An interview with Rosella Cappella Zielinski on war finance

War-making is one of the costliest endeavors a state can engage in: states must not only pay for troop wages, but also procure costly military hardware, support allies, and surmount immediate logistical dilemmas inherent in conflict. Peace following war brings its costs too: for example, by the end of the French and Indian War (1754 – 1763), the steep revenue requirements the British faced in protecting new territories would contribute to the instability that fomented the American Revolution.

Academic study of war in the social sciences is as old as historiography itself, and political economists have considered the economic logic of war and peace for centuries. Yet social scientists have left several questions on financing conflict unaddressed: Why do politicians prefer to finance wars in one way versus another? What are the implications of various financing strategies? What institutions grow and flourish out of the necessity to raise the “infinite sinews” of war? The study of war finance in specific can help us answer these questions.

In her 2017 book How States Pay for Wars, Professor Rosella Cappella Zielinski maps out a theory of war finance. As a sub-discipline, war finance has long existed on the periphery of academic debates in International Relations. Cappella Zielinski’s book is a novel contribution to a growing field, providing the first systematic review and analysis of how states are able to float the cost war. Her overarching theory of war finance is expansive, flexible, and useful for understanding the far-reaching implications of wars past and present. Cappella Zielinski’s research sheds light on the “tools of the trade” for raising money, the balancing act between domestic political concerns and politicians’ war finance decisions, and the unexpected consequences war finance has on income inequality.

Below we discuss what first sparked her interest in war finance, the history of the sub-discipline, and the puzzles that remain to be solved.

Kapu Rao: Can you start by saying a bit about what war finance is?

Rosella Capella Zielinski: In my research, I explore how states procure resources and mobilize those resources for their national security needs. More broadly, as a discipline, people who study war finance explore how states pay for war. To give you an example, a recent report by the Cost of War Project at Brown places the cost of the 9/11 wars—17 years and counting—at $5.9 trillion. When we see that number, and look at the details, we can ask a question: Why have three administrations—from two different parties—all paid for the war in the same way? What are the implications of that?

My work provides a framework for understanding these kinds of questions. States can pay for wars in a variety of ways: taxation, debt, printing money, plunder—but typically, in the United States, we think of just two ways to pay for war: taxation and debt. I believe that this dichotomy greatly simplifies all the varying types of taxation and debt, and that the differences between those types actually have huge implications for the distribution of wealth in a state’s economy.

KR: In your book, you present the different war financing strategies along a “citizen’s awareness” continuum. Direct taxation and forced labor are placed on one end of the spectrum, with citizens being highly aware of those strategies; while foreign debt rests on the other end, often barely comprehended by the average citizen. Why did you decide to use citizen awareness as the axis along which you place the various financing strategies rather than, say, cheaper versus costlier forms of financing?

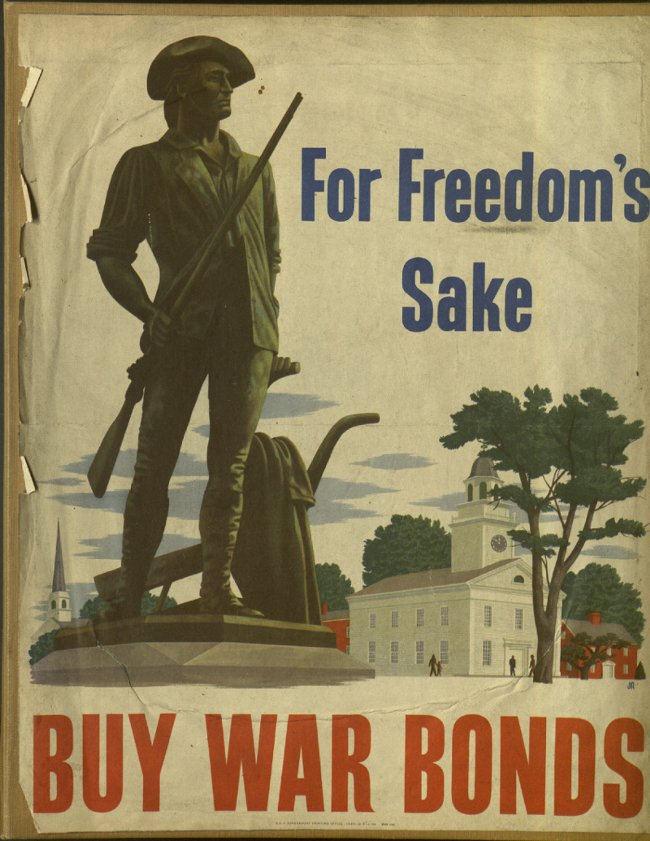

RCZ: The basic insight driving this is that leaders care about being reelected. (There are other scholars who write more directly about this, like Sarah Kreps, in her book Taxing Wars.) What’s important about this is that, because leaders care about being reelected, they are responsive to public opinion. Of course, there are different types of regimes and different types of leaders, but, for the most part, leaders care about public opinion and they anticipate how the public might react in different ways to different forms of financing conflict. Most people don’t like to be taxed, so leaders attempt to finance wars accordingly. If they think the war is going to get a lot of negative attention, they’re going to finance wars in ways that mitigate citizen awareness. This means they’ll borrow, or finance in other ways to make sure that citizens won’t feel that direct sacrifice, that direct relationship to the war.

This concept is pretty old: Adam Smith and other classical economists forward this idea that once citizens feel the sacrifice of war, they’re not going to want it. Smith put it like this: Governments “are unwilling [to increase their revenue], for fear of offending the people, who by so great and so sudden an increase of taxes, would soon be disgusted with the war.”

In modern times, leaders internalize this as a fear of getting kicked out of office if public opinion swings too hard the other way.

KR: Can you talk about what drew you to war finance?

RCZ: The less nerdy answer is that I was interested in political economy, had attended the Saltzman Institute for War and Peace Studies, and was going to grad school in the early 2010s—a time in which we were paying for these wars by borrowing. That seemed insane to me: we’re mobilizing, we have people dying, and yet at the same time we have these major tax cuts and Senators telling us to go shopping, to go to Disneyland. Everything was supposed to be “normal.” And I thought, something about this is not right. That’s how I started going down this rabbit hole of looking at how and why states pay for wars.

KR: It seems like these days, while mentions of war are pervasive in the news and film and TV, it’s generally out of sight in ways it hadn’t been previously. In terms of your war finance continuum, this aligns with a shift to the low-salience strategy of borrowing—awareness of the war itself has diminished in tandem with awareness of the financing for it. There’s a distance between the war and the people involved directly in it, and the rest of the public.

RCZ: Yes, that distance is interesting—and I believe money is the one thing that connects it all together. There was a Pew Study in 2011, on the tenth anniversary of 9/11, that asked respondents about the idea of sacrifice. It found that most Americans agree that those in the military are making a sacrifice, and that they’re sacrificing a lot. Yet those same people also have the mentality that “Well, this is what you signed up for.” The respondents in this survey didn’t value that sacrifice the same way the average American did during the Korean or WW2 era. And in the absence of this strong connection to the idea of sacrifice, many argue, one of the few connections citizens feel to a war effort is financial. I think this ultimately has to do with inequality. And this is the bigger problem: how these changes affect the redistribution of wealth in the United States.

KR: I think for most people the connection between financing wars and redistribution is obscure—we think, oh sure you have to raise money for war, but what does redistribution have to do with it?

RCZ: I just wrote a piece for Foreign Affairs on how wars can exacerbate inequality. There’s a simplistic version of this that says: We borrow for war, and it’s unfortunate because we put that debt on future generations and that’s awful… But that’s not where the story ends!

The future burden of that debt servicing—paying back the war debt—falls on the entire tax base. And when we have tax cuts during wartime, like in the Bush, Obama, and Trump Presidencies, that’s going to fall on middle and low-income households, who eventually pay off much of the government debt.

If you’re wealthy, or you’re a bank, you can buy government debt. So the government borrows from the rich and that money comes back to them with interest. Those middle and low-income households who can’t lend are taxed nonetheless, but never receive the interest payments—so when you pay for these wars by borrowing, there’s a huge redistribution of wealth from the middle and low-income classes to the wealthy. Thomas Oatley wrote an excellent book on this in 2015 that looks at how these wars—in particular Iraq and Afghanistan—have been paid for entirely by borrowing.

It doesn’t have to be this way: we paid for WWI, WWII, Korea, by taxation and borrowing—which was done by lower and middle classes as well. And what happened was a huge redistribution of wealth downwards, which promoted the creation of a healthy middle class in the United States. That’s one example of how paying for war matters.

KR: I’m interested in the change in public opinion you noted earlier—that Americans’ attitude toward the military have shifted to an, “Oh, you signed up for this” type of mindset. Why did this shift happen?

RCZ: My intuition is that it was the shift to a volunteer force in the 1970s. This has further separated Americans. If I ask my lecture hall of 300 students, “How many of you know someone in the services?” Maybe 10 or 15 percent of the lecture raises their hands. But just a few decades ago, everyone would have raised their hand. The services are almost becoming a separate class: You marry someone in the service, your family has been in the service… the military is recruiting from a much smaller group of people. I think this separation—the idea of “don’t worry, just go to Disneyland”—has created a disconnect.

KR: I want to ask about war finance as a sub-discipline within International Relations. When did war finance start?

RCZ: The act of paying for war is of course itself very old. Any political entity—a state, an empire, a principality—that goes to war must mobilize its resources. Everyone quotes Cicero, writing in the first century BCE: “The sinews of war are infinite money.” This is true across time and space: you need resources to wage a war. From a more contemporary perspective, scholars who wrote during the world wars began to observe how wars were increasing in scale. However, this increase in the cost and scale of war didn’t really become a conversation in political science and International Relations disciplines until the 1970s and 80s. At that time there were comparative politics scholars—the most famous being Charles Tilly, with his dictum “war made the state and the state made war”—who began to look at the relationship between wars and state building. And International Relations scholars started to look at the sustainability of long-term military competition, in the context of the Cold War. But most of what I do, and what we understand as the current discipline, focuses on financing war in the immediate. This has really only taken off over the last decade.

KR: Where do you think the study of war finance will be going in the future?

RCZ: The question of the difference between inter-state and intra-state wars is where I see the field heading. By that I mean the financing of civil wars. I’m actually starting a new project on this, and I’ll say this: civil wars are inherently different than inter-state wars. We know that in these cases the state is divided. Think about borrowing for a minute: when the US borrows money, it has the treasury and the central bank ensuring that conflicts are funded, controlling the cost of war via interest rates, maintaining balance of payments and exchange rates, guarding against capital flight, and so on… These central institutions allow a state to run a war economy in a controlled manner. Today, no American is stressed out about the instability of our economy during a war.

But during a civil war? Imagine the instability with no central institutions to comprehensively manage these factors. These conflicts are often in emerging market economies characterized by non-democratic regimes dealing with threats to infrastructure, a civil service that may or may not be loyal to the existing regime, the politicization of central banks, and so on. Studying these conflicts is a lot harder. There’s been a huge explosion in civil war literature, but there’s little work done on the financing of civil wars, and on the bureaucratic and organizational morasses that exist in the midst of them.

KR: I imagine it’s much more difficult for us to get our hands on data in these cases. For example, the Nepali government—the people most invested in finding data on war finance—couldn’t obtain any information on the finances of their insurgent adversaries in the late 1990s. Is an acute lack of data a significant hurdle to people in this field?

RCZ: Great question, I’d say no. Let’s think about the Cambodians and the Khmer Rouge. They got rid of money! Looking at that war, I can’t tell you in a dollar amount how much the war cost, but I can tell you how it was financed. If you care about processes, there’s still much to look at in terms of how these parties pay for the conflict. You’ll never get the numbers in the same way, but the processes can be determined. For example, Neta Crawford who works on the Cost of War Project at Brown, studies the numbers. She tries to tabulate the cost of interstate war, which is really challenging. But my interest lies in the processes.

KR: I’ve recently read Jonathan Kirshner’s work on bankers and war. You’re a political scientist, but I wonder if you have thoughts about what people on the finance side of things can, or should be, asking about war?

RCZ: I will say this: in a different time and place, the financial sector responded to the events of a war. If war went poorly for one state, the financial community reacted. I don’t think that sensitivity is there anymore. If anything wrong goes in Afghanistan, for example, I don’t think anything moves at all in the financing world. The financial community should have more awareness about their role in the process.

KR: Something interesting about this question to me is that finance in general is predicated on expectations and deviations from expectations, but war seems to be chaotic, where tiny variables have significant and unpredictable impacts.

RCZ: Yes, and today, what we’re doing militarily, from a financing perspective, seems very stable. The wars in Iraq and Afghanistan, Syria, and Yemen, are financed in a very stable way. The financing for these wars is so impressively stable that it feels like an aberration.

KR: There’s another oddity in war finance: there are countries that don’t seem to be particularly wealthy, and you might wonder how they’ll be able to raise money, but they raise monopoly money.

RCZ: I always thought that when a state runs out of cash, the war stops. This is completely untrue. Besides the case of the Russians during the Russo-Japanese war, I have never seen a case of an interstate war ending because of money. It doesn’t happen. Money isn’t an inhibitor because there are so many opportunities to get it. I went into this subject thinking the state has a finite number of resources: it does not. The state can print money, go outside the country, collect diaspora remittances. There are simply so many places where the state can procure resources that money is not a barrier.

KR: Is there a general rule that states should raise as much money as humanly possible; that states should not only max out the credit card, but get as many credit cards as possible and max them all out?

RCZ: No, actually, I wouldn’t say so. I think there’s a level of prudence. I think the idea of full economic mobilization is quite rare. Normally, mobilization is done in a prudent way. When done smartly, it’s trying to meet domestic needs as well as wartime needs. War does not subsume everything else, I don’t think, except in extreme cases (South Korea during the Korean War, for example).

KR: How do you think other disciplines—or the average person—should engage with the study of war finance? And what can the discipline learn from outside itself?

RCZ: First of all, I think all US citizens should be doing this: there has to be democratic accountability, and all citizens should be at least somewhat conversant in war finance, to understand where their money is going and what the effects are. Historians and economists who write about this bear a unique responsibility to communicate this information to the public. Sadly, I think economic historians are a dying subset of economics. But more broadly, everyone has something to learn and contribute to these conversations. These more abstract questions of value, money, and meaning can all help us understand why our societies pursue the policies that they do. The social sciences at large can learn a lot from this.

Filed Under