As the American economy reopened in the first half of 2021, reports of a “labor shortage” spread throughout US industries. But there was one sector where employer panic about hiring was old news: the massive and decentralized US construction industry. According to industry surveys, the share of homebuilders who rank the “cost and availability of labor” as their most significant problem has increased every year since 2011. This summer, the complaints continue.

What can construction tell us about the increasingly widespread idea of a “labor shortage”? Mark Erlich, the former Executive Secretary-Treasurer (EST) of the New England Regional Council of Carpenters, now a fellow at the Harvard Labor and Worklife Program, laughs at employer claims: “Labor shortage” has been a “chronic cry for decades. And yet somehow there always seems to be enough labor to get the job done.” Even at low wages, employers have been able to find someone to risk their lives on a job (in a pinch, there’s always prison labor).

But in another sense, the employers’ complaint illuminates a real dilemma. Since the 1960s, the construction sector has undergone a profound transformation in business practices. Most importantly, once-powerful building trades unions have been sidelined from the cities that have grown fastest over the past generation. From a high point of 80 percent of construction spending during the early 1970s, the share of projects taken by unionized firms has collapsed to some 20 percent today. One consequence is the erosion of occupation-specific apprenticeship programs—funded by employers and administered jointly with unions—that once renewed the industry’s pool of skilled labor. As industry veteran Erlich explains, “The nonunion sector has never figured out a pipeline for training for bringing people into the industry.” Understanding this dynamic can help us move beyond a mechanical image of “labor shortages”—too much demand, too few unemployed—toward a richer understanding of the institutions that reproduce the labor force and determine its compensation.

Training expenditures are just one of the traditional obligations that construction employers have been able to shed. To a striking extent, many builders have ceased to be legal employers altogether. They were the pioneers of the “gig economy” model, in which employees are transmuted into “independent contractors,” so that employers no longer have to honor the protections of labor law or contribute to public social insurance or private supplementary benefits. Despite its dubious legality, the cost advantages of the model have made it increasingly attractive for other industries. Famously, Obama-era growth companies such as Uber and Postmates reimagine every worker as an entrepreneur, so that there is no need for companies to internalize the costs of wages or social insurance—much less education and training. As greater shares of the American economy take on aspects of the construction industry, we would do well to consider its precocious example.

The Downward Spiral

Construction is the only goods-producing industry in the country whose share of total employment actually increased over the twentieth century. Today between 7.5 and 11 million workers (about 1 in 14) claim construction as their primary employment. In the post-World War II period, it has absorbed a steady 40 to 50 percent of US gross private investment. Alongside this continued centrality, the industry has been the site of a thorough restructuring of business practices and labor relations.

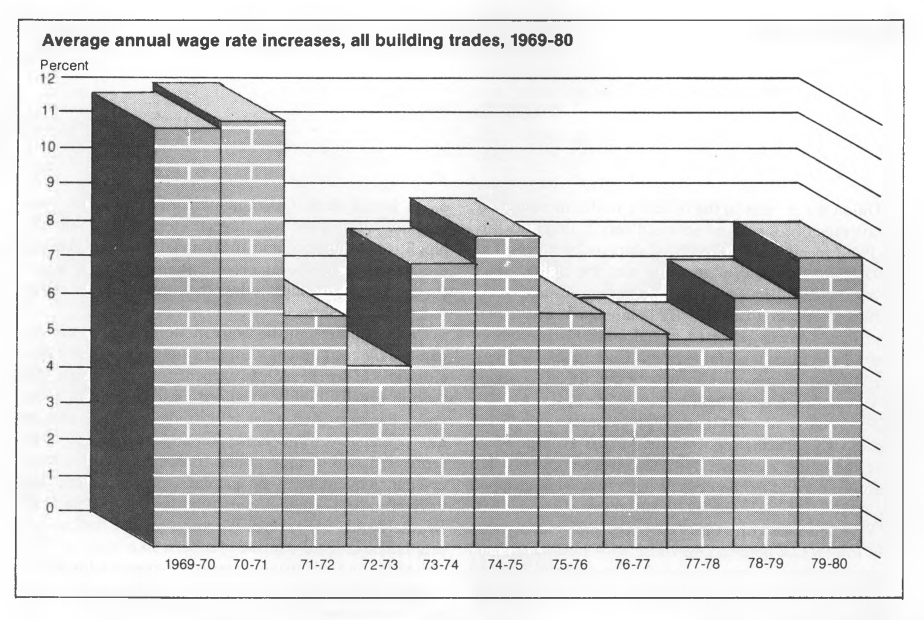

The transformation began in the late 1960s, the last time US employers had to reckon with the consequences of full employment. During the Vietnam War, a booming economy coincided with the draft of young working-class men, leaving construction workers in an unusually favorable bargaining position. Their strength was reinforced by union representation, which then covered at least half of the industry.1The Johnson administration’s wartime stabilization program had hinged on a voluntary national wage policy that would hold these union wages stable, while the boom raised the low wages in the disproportionately female and nonwhite service-sector, equalizing labor income across sectors. But as large companies refused comparable profit restraint, prices rose and real construction wages fell. Across the country, construction unions began to demand and win raises at higher rates than unionized manufacturing workers, not to mention the nonunion service sector. The tottering wage stabilization program collapsed.

In response, large international corporations, whose plant expansions made them major users of construction labor, launched a political project to transform the industry. Led by Roger Blough of US Steel; Virgil Day, Fred Borch, and Ralph Cordiner of General Electric; Charles McCoy of DuPont; W.B. Murphy of Campbell’s Soup; and David Packard of Hewlett-Packard, among others, the opponents of profit controls during the Johnson administration organized to apprehend the critically rising cost of new buildings. Just months after Nixon’s election, they formed the Construction Users’ Anti-Inflation Roundtable to agree to limits on the final construction prices their firms would pay, compelling contractors to draw the line against their unionized employees. “It’s time for a showdown,” said Chamber of Commerce president Winton Blount, himself the owner of an Alabama building contractor, one of the largest in the country.2 Nixon appointed Blount Postmaster General, and during the administration’s wage-and-price stabilization program, the construction users’ group merged with an older association of HR executives from many of the same firms, the Labor Law Study Group, which had formed during the Johnson administration to protect Right-to-Work laws and lobby for tightening regulations against strikes. In 1972 the two groups merged to help put a ceiling on wages. They formed the Business Roundtable—originally called the Business Roundtable for Responsible Labor-Management Relations—to lead the push by Fortune 500 companies against the decade’s anti-corporate mood.

Today, the construction industry’s two major employer organizations reflect the success of that project. The Associated General Contractors of America (AGC), representing 27,000 firms including the unionized portion of the industry, is the older contractors’ association. It is rivaled by the Associated Builders and Contractors (ABC), an exclusively anti-union lobby representing 21,000 firms across 69 local chapters. The ABC benefited from the new period of business organization, doubling in size during the 1970s as population and investment shifted toward the Sunbelt, where unions were weak and nonunion construction was easily established as the norm.

The Business Roundtable and the shift in political power towards the Sunbelt states helped to defeat pro-union labor legislation in Congress in 1975 and 1977, tilting the industry firmly towards the nonunion model.3 In contrast to the “union shop,” ABC member employers describe their model as the “merit shop”—meaning pay rates and benefits are determined unilaterally by contractors according to employee “merit” rather than union-negotiated pay scales. The Current Population Survey (CPS), which began asking respondents about union membership in 1971, found 42 percent of workers in all construction occupations belonged to unions, while the Bureau of Labor Statistics (BLS) found 60 percent of blue-collar construction workers were covered by collective-bargaining agreements that year.4 By 1983, the CPS reported just 27.5 percent of workers in all construction occupations were union members, a figure that fell below 20 percent during the 1990s and today sits somewhere between 12 and 13 percent.5 While industry employment continued to expand, the widening divergence in costs for employers between union labor and unorganized markets compounded these trends. In a highly competitive environment, nonunion employers are unable to pay for robust training programs—even if they wanted to.

Throughout the 1980s and 1990s, “merit shop” companies secured further competitive advantages by converting their workforce to independent contractors. This eliminated their employer contributions to Social Security and Medicare, and their workers’ compensation insurance policies. The Carter administration gave regulatory approval to this labor-market transformation when the Congress legislated Section 530 of the Internal Revenue Act of 1978. Further liberalized by the Reagan administration, the law allows employers to classify workers as independent contractors if a pre-existing pattern for contracting existed in an industry.

Long before the proliferation of app-based employment in transportation, the shift in the construction industry towards independent contracting by nonunion employers marked the emergence of the gig economy. The nature of construction work remained unchanged: subcontractors continued to direct the same structural, drywall, window framing, utilities, flooring or roofing projects on sites. But given the legal shift in tax collection and employment obligations, this massive shift towards “self-employment” represented the de facto toleration of widespread payroll fraud. State workers’ compensation programs lose as much as \$1.74 billion annually to such payroll misclassification, according to a 2020 study sponsored by the United Brotherhood of Carpenters and the Institute for Construction Economic Research. Workers are denied at least \$811 million annually in FLSA-mandated overtime pay. Employers shift at least $3 billion in annual Social Security and Medicare taxes onto their workers’ paychecks.

The shift to independent contracting was only the beginning. Today, nonunion construction is largely an underground cash economy defined by day labor and wage theft. In many regions, the informal sector is now organized through labor “brokers” who recruit workers from their long lists of personal contacts, often undocumented and paid under the table.6 Verbal agreements on wage rates with undocumented workers are regularly violated. “We’re in a country where our immigration policy is in direct conflict with our labor protections,” says Cal Soto, Director of Workers’ Rights at the National Day Labor Organizing Network (NDLON). “Employers can take advantage of the fact that one worker can be paid less because that worker is afraid of retaliation from immigration enforcement, or they’re afraid that they don’t actually have the same protections under the law, because of their [immigration] status.”

By nature, the incidence of such payroll fraud and wage theft in a quasi-underground labor market are impossible to measure accurately. A 2008 survey of over four thousand low-wage workers across the country found that two in three had experienced wage theft—payment below the minimum wage, for example, or nonpayment of overtime—in the previous week. A 2010 survey of 1,800 low-wage workers in Los Angeles (earning less than $11.90 an hour in 2006 dollars), of which half were unauthorized immigrant workers, found 88 percent of respondents had experienced a pay violation (most commonly, sub-minimum wage pay) in the previous week. Conservative estimates find that payroll fraud affects between 12 and 20 percent of the industry workforce nationally, or between 1.30 and 2.16 million workers.

Eventually, even employers sensed something was wrong. In 1992, Ted C. Kennedy, a merit-shop advocate and former ABC president, warned an industry gathering that “As long as contractors continue to treat their employees as seasonal harvest hands instead of skilled professionals, we cannot expect to maintain a workforce of skilled 20-year veterans.”7

Recognizing the problem was easier than remedying it. At root is the industry’s decentralized and geographically fragmented structure. Unlike other industries (like retail or tech) where employers have defeated new organizing campaigns, building contractors are often small and unable to develop nonunion alternatives for training new workers. Many contractors are unwilling or unable to internalize training costs in elaborate HR bureaucracies in companies promising upward mobility. Neither have they been able to get government to foot the bill. White-collar employers benefit from federally-guaranteed student debt, which provides them with the free gift of an educated labor force. But builders have failed to win vocational education subsidies on a comparable scale.

It would take a powerful labor movement to compel employers to finance training or allow unions to manage training and hiring. But in a competitive, decentralized industry, worker power threatens individual firms. Wage determination and skill requirements are thus inseparable, but not in the way most labor economists argue. “Human capital” explanations for inequality in recent decades have drawn attention to labor allocation—to the matching of skills and jobs. The solution has been to focus on skills “upgrading” and access to college degrees. But it is control over credential requirements—rather than the credential itself—that empowers the parties to a wage bargain. As economists such as Alicia Sasser Modestino, Aaron Sojourner, and Claudia Macaluso have shown, employers can simply increase the amount of education required—“upskilling”—for given types of employment.

Within construction, where access to any kind of training has collapsed with the rollback of union power, employers have been left to lobby for the expansion of vocational education—shifting training costs onto the federal and local governments. Given the larger disconnect between market wages and credentials, there is no reason to expect vocational education to raise wages unless it is a step to collective bargaining. It is influence over the price of skills, and not skills alone, that determines wages in the labor market.

The Shutdown and its Sequels

UCLA economist Edward Leamer argued in 2007 that “Housing is the business cycle.” But during the unusual Covid-19 recession, building defied the business cycle. With the designation of construction as an “essential service” in many states, the continuation of residential and warehousing construction through the shutdowns marked out a rare arena of economic dynamism. “We are in the midst of one of the longest construction booms in my memory,” Erlich told me in May. It is “as if the pandemic hadn’t happened.”

Private residential and commercial construction are major barometers of capitalism’s health that today issue widely divergent readings. Commercial property values have fallen across the nation during the pandemic, as tenants renegotiate leases for office and retail space. Despite the industry’s buoyancy during the shutdown, industry spokesmen claim that the need for public spending to stimulate the industry is dire. “This is clearly going to be a difficult year for the construction industry,” Stephen E. Sandherr, CEO of the AGC, said in March 2021. “Demand looks likely to continue shrinking, projects are getting delayed or canceled, productivity is declining, and few firms plan to expand their headcount.”

At the same time, residential building is booming. As potential home sellers postponed moves during the pandemic, sales inventory remained at a cyclical low. Many of the sales of 2020 never occurred, and active listings, which peaked at 1.3 million monthly in the summer of 2019, fell this spring to around 490,000. With supply restrained and demand fueled by historically low borrowing costs, the price of homes has skyrocketed. High sales prices and easy financing, in turn, has led to a boom in private housing starts, which in January surpassed its pre-pandemic peak of 1.6 million units. Likewise, the growth of e-commerce and logistics during the pandemic spurred a parallel boom in warehousing space, while the same trends that are dragging down commercial real estate valuations create new construction projects to convert existing properties. As CBRE, the nation’s leading real estate firm, reports, a “new trend has emerged: the conversion of underperforming or obsolete retail sites into warehouse/distribution facilities.” The National Association of Realtors’ first quarterly survey for 2021, for example, found 39 percent of commercial members’ reported construction projects for converting vacant malls into mixed-use projects.

The fractured economic landscape is matched by political confusion. Historically, the growth of the nonunion, independent-contracting, and quasi-legal construction economy has left the industry in an awkward position. The anti-union ABC endorses conservative Republicans who campaign on reducing undocumented immigration—even as their members make up the portion of the construction market most dependent on unauthorized workers for cheap labor. While the ABC supports “a flexible visa system that allows sufficient access to permanent and temporary foreign workers,” it is also “concerned” that legislation to create a pathway to citizenship for the 11 million undocumented immigrants in the US “largely ignores the drivers of illegal immigration and the enforcement needed to prevent the circumvention of our nation’s borders and immigration laws over the coming years.”

During the Obama administration, the ABC sued every regulatory change the Department of Labor promulgated to constrain the use of independent contracting and raise employment standards. It opposed executive orders to raise the minimum wage for federal contractors, and won an injunction against the administration’s “Fair Play and Safe Workplaces” executive order mandating all federal contractors disclose past complaints for violations of labor and employment law. Together with the AGC, it opposes federal funding for jointly administered apprenticeship programs, prevailing wage laws, and any tightening of the rules on the use of independent contracting. This shamefaced reliance on the apartheid-like interaction of US labor and immigration law, with a simultaneous plea for public subsidy for unilateral employer training, was embodied by Donald Trump, a real estate developer who campaigned on infrastructure spending and whose personal use of undocumented labor did not stand in the way of his anti-immigrant political platform.

In 2020, the national ABC endorsed Donald Trump for re-election (the AGC declined to take sides). During the campaign, Michael D. Bellaman, President and CEO of ABC, and Tim Keating, ABC 2020 National Chair, wrote to Trump praising his “promise to veto the Protecting the Right to Organize (PRO) Act,” a proposed labor law reform which would make it easier for workers to unionize. The ABC hailed President Trump’s stance as an assurance that the administration “will protect the merit shop construction industry and small businesses, which are the backbone of our economy.” Though many of the AGC’s members engage in collective bargaining, the geographically fractured marketplace has left the unions unable to shift them toward supporting laws to eliminate the competitive edge of the nonunion firms: the AGC, like the ABC, is against the PRO Act and federal funds for jointly administered apprenticeships. But the employers have also found elements of the Biden administration congenial. Both the AGC and the ABC call for more infrastructure money, while they vigorously denounce tying the funds to the administration’s broader professed labor agenda.

Can the Biden administration, which supports passage of the PRO Act, enfranchise the underground army of construction workers and bring order to the wild-west dealmaking of subcontractors and labor brokers? As with much of the liberal program, this will depend on whether congressional Democrats can overcome obstacles like the Senate filibuster. Democratic Party leaders in both the House and Senate have proposed including immigration reform in the next continuing resolution on budget reconciliation, packaging it with the infrastructure program (which itself contains provisions bearing on union employment on federally-funded projects).

One sign of the administration’s seriousness was the appointment in January of Marty Walsh, former president of the Boston Building Trades Council, as Secretary of Labor. In February, the administration appointed Julie Su as Deputy Labor Secretary. As director of the California Division of Labor Standards Enforcement, Su has been responsible for much of the data and increased enforcement against wage theft and payroll fraud in that state over the past decade. More recently, Walsh invited David Weil, who pioneered the study of wage determination in independent contracting, to reprise his late-Obama era role as Administrator of the Wage and Hour Division.

But labor law and regulatory reform has powerful enemies in an economy whose growth sectors are marked by the pervasive use of independent contractors. With an ally of organized labor in the White House, the ABC has reprised this role as attack dog for the broader anti-union movement in the US. In January, the Trump Labor Department issued a rule excluding many contractors from the Fair Labor Standards Act—a final regulatory bid to protect the sprawling independent-contractor economy. When Walsh reversed the rule, the ABC’s Southeast Texas Chapter spearheaded a lawsuit against the new Labor Secretary. Together with the Coalition for Workforce Innovation (CWI), a lobby founded by the Retail Industry Leaders Association and backed by such app-based employers as Uber and Postmates, the ABC hired the anti-union firm Littler Mendelson to file a federal complaint in the Eastern District of Texas. An interest in blocking reform draws together such apparently different actors as Silicon Valley and nonunion construction. The coalition to protect independent contractors is growing, with over thirty industry associations from America’s Newspapers and the American Trucking Association to the financial services and multi-level marketing industries backing the CWI.

Can a balance of power be found between the beleaguered construction unions and the anarchic, highly competitive, and pervasively fraudulent industry of building contractors? Since the 1970s, an unregulated, underground, and cash-based labor market has grown up across the US to provide contractors and construction users with a solution to the problem of high labor costs. In the form of the “sharing economy,” a sleeker, legally sanctioned version of the construction labor market model now structures the working lives of millions across the service sector, from transportation and retail to education and healthcare. Some hint of workers’ future in these other sectors will be found in the fate of organized labor within its historic stronghold, construction.

In circumventing the sources of worker power—construction unions—employers also destroyed the institutions that had historically been responsible for training skilled workers. In responding to one labor shortage, they wrote the script for another, and now find themselves unable to offer a coherent private option for investing in the workforce of the future.8It may be that the current experience of scarcity will offer an opportunity for progress: not for the first time, liberals are presenting their reformist economic programs as supply-side solutions to market shortages. But any such effort will run aground unless it recognizes that the “skills gap” is not a technocratic question but one whose solution will require the reordering of labor-market institutions and the power relations underlying them.

Union density in the decentralized construction industry is notoriously difficult to measure accurately. Great Society-era surveys by the Office of Economic Opportunity found 47 percent of nonsupervisory construction workers were union members. Industry experts during the early 1970s put the share of the industry spending going to firms working under union agreements much higher at around 80 percent. (Unions find measures of market share a more meaningful indicator of organization than the number of workers who claim union membership on surveys; the large number of handymen, part-time, and self-employed workers who claim construction as their primary employment do not necessarily compete for the large contracts that drive the industry.)

↩“Attacking the Bargaining Crisis,” Engineering News-Record, May 30, 1968, p. 11, quoted in Marc Linder, Wars of Attrition: Vietnam, the Business Roundtable, and the Decline of Construction Unions (2000), p. 182.

↩Gerald Ford had promised Labor Secretary John Dunlop to support common situs picketing for the construction industry, legalizing secondary boycotts on building sites by unions against subcontractors using nonunion labor. When Ford chief of staff Richard Cheney persuaded Ford to renege, Dunlop resigned. See chapters by Richard Cheney and John Dunlop in The Ford Presidency: Twenty Intimate Perspectives of Gerald R. Ford, ed. Kenneth W. Thompson (Miller Center for Public Affairs: 1988) Two years later, the Carter administration proposed and the House of Representatives passed the Labor Law Reform Act of 1977, which would have outlawed Right-to-Work laws, loosened regulations on unions, and expanded the National Labor Relations Board from five to seven members. Opponents in the Senate filibustered the bill, and the Carter administration failed to find enough votes for cloture before the second session ended in the summer of 1978. Melvyn Dubofsky, “Jimmy Carter and the End of the Politics of Productivity,” in The Carter Presidency, Policy Choices in the Post-New Deal Era, eds. Gary M. Fink and Hugh Davis Graham (University Press of Kansas: 1998), pp. 105-7.

↩The CPS, which is a household survey, includes many construction workers beyond the major commercial, industrial, and large-scale residential projects; the BLS Expenditures for Employee Compensation survey, which was terminated in 1977, was an establishment survey and presents a more accurate picture of union power in the highly capitalized core of the industry.

↩Government survey data in this paragraph is from Steven G. Allen, “Declining Unionization in Construction: The Facts and the Reasons,” Industrial and Labor Relations Review, Vol. 41, No. 3 (April 1988), and Richard B. Freeman and James L. Medoff, “New Estimates of Private Sector Unionism in the United States,” Industrial and Labor Relations Review, Vol. 32, No. 2 (January 1979).

↩Around 20 percent of construction projects today are still unionized. According to median weekly wage data from the Current Population Survey, union construction workers earned 36 percent more than non-union members in 2020. For a sense of regional diffusion, consider that a carpenter in nonunion Houston earns 46 percent less per hour than a carpenter in union Los Angeles.

↩Linder, Wars of Attrition, 391-2.

↩A similar case can be seen in the trucking industry, which like construction was fundamentally restructured along nonunion lines after the 1970s. Persistent employer claims of a “truck driver shortage” prove, on closer examination, to be better explained by the fact that “truck drivers aren’t being paid enough or treated well enough by their employers.”

↩

Filed Under