The 2008 crisis heralded a new age in central banking. The scale and nature of central bankers’ interventions was unprecedented. Traditionally, as lenders of last resort, central banks lend at escalating rates against good collateral to solvent institutions in times of crisis. In 2008 central banks broke every rule in the book: deviating from the principle of full collateralization, they lent to non-bank entities and made outright asset purchases. This exposed their balance sheets to various credit, interest-rate, and market risks. The European Central Bank made asset purchases under an “enhanced credit support” program that dealt in public securities of various credit risks and even provided liquidity in foreign currencies, primarily the US dollar.1 The Bank of England made outright purchases of government bonds while the US Federal Reserve purchased up to 90 percent of all new issues of mortgaged backed securities (MBS) to ensure liquidity in US money markets. The Fed also established swap lines with various central banks, including the Swiss National Bank, the ECB, the BoE, and the Bank of Japan. It went as far as to provide these lines to a select few central banks in the Global South, among them the Central Bank of Brazil and the Bank of Mexico.

Scholars and market watchers have documented and discussed the evolution of crisis-management tools at length. But the most consequential boundary that central banks trespassed was not during the crisis—after all, discretionary measures to prevent a system collapse have been part of central banks’ evolution. The real innovation came in the adoption of crisis tools in noncrisis times, under the banner of so-called unconventional monetary policy. While the use of emergency facilities has attracted much analysis and debate, the adoption of long-term asset purchases in noncrisis times remains underexamined.

The rise of interventions

A quick recap of the British monetary orthodoxy debates of the nineteenth and twentieth centuries provides a sense of just how far central banks have come in embracing an activist role. Intervention went against the classical monetary theory of David Hume and Adam Smith, who advocated an invisible-hand approach to banking: for Hume, this was based on the price-specie-flow mechanism; for Smith, on competitive banking. It was not until the publication of Walter Bagehot’s Lombard Street in 1873, which outlined a role for central banks as what we now know as the lender of last resort (LoLR), that the debate took a turn. Against the background of multiple crises in the centralized English banking system, the Bank of England—until then reluctant to act as a lender of last resort—accepted the legitimacy of intervention in crisis periods.

The acceptance of, and justification for, interventions during noncrisis periods (let’s call it monetary policy), however, took much longer. Monetary policy as we know it, while first having been articulated by Henry Thornton, had to wait for Knut Wicksell’s 1898 Interests and Prices to make a mark in the debate. Whereas Bagehot’s primary concern was ensuring an adequate level of reserves and maintaining trust in the financial and monetary system, the Thornton-Wicksellian monetary policy envisioned a broader mandate for the central bank. As lender of last resort, the central bank was to simply defend the banking system against a sudden collapse (defensive central banking); monetary policy, by contrast, sought to influence or fine-tune the real economy through monetary instruments such as the Bank Rate (active central banking).2 Prior to the 2008 crisis, most central banks had one goal, price stability, and short-term interest rates were the primary policy lever to achieve it.

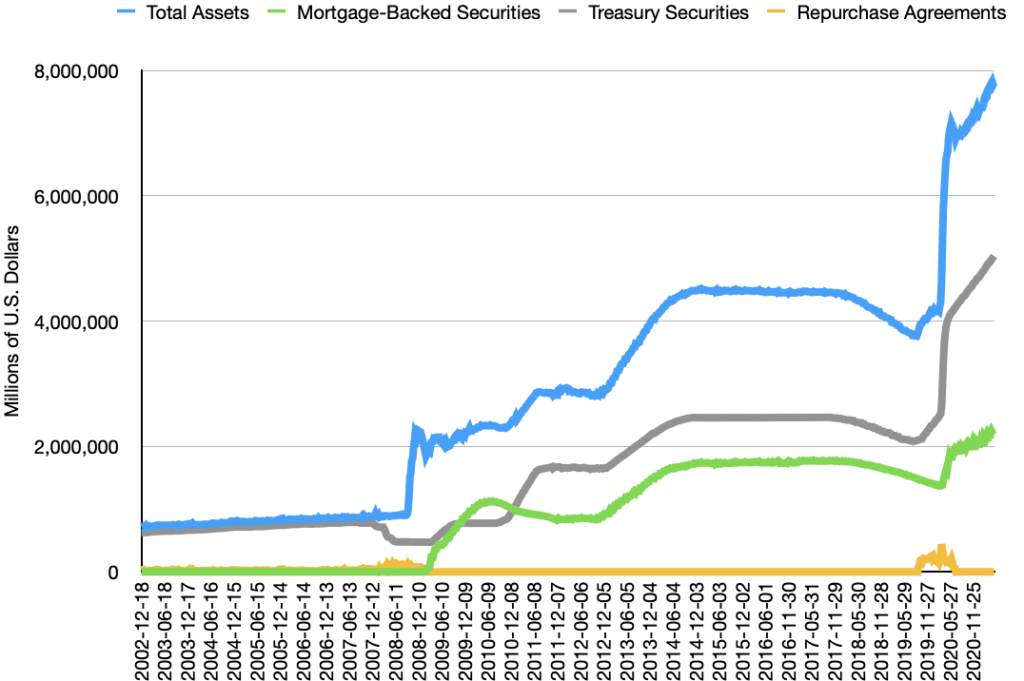

If we fast-forward to the postcrisis period after 2008, we encounter highly active central banks making large-scale asset purchases in the name of monetary policy. Interventions undertaken as part of unconventional monetary policy are indistinguishable from asset purchases made during the height of the 2008 crisis. For example, during the crisis, the Fed bought up vast quantities of MBS as traditional market-makers refused to take on the risk exposure.3 Subsequently, similar asset purchases came to be understood as unconventional monetary policy, or quantitative easing, whereby the Fed purchases long-term securities through the issue of new money. The Fed has done four major rounds of QE since the 2008 crisis. The resulting expansion in the Fed’s balance sheet is shown in Figure 1.

One way to interpret these measures is to accept central bankers’ justification that once the policy rate approaches the lower bound, central banks need new tools to provide additional stimulus.4 Another way to read this is to consider how the shadow banking system requires central banks to broaden their interpretation of monetary policy to include a financial stability mandate. Shadow banking, defined as credit intermediation by nonbank entities,5 renders the financial system highly vulnerable to sudden losses in liquidity. In shadow banking, liquidity squeezes manifest as confidence crises in collateral value and counterparties, giving rise to “disorderly” or “dysfunctional” financial markets (as opposed to bank runs per se), that is, crisis in modern finance plays out through its plumbing.6 Large-scale asset purchases stabilize the system by injecting liquidity to prop up asset prices and restore confidence in financial securities and markets. Importantly, ensuring financial market functioning, or market liquidity, is also a prerequisite to the conduct of monetary policy.7

Monetary policy works through the plumbing of finance; central banks target the overnight rate primarily through reserve requirements and open-market operations in domestic repo markets. When repo markets freeze and bond and equity markets face disruptions, central banks face challenges in the implementation of monetary policy (moving the short-term interest rate, such as an overnight rate, toward the policy rate) and in its transmission (influencing inflation, employment and growth). It is not surprising then that they cite “dysfunctional financial markets,”8 “disruptions in financial markets,” or “market dysfunction,”9 and “malfunctioning of markets”10 as a key motivation for unconventional monetary operations in the postcrisis period.

Absorbing risk

While it is the case that providing economic stimulus (lower market yields, both short- and long-term) is a key driver for QE, equally prominent is the goal of fixing “dysfunctional markets”. The Fed undertook its fourth round of QE in March 2020 during the early heights of the Covid-19 pandemic. When asked why it continued to buy $40 billion per month in MBS despite a strong housing market, Fed chairman Jerome Powell signaled the importance of financial stability: “we started buying MBS because the mortgage-backed security market was really experiencing severe dysfunction…it’s not meant to provide direct assistance to the housing market. That was never the intent.”11

It is not always clear what objective—stimulus or stability—the Fed targets with asset purchases, a fact recognized by central bankers themselves. According to the 2020 BIS Annual Report, while the objectives of monetary policy and LoLR differ, instruments used in these operations increasingly overlap, making the relationship between monetary policy and LoLR more “complex” and “nuanced.” This overlap poses numerous challenges, one being that whereas liquidity provision through wide-scale asset purchases may be justified as LoLR operations because they are temporary and prevent system collapse, the same does not apply in the case of monetary policy. Asset purchases undertaken in the name of monetary policy appear to be permanent with lasting distributional implications. It involves a major risk transfer: swap out illiquid financial instruments on private balance sheets for high-quality assets, including central-bank reserves, from the Fed.

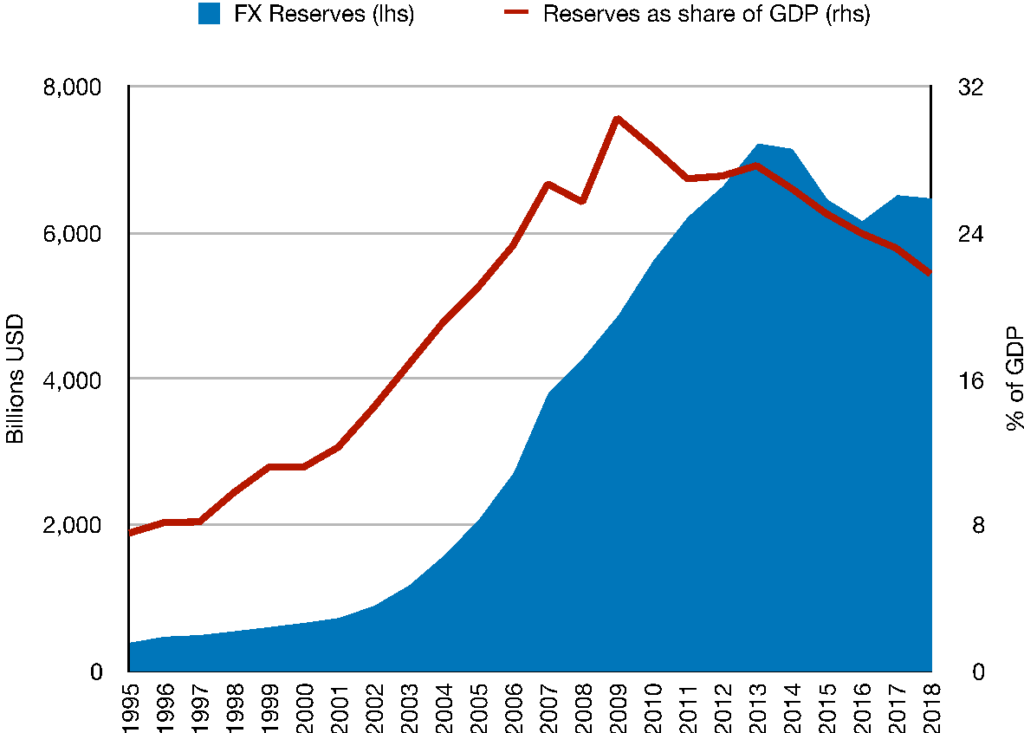

The trend is not limited to the financial core. In fact, central banks in the Global South have long used their balance sheets in normal times to absorb risk for the private sector. This is clearest in the accumulation of foreign-exchange (FX) reserves as an insurance policy against currency crisis, the single biggest threat to financial stability in the Global South. The 1990s and 2000s saw a series of currencies collapse under the weight of short-term volatile capital flows, from the South Korean won to the Turkish lira. Central bankers quickly learned that maintaining financial stability in a rapidly integrating world economy required currency management. This meant that central banks accumulate “war chests” of foreign-exchange reserves (see Figure 2), mostly denominated in US dollars, which they then use to manage the exchange rate via the sale and purchase of hard currencies. As with the Fed’s QE policy, reserve management works to improve central-bank balance sheets. And similarly, it reconstitutes the central bank as a market-maker bearing risk for an increasingly fragile, collateral-intensive, segmented, and yet globally integrated financial system.

Private actors who engage in cross-border transactions benefit via the currency hedge that central bank FX purchases provide. In India, for example, reserves held by RBI facilitates the expansion of Indian multinationals such as the Tata Group which borrow vast sums on international capital markets. There is convincing evidence to conclude that when Lehman collapsed, Indian MNCs borrowed dollars from onshore markets to make good on their outstanding payments.12 This was of course made possible by the fact that RBI had dollar reserves at its disposal. While reserves help RBI restore stability, the sale of hard currencies during a global liquidity squeeze generally registers losses on the central bank’s balance sheet. The central bank is thus left covering exchange-rate risk and holding a ballooning balance sheet. Moreover, the opportunity cost of holding reserves is sizable, ranging anywhere between 1–3 percent of GDP.13 Finally, reserve management can put upward pressure on the interest rate where central banks seek to sterilize FX purchases (which they generally do in the context of price stability), harming domestic borrowers that cannot access international capital markets. Global players benefit from exchange-rate risk insurance at the expense of the public budget and domestically-constrained actors.

Permanent crisis?

Why is it that these crisis measures are routinely implemented by central banks, even in “normal” times? There are two possible answers to this question. Either we are in a permanent crisis, and therefore an institutionalized central-bank backstop is essential for financial-market functioning; or, so-called crisis measures should simply be understood as monetary policy and exchange-rate management instruments commensurate to a more complex financial system. The two answers are not mutually exclusive, and both throw up profound challenges to conventional justifications for central bank intervention. The notion that the system is in permanent crisis has major implications, and fundamentally questions basic principles like the efficiency of financial markets and their capacity to disperse risk. In the place of efficient markets, today we find financial markets highly vulnerable to liquidity shocks and dependent on a risk-bearing central bank to generate returns: that is, the socialization of risk and the privatization of returns. If the global financial system needs a permanent backstop, provided by the US Fed, then there needs to be greater public discourse and scholarly scrutiny about what the public should demand in return (beyond a diffuse financial stability goal) for backstopping financial risk-taking, particularly when such “risk-taking” benefits asset-holders and wealthy elites rather than stimulating productive activity in the economy.

The notion that these newer measures are the result of central banks updating their tools to new financial realities, requires a more nuanced lens to draw out the implications. In the case of rich economies (and some emerging economies), the reconstitution and expansion of monetary tools requires us to ask: what justifies the expansion in the repertoire of monetary policy instruments, as well as the broadening of monetary policy goals to include financial stability? As Occupy Wall Street and other protests around the world demonstrated, the public views the provision of temporary backstops to the financial system—bailing out financial actors—as unfair. Unconventional banking where central banks provide a permanent backstop through asset purchases seems even more problematic, but the issue remains off the public radar and receives anemic attention in the scholarship.

This is concerning given that traditional justifications for central-bank independence, centering on the importance of monetary-policy autonomy and the lack of a clear distributional pattern, no longer hold in an age of unconventional monetary policy.14 Prior to the crisis, central banks relied on a single instrument—the short-term interest-rate—and held themselves accountable to the single clear goal of flexible inflation targeting. Post crisis, tools like QE have direct distributional implications, most saliently with the deepening of inequality: QE increases the value of financial assets and enables share buybacks and speculative trading, benefiting those who can afford to buy and hold financial assets. Moreover, the broadening of monetary-policy goals to include direct lending and asset purchases puts central banks in a position to pick winners and losers, which undermines the case for independence.

When it comes to FX reserve accumulation and associated costs in the Global South, the lens needs to be broader, looking beyond central-banking practices to take in the broader monetary and financial arrangements within which central banks are embedded. Given the hierarchy in the international monetary system, central banks in the Global South have little latitude in challenging the mandate of financial stability over credit provision in any meaningful way. Monetary subordination subjects countries to heightened external vulnerability, a dominance in short-term portfolio flows seeking high returns, and structural balance of payment crises.15 These obstacles to development should prompt debates about re-imagining the international monetary system and re-constituting it in such a way that the Global South has access to reserves to meet deficits, and the capacity and policy space to exercise sovereignty over capital flows.

The transfer of risk from private balance sheets to the central bank’s has become a staple of modern finance. As is historically the case, the practice of central banking is far outpacing its theory. In practice, central banking appears to be converging on one goal: addressing market disruptions. It is increasingly difficult to distinguish between LoLR tools on the one hand and monetary or even exchange-rate operations on the other. Central banks in rich economies as well as in the Global South expend enormous resources in guaranteeing functioning financial markets by providing market liquidity through asset purchases. But we lack clear theories about what justifies this active and long-term intervention, particularly in noncrisis times.

Central bank balance sheets continue to be inflated as they appear to lack a clear strategy on how to exit financial securities without spooking markets. Even with the threat of inflation, the Fed struggles to meet its target for balance-sheet runoff. As the Fed raises interest rates to target inflation, the interest it will have to pay on its liabilities increases, which may see it register losses. An increase in policy rates at the core will also likely reinforce the need for reserve accumulation in the Global South as investors prefer to hold hard currency assets. Given this permanent embedding of central bank balance sheets in financial markets and the risks that they bear in the name of the public good, the task of theorizing and problematizing wide-scale asset purchases has never been more urgent.

José Manuel González-Páramo, “The Response of the Eurosystem to the Financial Crisis” (speech, Brussels, November 10).

↩Arie Arnon, Monetary Theory and Policy from Hume and Smith to Wicksell: Money, Credit, and the Economy, (New York: Cambridge University Press, 2010).

↩Perry Mehrling, “Why Central Banking Should Be Re-Imagined,” BIS Papers No. 79, Bank of International Settlements (2014)

↩Benjamin Bernanke, “The New Tools of Monetary Policy,” Brookings Institution, 2020.

↩Financial Stability Board, “Shadow Banking: Strengthening Oversight and Regulation,” 2011.

↩Perry Mehrling, “Why Central Banking Should Be Re-Imagined,” BIS Papers No. 79, Bank of International Settlements (2014); Daniela Gabor, “Critical Macro-Finance: A Theoretical Lens,” Finance and Society 6, no. 1 (2020): 45–55.

↩Benjamin Braun, “Central Banking and the Infrastructural Power of Finance: The Case of ECB Support for Repo and Securitization Markets,” Socio-Economic Review 18, no. 2 (2018): 295-418; Benjamin Braun and Daniela Gabor, “Central Banking, Shadow Banking, and Infrastructural Power,” in Routledge International Handbook of Financialization, edited by Philip Mader, Daniel Mertens, and Natascha van der Zwan. (Abingdon, Oxon: Routledge, 2019).

↩Hervé Hannoun, “The Expanding Role of Central Banks since the Crisis: What Are the Limits?” Bank for International Settlements, June 18, 2010.

↩Andrew Hauser, “From Lender of Last Resort to Market Maker of Last Resort via the Dash for Cash – Why Central Banks Need New Tools for Dealing with Market Dysfunction,” Bank for International Settlements, January 2021.

↩Jean-Claude Trichet, “The ECB’s Response to the Recent Tensions in Financial Markets.” (speech, Vienna, May 31, 2010)

↩The Fed, “Transcript of Chair Powell’s Press Conference — April 28, 2021,” April 29, 2021.

↩Ila Patnaik and Ajay Shah, “Why India Choked When Lehman Broke,” India Policy Forum 6, no.1 (2020): 39–72.

↩Dani Rodrick, “The Social Cost of Foreign Exchange Reserves,” International Economic Journal 20, no. 3 (2006): 253–66; Kevin P. Gallagher and Elen Shrestha, “The Social Cost of Self-Insurance: Financial Crisis, Reserve Accumulation, and Developing Countries,” Global Policy 3, no. 4 (2012): 501–9.

↩Jens van ‘t Klooster, “The Ethics of Delegating Monetary Policy,” The Journal of Politics 82, no. 2 (2020): 587–99.

↩Annina Kaltenbrunner and Juan Pablo Painceira, “Subordinated Financial Integration and Financialisation in Emerging Capitalist Economies: The Brazilian Experience,” New Political Economy 23, no. 3 (2018): 290–313.

↩

Filed Under