditure was the politically expedient thing to do, at least for a few years—and hopefully until the next election. Milton Friedman’s 1967 presidential address was entirely directed towards this. And so was Robert Mundell’s argument that it is monetary policy—and not traditional Keynesian demand stimulus—which works in a globalized economy. This inability to pursue expansionary fiscal policy in a global economy is at the root of the economic problems we face today. Indeed, quantitative easing operating mostly through the balance sheets of the central banks is a variation on the same theme.

ma: The problem you identify, of stagnating output, is one which persists to this day. We may not have rising wages, but across the Global North, we’re still living in low growth economies in which the majority of growth is concentrated in the financial sector. How are welfare politics different in this low growth environment?

ab: The question is not about growth per se. What we need to be thinking about is the sort of growth that we are generating. Different types of growth carry with them different distributional outcomes. There’s a tendency today to focus on creating growth by increasing productivity while sidelining employment. This is true across the board—from India and China to Germany, Japan, and the US. Countries like China and India have been good at increasing output, but they have failed to increase employment. This means increased mechanization driven by international competitiveness with little or no increase in public expenditure on the social wage, which generates enormous inequalities. Countries like the US, Britain, and France were able to externalize some of their demand for raw materials for higher industrial growth. But in the large late-industrializers, the frontier of growth is taking place through growing marketization of natural resources. The impoverishment generated by these expansions of natural resource markets is, I think, not acknowledged widely enough.

How does this mechanism of growth maintain inequality? When we redistribute to the rich, as we have done in recent decades, we also starve the real economy of effective demand. There are only so many houses the rich can buy. And in the US, the data indicates that the rich and the companies simply tend to invest most of their money from property income back into the stock market in times of sluggish demand. So you have expanding demand for financial goods and a stock market performance which doesn’t reflect the state of the real economy. The compulsions of a welfare state is marked by a persistent divergence between the real and the financial economy of stocks and property titles. But what is less clear is who would finance welfare and how. Economists like Piketty propose financing it through a wealth tax. But as Joan Robinson once told me, almost paraphrasing Kalecki, a country which can effectively implement that sort of wealth tax required would no longer be a capitalist country. What proponents of the wealth tax don’t seem to understand is that every economic system is embedded in a structure of political power. The sphere of policymaking is bounded by that structure.

I visited Brazil during Lula’s first government. And I remember being told, in slightly different words, that whatever we advise, we should avoid doing something which disturbs the financial markets too much. To return to your main question, the constraint on distribution is not so much tied to low growth, it’s tied to our capacity to change the finance-based power relations now underpinning the economy. Beyond Tobin taxes, which would require much global coordination to function, one idea which Keynes actually presented in the General Theory is a financial transactions tax.

ma: You raise the question of capital flight, and the constraints it imposes on left governments. In the case of the US, at least in the near future, I always think: where would the capital go? Do you think there’s some more policy space here?

ab: I think you are right. The position of the dollar as a global currency, and the enormous size of America’s capital market, gives governments in the US a tremendous unilateral advantage. To go back to your earlier question—I think saying that we can’t have welfare with low growth is like saying we can’t have socialism because it will redistribute property. The constraints on distribution do not emerge from the level of growth, but from the type of finance oriented growth process pursued. This was a relatively neglected aspect of the Keynes-Kalecki theory of effective demand because the composition of investment matters a great deal—both for generating demand in the short run and the supply of social wage goods in the long run. Universal health care and the Green New Deal are obvious examples in the United States.

ma: Earlier, you identified the globalization of financial markets as a key factor in the breakdown of social democracy. How do we navigate a response to globalization that doesn’t fall into nationalism?

ab: Having a focus on the domestic labor market rather than the international one is, at this moment, a good thing. The bluff on the right is the claim that we can achieve this through profit-led growth. If we look at the lower half of income percentiles in the United States, and it’s far more dramatic in a country like India, we see that their purchasing power doesn’t line up with what large corporations, especially financial corporations are willing to produce. The subprime mortgage crisis was a classic example of this. So long as you try to solve the problems of the poor through a profit-led growth of the financial sector, you will only generate economic instability and stock market mania leading to occasional breakdown and rising inequality.

The left response to globalization originates in a sort of fear of the global market. In poor countries, there are good reasons for this, because you have to produce for the poor majority in your domestic market. Once you have capacity to produce enough quality products for your domestic market, you can start to export and trade more internationally. But you should not reverse the sequence. That was the mistake made intentionally or unintentionally in many third world countries. You must not forget the World Bank, the IMF and international credit agencies like Moody and S&P rate not merely financial papers but also the quality of a democracy in terms of its “the ease of doing business.” And governments in developing countries pay great attention to it in a globalizing financial market.

ma: One of the problems with developing the capacity to produce for your domestic market is that it requires sustained investment over a long period of time. The political consolidation required to ensure this long-term investment has frequently given way to one-party governments which end up silencing the dissident movements they claim to represent. You propose an alternative model of decentralized industrialization. Can you talk more about that?

ab: This is a question which has haunted me, and I wrote a book about it called Development with Dignity. It was always wrong to pose a choice between bread and freedom. I have seen when bread is more important: when I was in Vietnam in the 1970s, soon after the revolution, it was the most important thing. The same was true in Cuba and Chile. Revolutionary moments must be especially careful of high inflation when poor people are starved out, and exert control over distribution of essentials. But this initial moment of “bread” cannot last forever. The authoritarian seed of these governments is not only the one-party state. It’s something far more insidious, which exists also in institutionally democratic governments like that of the US—blind commitment to one’s party. What you can have, in these one-party governments, is decentralization from the top. And this is something which the communist state government of Kerala, in India, has done relatively well.

When I talk about decentralization, I’m talking first about fiscal decentralization combined with large numbers of people elected at the local level making expenditure decisions independently at the local level. In India, we have more than 250,000 local government bodies. Some of them may be corrupt, and some of them may be incompetent. But even 10-15% of them would constitute a significant social movement. So in large countries like India, Brazil, and to some extent Argentina, you can have a decentralization of financial power at the local level and allow communities to decide how to allocate their resources. And if local governments fail to use their money towards appropriate social purposes, the central government can reduce or eliminate funding in the next round. In this way, we allow communities to decide how to allocate their resources at the local level.

I think by doing so we also allow for industrialization alongside greater democracy. From this point of view, a universal basic income scheme in a centralized system is a wrong way to proceed because it would strengthen the patron-client relation and have greater tendency towards authoritarian democracy with a top-heavy bureaucracy between the state and the people.

At the local level, democracy also works much better. This brings me back to our earlier conversation about social democracy, and this idea that capitalism is far more amenable to political rather than economic change. In India, we’ve managed to gain one-third representation for women, one-third representation for so-called lower castes. But we haven’t yet seen these changes manifest economically. At the level of the economy, decisions are still highly centralized. So the fight for the left in countries with formal democracies is to combine every political right with an economic one. And in India, and countries with similar social structures, what is urgently needed is the accommodation of financial power at the local level.

ma: To close, it would be nice to take a step back and hear about the trajectory of your intellectual development. Which ideas have most consistently influenced you over the course of your career?

ab: The biggest influences on me have not necessarily been theoretical, but experiential. After finishing my PhD at Cambridge and working in Delhi for a while, I moved to Sri Lanka at the invitation of Lal Jayawardena to work on the development of an irrigation project and a “free rice” public distribution system. In that moment of the Vietnam War and May 1968, there were also popular revolts of unemployed youth in Sri Lanka, and peasant uprisings in Naxalbari, West Bengal, later joined by students in large numbers. After leaving my position in Sri Lanka I traveled around West Bengal villages and saw the movement first gain momentum and then get ruthlessly suppressed by the communist government in power. In 1975, I moved with my wife to Hanoi, where for more than a year I observed the post-revolutionary mobilizations. And on my way to Hanoi, I was stranded in Vientiane, Laos, on the very day the revolutionaries took power in the capital. I vividly remember watching the Revolutionary soldiers, young peasant boys and girls with rifles on their shoulders, enter the city by the hundreds to mark the end of the nearly 700 year old monarchy.

From these experiences, I began to develop my political orientation. I understood clearly the disastrous consequences of equating party with society, despite my total recognition of the achievements that these parties accomplished. I remember the first thing that struck me when I passed through China, right after Mao’s death, when the Cultural Revolution still had resonance, was that they actually managed to give people basic food, and clothing and housing. It was modest, but everyone got it; not like India. And even today, after fifty years, it stays in my mind. But as I mentioned before, the bread is not enough. At a certain point, you have to change the relative emphasis between bread and freedom, and the equation between the party and the wider society. My interest in reinventing social democracy is driven by this.

Filed Under