Few economic terms over the last decades have been more influential than “austerity”—invoked by governments and financial institutions as a blanket solution for economic crises, and inspiring years of debate in the public sphere. Austerity, defined by Alesina, Favero, and Giavazzi as “a policy of sizable reduction of government deficits,” or by a general dictionary as an “enforced or extreme economy,” is related to the size of a contractionary fiscal shock.1 Since the 2008 financial crisis, news media have frequently linked austerity to different dimensions of impoverishment,2 and multi-disciplinary research has investigated its impact on living standards,3 as well as its relationship with political instability and democratic erosion.4 However, despite the term’s widespread usage and interest, economists still lack key knowledge about austerity’s long-run impacts.

The global financial crisis ushered a “renaissance in fiscal research,” as referred to by Vallery Ramey.5 This new wave of studies has significantly improved the empirical analysis of fiscal shock effects. Jordà and Taylor,6 for example, have introduced new estimation methods, and the work of Devries et al. constructed historical “narrative” datasets that aim to identify exogenous variations in policy.7 Other papers have indicated that the size of the effect depends on the current state of the economy (during a recession or expansion) and the type of shock (tax or expenditure changes). Importantly, this new literature largely discredits the “expansionary austerity” hypothesis—the idea that fiscal cuts increase GDP. Although first proposed in the 1990s, this hypothesis became increasingly relevant in policy debates after the 2008 financial crisis.

But these works have a major gap: they tend to focus on the short-term impacts of contractionary fiscal shocks, examining effects for a maximum of five years. Although this research provides useful knowledge about the immediate effect of fiscal shocks, it does not address influential claims that austerity’s negative effects only take place in the short-run. Those in favor of austerity policies argue that over time, the economy benefits from more efficient firms and higher market confidence.

In addition to its limited time horizon, the literature has another important gap. As noted above, austerity is defined by the size of a contractionary fiscal shock. But the literature tends to look at fiscal shocks in general, and not austerity policies specifically. Fiscal expansions and contractions, and shocks of different sizes in any given direction, potentially have different effects on the economy. Investment plans tend to be modified only in face of relatively large shocks, and disruptive effects on the financial market are more likely to be caused by contractions than expansions, for example.

Despite lacking knowledge on the key implications of austerity, governments have continued to implement these policies, first after the 2008 financial crisis, and then years later in the Eurozone following the debt crisis. Now a new wave of austerity looms again, as many countries, particularly those in the global South, are resorting to expenditure cuts in the face of fiscal imbalances related to the increased costs of public debt and tax reductions.

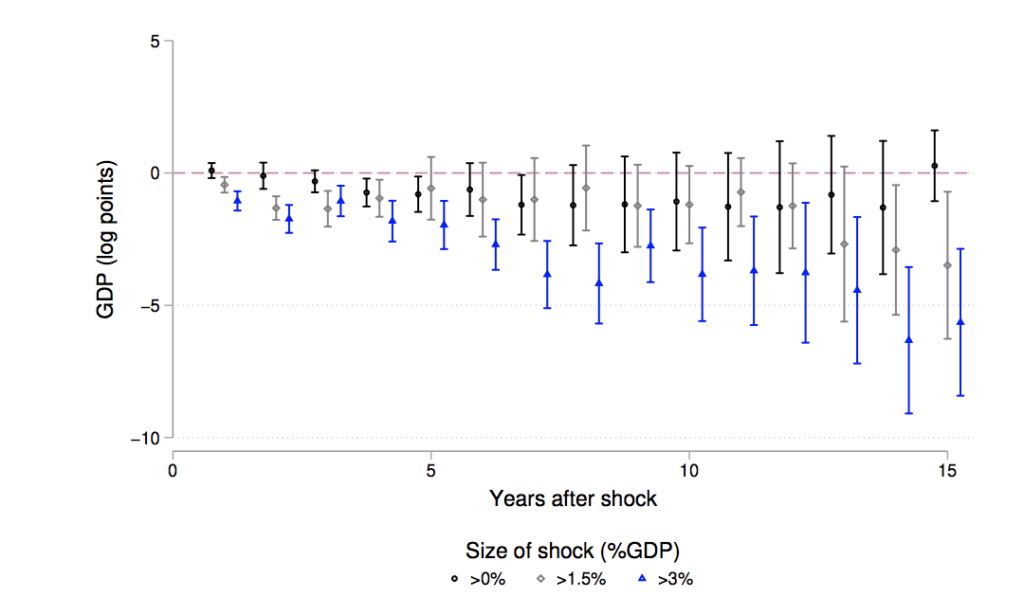

In a recent paper that aims to fill these gaps, I examine the long-run effects of austerity policies implemented in sixteen OECD countries from 1978 to 2014. I address the mentioned problems in the literature by excluding fiscal expansions from these datasets, studying shocks of different sizes separately, and extending the time horizon of analysis. The results indicate that austerity policies have significant long-run negative effects on the economy: contractionary fiscal shocks larger than 1.5 percent of GDP are associated, on average, with a negative effect of more than 3 percent on GDP, even after fifteen years. The permanent drop in GDP tends to increase with the size of the shock, reaching 5.5 percent for fiscal contractions larger than 3 percent.

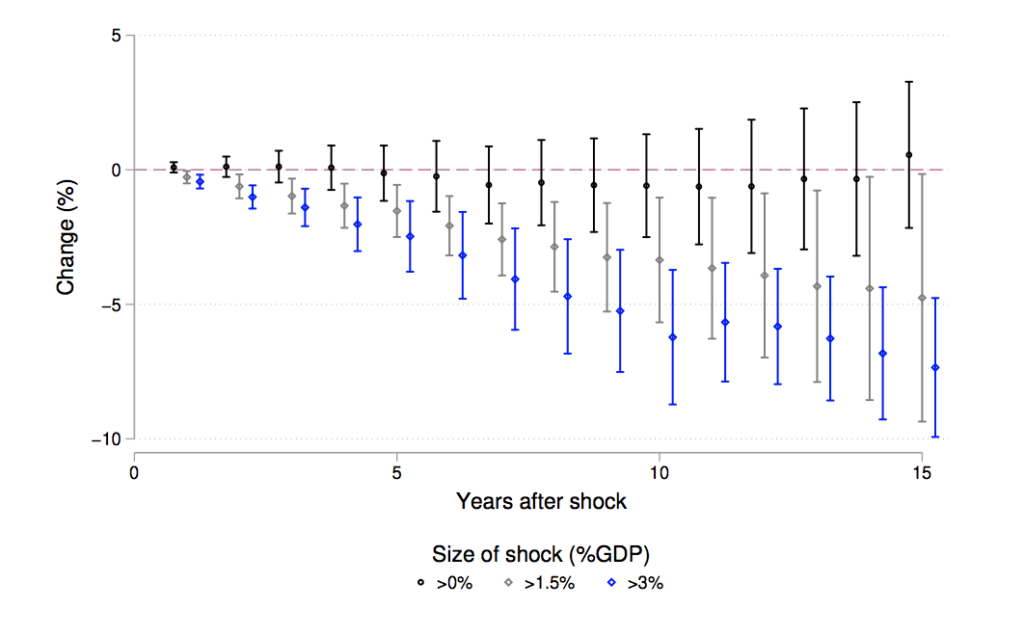

I also find that shocks of different sizes have distinct proportional effects, corroborating the notion that the impacts of austerity shocks are different from fiscal changes in general. Our results that take into account these elasticities of the shocks’ effects indicate that a contraction of around 5 percent of the GDP—as was the case of Italy in 2011—can cause a reduction in GDP of around 7.5 percent in the long run. The 2010–2011 austerity measures in Great Britain—representing 3.6 percent of GDP in 2010 and 3.9 percent in 2011—could, combined, generate a GDP drop of over 10 percent. These austerity measures have even stronger negative effects on the capital stock, confirming that these shocks significantly and permanently reduce an economy’s potential size. The results are robust to several modifications, such as different measures of austerity shocks and GDP, and do not rely on specific episodes or countries.

Figure 1: Effect of austerity by size of the shock

Figure 2: Effect by size: stock of capital

The conclusion that austerity shocks have long-run effects also has important political consequences. Since the 1980s, mainstream economic thinking has asserted that only supply shocks have permanent effects, while changes in demand affect the economy’s fluctuation. Recent years have seen a resurgence of interest in the potential permanent effects of demand shocks, leading to growing research on the long-run effects of financial crises. No research, however, has examined the long-run effects of fiscal shocks.8 This paper, then, contributes to the broader understanding that demand matters for long-run economic growth. These findings suggest that a modern interpretation of “laissez-faire” economics—where governments focus on supply-side policies, leading to labor market flexibilization and financial deregulation with minimal demand management—is flawed.

Back in 2003, influential figures in the profession confidently stated that “macroeconomics’s (…) central problem of depression prevention has been solved.”9 Just a few years later, as mainstream economic thought failed to prevent the largest economic crisis since 1929, it actively promoted fiscal austerity policies that significantly harmed economies in the long run. It is not surprising, then, that in recent years economists have been tasked with revisiting the state of disciplinary knowledge. A greater understanding of austerity’s long-run impacts and the importance of demand for growth can serve as a contribution to this theoretical effort. With new policies again threatening to place the majority of the world’s population under the influence of austerity, it’s all the more urgent to recognize both its immediate and permanent consequences.

Alesina, A., Favero, C., and Giavazzi, F. (2019a). Austerity: When it Works and When It Doesn’t. Princeton University Press.

↩To cite some examples: https://www.theguardian.com/uk-news/2019/sep/10/senior-officer-suggests-austerity-fuelled-surge-in-violent; https://www.aljazeera.com/features/2014/2/21/austerity-and-addiction-in-athens.

↩Rajmil, L., Hjern, A., Spencer, N., Taylor-Robinson, D., Gunnlaugsson, G., and Raat, H. (2020). “Austerity policy and child health in European countries: a systematic literature review”. In: BMC public health 20.1, pp. 1–9.

↩Some examples are: Fetzer, T. (2019). “Did austerity cause Brexit?” In: American Economic Review 109.11, pp. 3849–86, Baccaro, L., Bremer, B., and Neimanns, E. (2021). “Till austerity do us part? A survey experiment on support for the euro in Italy.” European Union Politics 22.3, pp. 401–423, Ponticelli, J. and Voth, H.-J. (2020). “Austerity and anarchy: Budget cuts and social unrest in Europe, 1919–2008.” Journal of Comparative Economics 48.1, pp. 1–19, and Guriev, S. and Papaioannou, E. (2022). “The political economy of populism.” Journal of Economic Literature 60.3, pp. 753–832.

↩Ramey, V. (2019). “Ten years after the financial crisis: What have we learned from the renaissance in fiscal research?” Journal of Economic Perspectives 33.2, pp. 89–114.

↩[Jordà, Òscar, and Alan M. Taylor. “The time for austerity: estimating the average treatment effect of fiscal policy.” The Economic Journal 126.590 (2016): 219-255.

↩DeVries P., J. Guajardo, D. Leigh and A. Pescatori (2011), New Action-based Dataset of Fiscal Consolidation, IMF Working Paper No. 11/128, International Monetary Fund.

↩See Table 1 in the working paper for a list of studies on the effects of fiscal shocks on GDP.

↩Lucas Jr, Robert E. “Macroeconomic priorities.” American Economic Review 93.1 (2003): 1-14.

↩

Filed Under