In mid October 2021, when BlackRock revealed its third quarter results, the asset management behemoth announced it was just shy of $10 trillion in assets under management. It’s a vast sum, “roughly equivalent to the entire global hedge fund, private equity and venture capital industries combined,” and a nearly ten-fold increase in only a handful of years for a firm that first broke the $1 trillion mark as recently as 2009. Since the 2008 Financial Crisis, we’ve witnessed in BlackRock the rise of an undisputed shareholder superpower, but the firm, while exceptional, is not alone. Alongside its closest rival Vanguard, these two firms control nearly $20 trillion in assets and a combined market share of more than 50 percent in the booming market for exchange-traded funds (ETFs). And they’re not just big—they’re “universal,” controlling major stakes in every firm, asset class, industry, and geography of the global economy. It’s an unprecedented conjuncture of concentration and distribution, one which has prompted fierce debate over what this new era of common, universal, and increasingly passively allocated ownership means. For some, the new regime contains the seeds of a socialist-utopian economic vision; for others, it’s an anticompetitive, “worse than Marxism” nightmare.

At the heart of the debate is the theory of universal ownership, which contends that because today’s asset management giants are universal owners with fully diversified portfolios, they should be structurally motivated to internalize the negative externalities that arise from the conduct of individual corporations or sectors. Whether social inequality or the climate crisis, proponents of universal ownership contend that the enormous externalities of corporate capitalism will, eventually, diminish shareholder returns, and therefore universal owners should and will act to minimize them. It’s an elegant theory, but is it true? Ultimately, the answer to this question hinges on how we understand ownership.

In their definitive book on corporate governance, Robert Monks and Nell Minow, the originators of “universal ownership theory” wrote: “It is virtually inconceivable that something would be in the interest of pensioners that is not in the interest of society at large.”

However, there are several factors which undermine the promise of universal ownership. Chief among these is the fact that, unlike Monks and Minow’s pension funds, asset managers are for-profit financial intermediaries, investing on behalf of others while retaining the corporate governance rights that derive from share ownership. As the work of legal scholar Lynn Stout has shown, corporations are not, in fact, “owned” by shareholders, who instead own rights to income and governance. But even the ownership of shares themselves has become difficult to pinpoint. Should ownership be attributed to households, the ultimate beneficiaries of most financial wealth? To the pension funds in which much of this financial wealth is held? Or to the asset managers to whom these pension funds delegate, and who dominate today’s shareholder structure?

The answer is not a simple one; indeed, the lengthening of the equity investment chain has widened the separation of ownership and control, generating the “separation of ownership from ownership.” This separation has significant implications for how we understand the implications of the ascent of today’s asset management titans. By fixating on only one facet of this new landscape—that of universal ownership—we risk overlooking vital aspects of the broader configuration that we call asset manager capitalism.

A regime change

Generations of business students have absorbed the lessons of agency theory, according to which shareholders, apparently in contrast with managers or workers, are uniquely focused on the long-term performance of a corporation. From this perspective, what follows is a structure of corporate governance centered on protecting comparatively vulnerable minority shareholders against “expropriation” by insiders—namely majority shareholders, managers, and workers. As structurally weak stakeholders with skin in the game, the theory has it, shareholders need strong legal and regulatory protection, as well as extraordinary privilege with respect to the corporation’s governance and profits. The legacy of agency theory has been the orientation of Anglo-American business and regulation toward a corporation-dominated economy whose only efficient governance regime is, by extension, one geared towards maximizing shareholder value.

In the decades since the shareholder value regime took hold of corporate governance, inequality has soared, investment and growth have stagnated, 70 percent of wildlife has vanished, and a steady course has been set for a catastrophic 3 degrees of warming. Indeed, to state that shareholder value has failed—even on its own, efficiency-centered terms—is to state the obvious. But it may now also be to state the irrelevant. In the US and the UK in particular, asset manager capitalism is already firmly in place as a distinct corporate governance regime.

Reflecting the periods in which their frameworks were conceived, the shareholders that inspired Adolf Berle and Gardiner Means’ Great Depression-era analysis of the separation of ownership and control in the corporation were individual savers; Michael Jensen and William Meckling’s 1970s agency theory expanded this circle to include institutional investors like pension funds and university endowments. These were not-for-profit shareholders with a direct economic interest in the performance of their portfolio companies, which they actively selected, placing bets on individual companies in pursuit of maximum return. This “Berle-Means-Jensen-Meckling ontology” has been taken for granted by cheerleaders, students, and critics of the shareholder value regime alike. It was at the heart of Margaret Thatcher’s “shareholder democracy;” of Peter Drucker’s warnings of “pension fund socialism;” and of Peter Hall and David Soskice’s theory of corporate governance in liberal market economies being dominated by “impatient” institutional investors pursuing short-term returns.

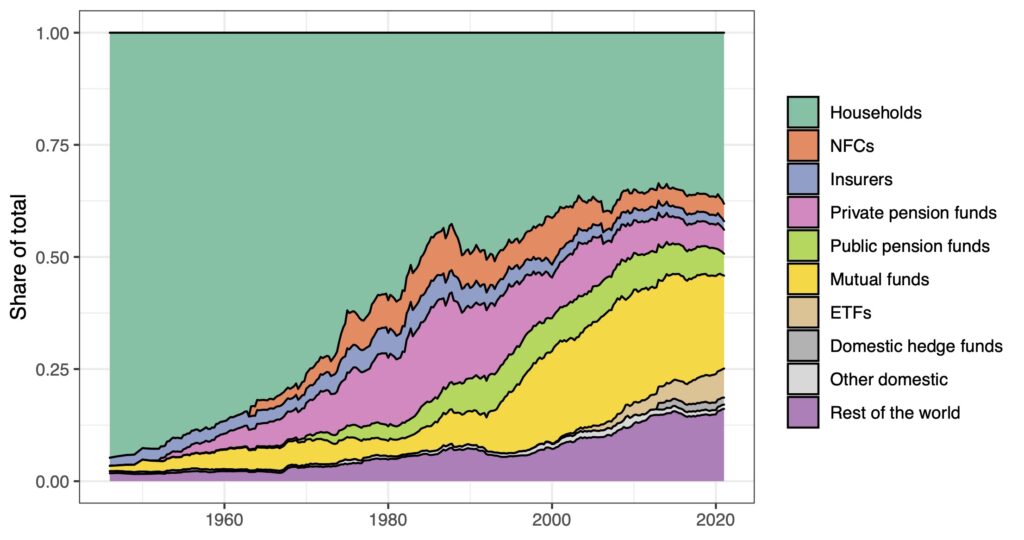

The evolution of the shareholder structure in the United States did not, however, stop with the rise of pension funds. As shown in Figure 1, over the past three decades, the key drivers of the re-concentration of share ownership has been the growth of mutual funds, and especially of ETFs. Today, the largest shareholders are US-based asset management firms—and they bear little relation to the shareholders of the Berle-Means-Jensen-Meckling world. Foremost, they are vast. BlackRock and Vanguard alone manage enough in assets to own every corporation in the UK, three times over. As a result of their growth, the dispersed shareholder structure in liberal market economies—a foundational component of theories of corporate governance and varieties of capitalism—has given way to a reconcentrated shareholder structure. BlackRock and Vanguard now collectively hold 10 percent of the total market capitalization of the FTSE 350 and, together with State Street, more than 20 percent of the average S&P 500 company. Due to their size, these stakes are fundamentally illiquid, effectively eliminating “exit”—selling shares—as a source of shareholder power and discipline for the largest asset managers. Moreover, the index-tracking funds that make up such a large portion of these giants’ offering cannot (or will not) exit individual firms at will, regardless of the size of the stakes—much to the chagrin of pro-divestment groups.

Data: Federal Reserve, financial accounts of the United States. Note: All corporate equity is shown, including equity issued by US-listed foreign corporations (21% of the total) and closely held equity (15% of the remaining domestic equity).

Though the combined 20 percent stake controlled by the “Big Three” may not, at face value, seem all that immense, it implies an extraordinary influence at corporate annual general meetings (AGMs), during which shareholders vote on resolutions pertaining to everything from director remuneration and retention to emissions targets. Moreover, their actual influence is typically measurably higher than this; while asset management firms are required to vote by the SEC in the US, for example, many smaller investors simply lack the resources or will to participate, edging the share monopolized by a small handful of firms even higher. In contrast to the weak shareholders of the agency theory imaginary, today’s titanic investment firms are very strong indeed.

Second, as a result of both their sheer size and the ever-increasing prominence of index-tracking investment strategies, the largest asset managers are fully diversified shareholders. There isn’t a firm in the FTSE 350 or S&P 500 in which BlackRock and Vanguard are not among the largest shareholders, and this diversification extends well beyond publicly listed equities, from sovereign debt to real estate and private equity.

Together, these two hallmarks of asset manager capitalism amount to an alluring promise. As strong and universal shareholders, asset managers are structurally incentivized to internalize the negative externalities that were part and parcel of the profit-maximizing calculus of smaller, selectively invested shareholders. Rather than seeking to establish the dominance of a particular firm or industry in which an investor has placed her bets, universal owners strive for consistent and stable long-term growth—making them uniquely attendant to systemic risks like climate breakdown, to which they are universally exposed. Moreover, as comparatively strong shareholders, larger firms should be capable of and perhaps even entrusted to wield power as forceful stewards of the economy, shepherding it toward optimal long-term outcomes. BlackRock CEO Larry Fink has emerged as the most vocal cheerleader of this promise. The $10 trillion question: Should we believe him?

To fully gauge the implications of asset manager capitalism, we need to consider its third hallmark. Asset managers, unlike the pension funds and foundations that dominated before them—are for-profit intermediaries. They are not investing for the sake of returns, either short or long term, as these pass through them to their ultimate beneficiaries. What motivates the asset manager is the scale of fees they accrue from their clients. Thus, the trouble with the rise of the asset manager is not that these investors are particularly short-termist; rather, it’s that there is an agency problem. While beneficiaries seek a maximized return, asset managers seek higher fee incomes, and their corollary: greater assets under management. This agency problem creates a stumbling block for the alluring promise of universal ownership in various ways.

The business model of the asset manager is to manage as much of other people’s money as possible, for a fee; and to invest it at as low cost as possible, often using index-tracking vehicles. Subpar investment returns impact Vanguard’s economic interests only indirectly, if clients move money out of its funds and into alternatives run by BlackRock or State Street. In this respect—that is, in the terms that have justified the income and governance rights bestowed upon shareholders—asset managers have little “skin in the game” of corporations’ actions.

There is, however, one channel through which investment returns directly affect asset managers’ profits: their impact on asset prices. This is because asset managers operate by earning a fee on every dollar they manage. The crux of the arrangement is that assets under management are marked to the market—all things being equal, a 20 percent increase of the S&P 500 brings a 20 percent increase in fee income made from S&P 500-indexed funds. In 2020, a stunning increase of asset valuations contributed a $29 billion gross revenue increase to the asset management industry, compared to a modest $5 billion from net inflows of new money. For asset managers, rising asset prices are the golden goose. Crucially, however, this is an aggregate preference. Unlike a small investor riding the rollercoaster of Tesla’s share valuation with plenty to lose depending on the outcome, BlackRock is comparatively unperturbed by Elon Musk’s errant social media behavior, provided that equity prices, in aggregate, continue to soar. What matters is the performance of the S&P 500 as a whole, rather than any of its individual components.

Asset price inflation is not, of course, just a game asset managers play. In a sense, it is the master game of a form of capitalism characterized by what Ben Ansell has called “asset dominance”—a world in which household incomes and political outcomes depend more on trends in real estate and securities markets than on labor market and wage trends. Recent scholarship has shed light on the politics of asset price inflation in areas such as housing and financial regulation and crisis management. We still know relatively little, however, about the role of the managers of the assets whose value is being inflated.

The politics of asset manager capitalism

What’s good for asset prices is good for asset managers. It is this overriding preference that explains BlackRock’s remarkable dedication to engaging on monetary policy. While Larry Fink’s ambition to sit at the helm of the US Treasury has to date been unsuccessful, he has had considerably more success gaining access to and influence over monetary policy, including BlackRock’s mandate for allocating the Federal Reserve’s pandemic-response asset purchase program, scooping up several of its own ETFs in the process. While the opportunity was welcomed by BlackRock, the main prize is the world’s single most important driver of asset valuations—the Fed’s monetary policy stance.

What do a former chairman of the Swiss National Bank, a former deputy governor of the Bank of Canada, and a former vice-chairman of the Fed have in common? All were hired by BlackRock. In August 2019, this trio managed to secure an invitation to the inner sanctum of the central banking world, where they, together with BlackRock Investment Initiative colleague Elga Bartsch, presented a paper titled “Dealing with the next downturn” at the Fed’s annual Jackson Hole symposium. Should there be another crisis, the authors argued, central banks should respond with audacious monetary easing. A few months later, when the Covid-19 pandemic hit, the Fed responded with maximum audacity.

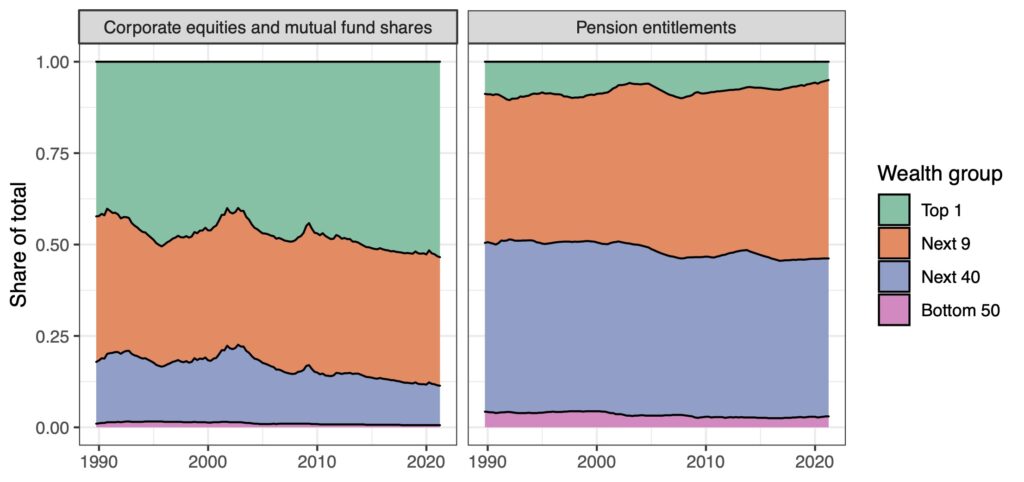

What’s wrong with BlackRock lobbying for expansionary monetary policy? The core problem, in contrast to the Monks and Minow, is that everybody is not a shareholder. To the contrary, as shown in Figure 2, half of all directly held stocks and mutual fund shares are held by the richest 1 percent of US households. The bottom half of households has virtually no equity investments at all, whether direct or via retirement plans. In this sense, a preference for asset price inflation is hardly a departure from the politics of the deflationary coalition, sustained as it is by a “cohort of powerful voters whose financial position depends on the continual appreciation of capital assets at the expense of wages.” To be sure, tightening labor markets and worker militancy may yet vindicate advocates of asset purchases. For the moment, however, pandemic response–induced asset price inflation has made the rich richer, and BlackRock’s assets and influence even greater.

Indeed, BlackRock alumni feature in significant roles in the Biden administration. Brian Deese, formerly senior advisor to President Obama before becoming Global Head of Sustainable Investing at BlackRock, is now chairman of Biden’s National Economic Council. Mike Pyle, former BlackRock chief investment strategist, has been appointed chief economic advisor to Vice President Harris. BlackRock was also invited to advise on the drafting of the European Union’s sustainable finance regulations, which would govern BlackRock’s own investments in the region.

These appointments have significance both in real terms, impacting how policy is drafted, as well as for understanding the motivations of asset managers more broadly. The shape of the Bipartisan Infrastructure Bill—after a period of heated contestation—provides a clear distillation of the politics of asset manager capitalism. As Larry Fink stated in his letter to investors, “climate risk is investment risk.” BlackRock has been quick to act on this insight. Approaching the crisis both as a universally exposed investor and an institution subject to financial regulation, BlackRock has fought hard to ensure that the contested terrain of decarbonization suits their interests.

Though unprecedented in its scale of climate-related investment, the bill nonetheless offers a wholly inadequate commitment of public funds to climate and other infrastructural investment, instead explicitly leaning on a climate-tailored implementation of Daniela Gabor’s “Wall Street Consensus”—shepherding in private capital, on favorable terms, backstopped by implicit and explicit government support. It’s an archetypal “socialize risk, privatize reward” model for policy, handed to eagerly awaiting asset management giants. The asset management titans know that ours is not a world where capital is scarce; investment opportunities are. And for the long-term investor, nothing could be more appealing than publicly supported infrastructure investments, ideally geared toward resilience to a deteriorating climate. In an economy that must rapidly transform if we are to have any chance of stabilizing the climate, ESG as a framework enables investors to bet on the shape of the future economy while marketing themselves as best equipped to mitigate climate risk and, in the case of the largest firms, to directly participate in legally designating what is and isn’t “ESG.” It has the added benefit of enabling vast firms to distill the votes at thousands of AGMs into tidy, manageable decision items.

These are not the motivations of the alpha-seeking, exit-prone, yet ultimately “weak” minority investors that populated the Jensen-Meckling imaginary. Under asset manager capitalism, finance capital is back. The dominant shareholders are vast entities that combine full diversification with significant control. They are in it for the long haul, with little liquidity, and a fundamental need for aggregate asset price inflation. Staring down the barrel of climate risk, they have undertaken a concerted effort to minimize their exposure to that risk while ensuring global efforts to tackle the crisis suit their interests—and the interests of those whose wealth they manage. Could it be that those private interests coincide with the (global) public interest? While a world may exist in which they do, the odds seem low that we live in it.

What we do know is that we no longer live in a Berle-Means-Jensen-Meckling world. Beyond having failed (on its own and other terms), the corporate governance regime of shareholder value has had its justifying assumptions utterly upended. The rise of BlackRock, Vanguard, and their competitors has ushered in a new regime—a combination of concentration, control, diversification and “disinterestedness” that is without historical precedent. The era of asset manager capitalism constitutes a new corporate governance regime whose implications for power and control in the wider economy we are only beginning to understand.

Filed Under