Recent years have seen the rise of the meme stock frenzy—a wave of stock purchases driven by social media trends. This tendency culminated with the Gamestop bubble of 2021, in which the value of the company’s stocks increased more than a hundred times over in just a few months. Beyond demonstrating the added risk introduced by meme stocks, the occasion revealed crucial insights regarding the role of retail day traders in the structure of contemporary equity markets.

Typically, retail traders purchase low-value stocks in high volumes and then try to promote their stocks so that other investors buy in. In January 2021, GameStop share prices skyrocketed as retail traders filled chat forums on Reddit. Retail broker-dealers executed these orders, then sold or “routed” them to wholesale market-makers—large firms that buy and sell securities for a fee.

It is through these market-makers that retail traders were able to access stock options. The enormous increase in stock options trading among retail traders in turn increased the default risk within the financial system. Retail brokers, like Robinhood, were thus called for billions of dollars in additional margins. Because these margins constitute primarily high-quality liquid assets, the process led to a “liquidity squeeze” in the market.

With the aim of constraining these developments, the Securities and Exchange Committee (SEC) has recently proposed a series of rules to regulate market-making businesses in the equity supply chain. Regulators attributed much of the instability to the behavior of wholesale market-makers like Citadel Securities and Virtu Financial, who profit from charging wider bid-ask spreads, as well as to retail brokerage firms like Robinhood and Schwab who charge high access fees in exchange for forwarding retail orders to the wholesale market-makers (a practice known as payment for order flow (PFOF)).

Among these proposals, two have the potential to significantly change the approach of market-makers toward retail trading. The first has to do with market-makers’ pricing strategies. According to the new rules, market-makers will have to standardize their retail and wholesale trade reportings and disclose both quotes to the large market centers. Importantly, they must include a quote for odd lots—stock orders of less than 100 shares which are very popular with retail traders. The rules also influence pricing strategies by lowering “tick size”—the minimum amount that the price of a security can move. Smaller tick sizes are intended to narrow the spread, a measure of market-makers’ profit, for another category of asset favored by retail traders, highly liquid stocks.

Second, the proposed SEC regulations aim to influence market-makers’ cost structure. Through the tick size rule, they seek to simplify and increase the transparency of the retail fee structures. Currently, retail brokers and their customers know their transaction costs at the end of the month. With the proposed rule, market-makers are obligated to display the transaction costs immediately to their retail clients.

In addition, through Best Execution rules, regulators seek to reduce the market access fees for retail traders. Currently, retail investors trade securities through their brokers. The brokers route the orders to market-makers for a fee, and market-makers execute each order at a price they set themselves. In the new market structure, retail brokers are meant to bypass market-makers and execute orders on-exchange through public marketplaces like NASDAQ or NYSE. These new tools have myriad implications for markets. Crucially, by targeting the pricing strategies and cost structures of market-makers, regulators overlook their vital liquidity functions. Compared to public market places, market-makers provide higher speed, pricing, and size flexibility—all attributes of market liquidity.

In what follows, I look at how information flows, allocation techniques, price formation, and bidding patterns (known as auction mechanisms) shape the nature of market liquidity. The likely upshot is that the SEC proposals will effectively restrain retail trading by making the market-making business for retail investors riskier and less profitable. At the same time, there is a risk of increasing market concentration, and thus constraining the supply of liquidity. The standardization push also has the potential to distort accurate risk pricing, as the existing price variations, in part, reflect varying degrees of counterparty risk. Finally, by targeting liquid securities and odd lots, the SEC reforms may destabilize the flow of such securities in the system and create collateral crunch. While they do render the market more transparent, the rulings may also destabilize equity markets in the coming years.

An overview of equity market structure

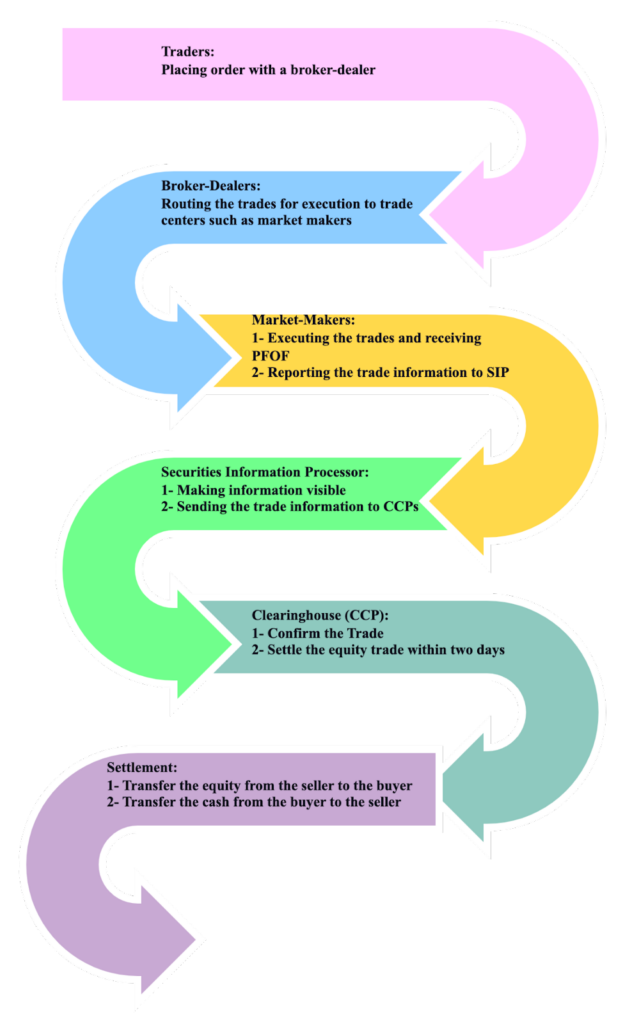

The lifecycle of an equity trade begins when a trader places an order through an account with a retail brokerage firm. The broker-dealer then routes the order for execution to a wholesaler or market-maker through a PFOF—the payment charged by the retail broker to route the retail orders to wholesale market-makers. Under current rules, market-makers are exempt from reporting the trade to a securities information processor for retail investments and odd lots.

For other wholesale trades, which are reported, the securities information processor collects, consolidates, and publicizes the trade details (for example, the buyer and seller both report the same security, price, shares, and dollar amount). The trade details are also sent to the clearing broker for verification. Finally, the clearing broker “settles” the equity trade within two days of the trade date by officially moving the stock from the seller’s brokerage firm account to the buyer’s brokerage firm account, and moving money from the buyer’s brokerage firm to the seller’s brokerage firm. This process is facilitated by clearing agencies registered with the SEC under the Exchange Act.

The SEC’s new proposals primarily aim to standardize retail and wholesale prices and compel market-makers to accept lower profits when serving retail traders. By discouraging market-makers to execute retail trades, however, the reforms may reduce the flow of collateral, and weaken the resilience of the financial system by hampering its systemic fluidity.

One way in which the proposed regulations might inhibit collateral flows is through the market-makers’ business model. The behavior of market-makers can be understood through the auctions framework: as the primary bidders, market-makers set prices across the equity market. They have minimal profit margins and, as the insurers of market liquidity, they take on enormous risks. Their revenue thus depends on the volume of transactions they pursue. They charge buyers a higher price than they pay sellers, and the arithmetic mean of the bid-ask spread constitutes the market price. They provide market liquidity and guarantee continuous prices by adjusting their inventory for immediate trade execution instead of merely matching customers. In doing so, the dealers offer “immediacy” and generate the feeling of frictionless markets by trading with investors for whom time is essential. Without market-makers, investors would have to wait in order to execute their orders.

Market-makers make money by providing liquidity to clients, but to do this they face flow uncertainty and, therefore, price risk. When there is excess demand or supply for a particular security, a standard market feature, the market-makers absorb such inventories into their balance sheets. However, their willingness to do so depends on funding availability, business cost, and ability to price counterparty risks appropriately. With narrower spreads, market-makers have to increase their balance-sheet risks and cost exposures. When these become too high, and the spreads become too narrow, then it is very likely that market-makers will depart from the market. If they do so, equity markets may lose a pillar which guarantees smooth trading.

This is the danger of imposing highly prescriptive rules to deter retail trading. If the SEC amendments are not successful in stopping the rise of retail trading, they may simply encourage smaller market-makers to drop out, leaving the larger market-makers to absorb higher risks. Because of the reforms, these higher risks may not come at a higher profit margin. Consequently, by discouraging the purchasing of riskier securities, the reforms may adversely affect liquidity in the market. Given that liquid markets are what enable the seamless purchasing and selling of securities, a less liquid market is likely to distort the flow of securities across the system.

Since the SEC explicitly targets liquid stocks, riskier and less liquid trading could lead to a shortage of high quality collateral and secured funding in the system. Given that financial stability depends on the flow of collateral, risk, funds, and payments, the effective trade-off between the rise of retail trading and existence of small- to medium-sized market-makers may increase the fragility of the market structure.

Regulating the equity market

Post-2008 macroprudential rules have attempted to regulate the inherent interconnectedness in the financial system. Accordingly, they lean on “discrete-time” financial indicators—liquidity, capital, and leverage ratios—to analyze functions like equity trading in the banking system at a certain point in time. However, discrete-time financial indicators cannot capture the dynamics of institutions’ business models and market structure. Therefore, regulators are left in catch-up mode, relying on inevitable crises to reveal the hidden business models and structural changes in actions.

The SEC is adopting a similar blueprint for regulating the equity market. The proposed regulations seem to disregard the industrial organization of the different firms that execute trades and provide all the elements of market liquidity.1 Instead, the SEC is focusing on a narrow concept—best prices—to measure best executions. But without considering the broader context, the SEC is overlooking business models and market structures, such as auctions, that allow firms to execute trades and move securities across the system.

Checking a snapshot of firms’ balance sheets or relying on narrow measures of market quality is inadequate. Financial stability demands a more dynamic understanding of the financial system. Regulators must ask: why do firms manage their balance sheets in a certain way, and under which structures do they perform? Viewing firm balance sheets as a pipeline of equity flows can uncover hidden market structure vulnerabilities and triggers for broader market failures. Effective regulation begins from an accurate understanding of the players involved—instead of supervising through a static evaluation of financial statements, we ought to monitor changes in statement balance sheets over time, combining the overlooked concept of firm industrial organization with a view of market structure.

This includes immediacy (speed of trade), depth (trade volume), breadth (price smoothing behavior), and resiliency (how quickly new order flow corrects order imbalances).

↩

Filed Under