A follow-up report, released April 2022, investigates the prevalence of misleading cost practices at elite private colleges. Read the report here.

The deceptive financial aid system at America’s colleges

When prospective students navigate the process of choosing a college, financing is a central and often determining factor in the final decision of enrollment. Students first turn to college websites and the College Scorecard to look at cost data, and many then apply for financial aid through FAFSA,1 which relies on cost estimates provided directly by colleges to determine aid packages. Prospective students know that college is a steep investment—they take seriously the decision of where and what to study and the costs it incurs. No matter how talented, hard working, and committed a student is, if financing falls through, the dream of obtaining higher education can be dashed. But much of the financial data that prospective students receive is misleading. In the cost information offered to prospective students, higher ed institutions consistently underestimate the non-tuition costs of attending college, and overestimate the amount of incoming aid from grants and scholarships. Discrepancies between estimated and real prices can add up to thousands of dollars in unanticipated costs, burdening students who already struggle to afford college.

In our research, we find that 41 percent of colleges underestimate room and board costs for off-campus living, with a median difference between real costs and estimates of $1,488 for public colleges and $2,045 for private colleges. Similarly, we show that students can expect to receive an average of $3,000 less in free aid as upperclassmen versus their first year of college. Overall, 83 percent of higher education institutions in the academic year 2017–2018 presented information that obscured similar reductions in financial aid for upperclassmen.

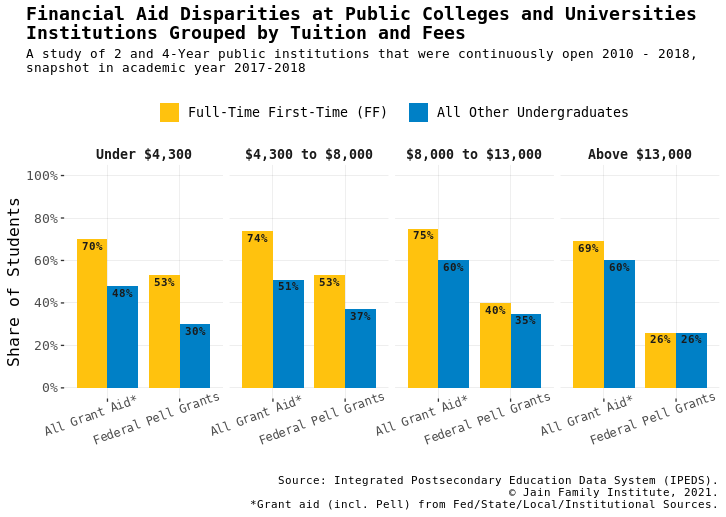

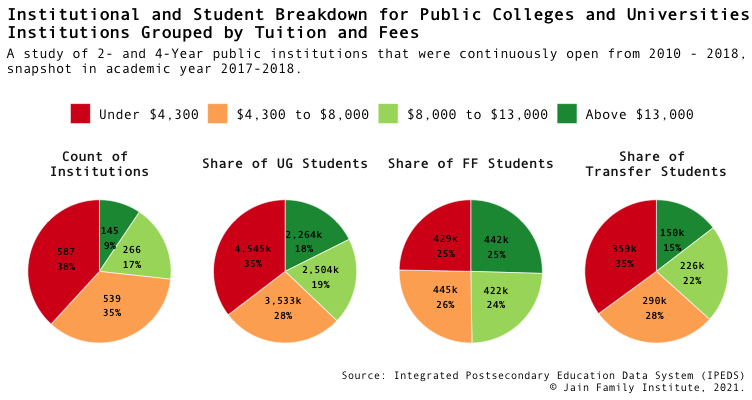

Students who have more financial flexibility to deal with the fallout caused by decreased aid packages and underestimated costs are more likely to continue at the same college in their second year. Some continue only because of student loan limits that increase as they advance through their degree, which colleges consciously plan for when reducing financial aid packages for upperclassmen. But the squeeze caused by unexpected high costs leads many students to drop out or transfer. The aggregate cost data that universities offer prospective students conceals the reductions in aid packages as students advance because it focuses solely on first-time full-time students.2 For low- and middle-income Americans, securing financial flexibility to continue college is largely dependent on whether or not they attend a college with lower tuition and fees, which are not subject to rampant underestimation. Lower price institutions, while taking an equal share of first-time students as their more expensive counterparts, enroll disproportionately more upperclassmen despite also presenting misleading data.

With each passing year, a greater share of students feel the effects of these oversights: dwindling grant or scholarship resources, student loan accumulation, and, in the worst cases, the inability to make ends meet when both tuition and cost of living continue to rise. The sticker shock of college hits hard once funding sources run dry, leaving a wide swathe of students worse for wear, through either unanticipated indebtedness of the student (and/or family through the Parent PLUS loan system) or delays and decline in college completion. The widespread misrepresentation of cost data exacerbates the harsh trends of the student debt crisis, by denying students and their families the information they need to make one of the biggest financial decisions of their lives.

Overestimating aid

The cost increase that first-time full-time (or “FF”) students see in later years is known as “bait and switch” or “front-loading.” First-time students receive generous grants or scholarships in their first year of college which decrease or disappear altogether in the second year of college and beyond. In a 2015 Hechinger Report, researchers estimated that about half of colleges and universities front-load; by the academic year (AY) 2017–2018, that share had risen to 83 percent.3 The “bait and switch” has been experienced by millions of students, especially those who are low-income, but is overshadowed in the higher education discourse by the dual crises of rising costs and ballooning student debt. At the aggregate level, front-loading is happening at such high rates that we can easily see its impact.

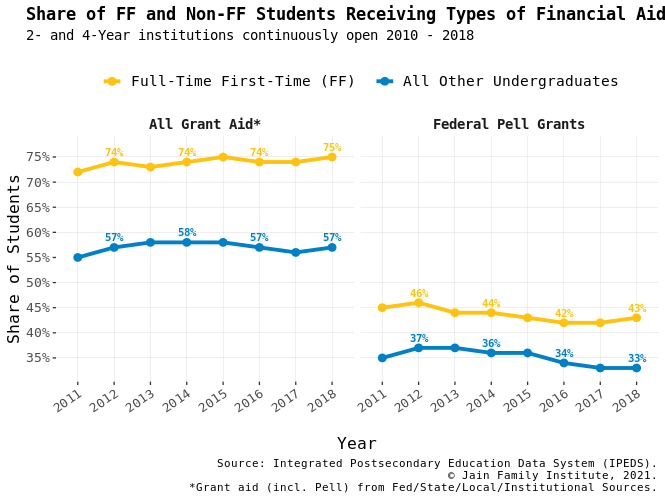

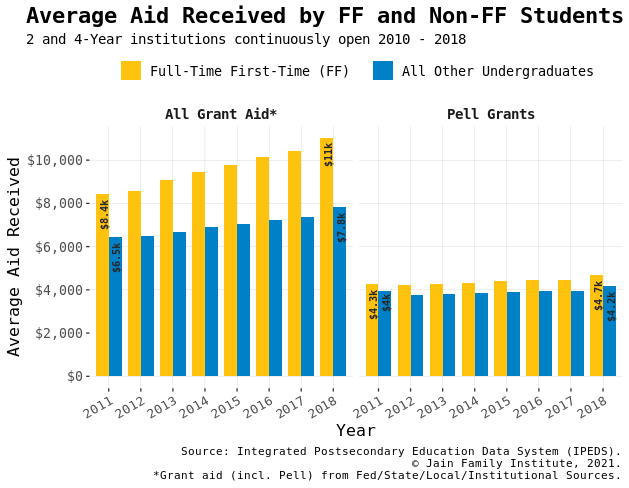

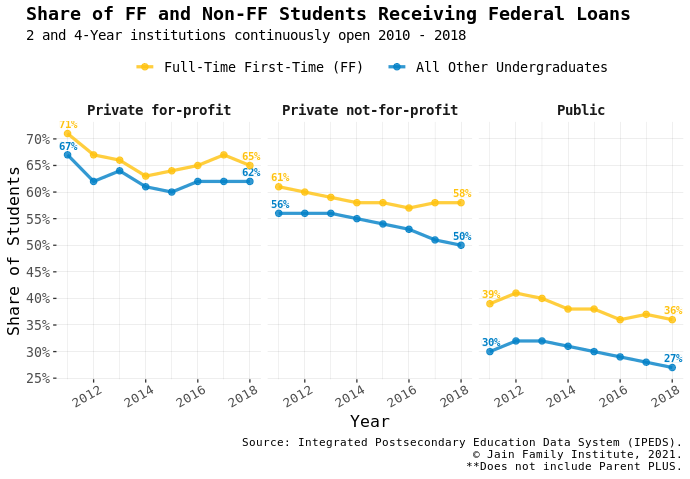

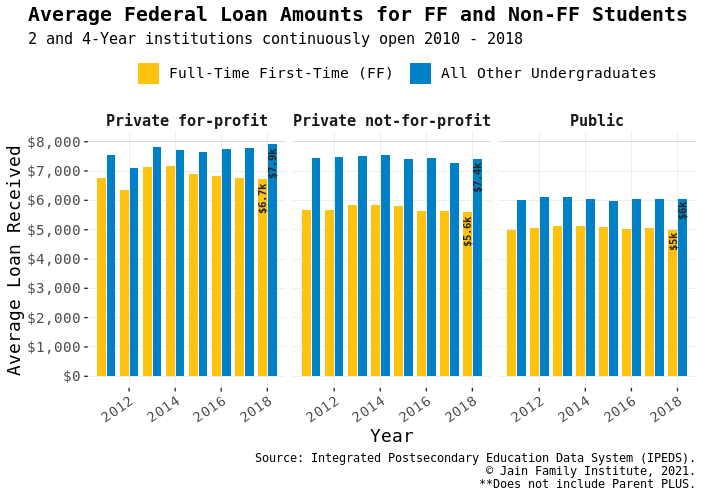

In every year of this analysis, from AY 2010–2011 to 2017–2018, the national average share of FF students receiving free aid was significantly higher than the share of non-FF students receiving the same type of aid. Most recent data shows FF students receiving, on average, over $3,000 more in free aid than all other undergraduates. Given the data, the student body makeup for FF students is visibly different than for other undergraduate students—there are significantly fewer Pell grantees in the latter group. If the proportion of Pell grantees in the student body and the average Pell grant decreases as an entering cohort ages in a particular institution, it signifies that lower-income students are dropping out at disproportionate rates.

Institutions front-load free financial aid in the first year of school, likely as a means to compete to enroll college students upfront. They bank on the premise that once students enroll for the first time, the college will face less competition from other universities should the cost of attendance increase. Knowing that continuing students are already invested in finishing a degree at their respective institution, colleges decrease aid packages in later years. In fact, the difference in average free aid for FF and all other undergraduates has been widening over the last several years as colleges further invest in front-loading. The trend is clear across all higher education institutions, including less expensive and less selective public colleges where poorer students are more likely to attend. For those types of schools, price is a selling point, so the incentive to front-load is even higher. Put simply, colleges are leading students on about the price of college.

When students have grant and scholarship aid removed in the second year of college, their only options are taking out (more) student loans, making up the cost difference with family or personal savings, or altering college plans by taking time off or transferring schools. Our research proves the latter options—which delay college completion—are happening at an alarming rate. A selection effect ensues: students with better aid packages and/or more financial flexibility are more likely to continue their program. The lower the cost of college, the less drastic the selection effect. Thus, less expensive schools, despite front-loading proportionally more, allow students greater financial flexibility to continue in college because they offer lower prices than their counterparts at more expensive colleges.

Regardless of its severity, the selection effect is seen nationwide as a result of front-loading. With many students enrolling due to generous aid packages, expensive schools see high headcounts of FF students, so the weighted average of tuition and fees among the national population of FF students skews higher with their inclusion. When that aid is reduced, students may drop out and potentially transfer to less expensive colleges, paying lower tuition and fees in the following year. These less expensive colleges, less prone to the selection effect because they have lower prices, now include a higher proportion of students when calculating the average tuition and fees for the undergraduate student body as a whole.

As a result of the selection effect, the national average tuition and fees is always higher for FF students than for all undergraduates. The differential is not due to upperclassmen receiving more generous aid packages (in fact, the opposite is occurring, as referenced in tables previously). Instead, after their first year, many students at expensive schools drop out entirely or possibly transfer to less expensive schools; at the same time, the largest portions of transfer students4 are filtering into lower-priced schools. The enrollment shares decrease at expensive schools when looking at FF to total undergraduates and increase at less expensive schools.

| Weighted Average Tuition and Fees for the Academic Year at 4-Year Institutions | |||

|---|---|---|---|

| Academic Year | First-time Full-time Students | All Undergraduates | Price Differential |

| 2010–2011 | $15,208 | $13,560 | $1,648 |

| 2011–2012 | $15,982 | $14,265 | $1,717 |

| 2012–2013 | $16,770 | $14,878 | $1,892 |

| 2013–2014 | $17,324 | $15,390 | $1,934 |

| 2014–2015 | $17,879 | $15,797 | $2,082 |

| 2015–2016 | $18,450 | $16,234 | $2,216 |

| 2016–2017 | $18,800 | $16,364 | $2,436 |

| 2017–2018 | $19,340 | $16,778 | $2,562 |

| 2018–2019 | $19,994 | $17,249 | $2,745 |

| Weighted Average Tuition and Fees for the Academic Year at 2- and 4-Year Institutions | |||

|---|---|---|---|

| Academic Year | First-time Full-time Students | All Undergraduates | Price Differential |

| 2010–2011 | $11,365 | $9,065 | $2,300 |

| 2011–2012 | $12,134 | $9,648 | $2,486 |

| 2012–2013 | $12,822 | $10,156 | $2,666 |

| 2013–2014 | $13,262 | $10,580 | $2,682 |

| 2014–2015 | $13,852 | $11,021 | $2,831 |

| 2015–2016 | $14,387 | $11,390 | $2,997 |

| 2016–2017 | $14,907 | $11,784 | $3,123 |

| 2017–2018 | $15,418 | $12,146 | $3,272 |

| 2018–2019 | $16,028 | $12,581 | $3,447 |

Despite nearly every institution reporting that tuition and fees paid by FF and all undergraduate students are similar, if not identical, the large difference in average prices faced by these groups (when weighted accordingly) signal that the students that persist in their four-year degree are those that face lower prices. The discrepancy is the direct result of colleges competing for (in-state and out-of-state) students by offering generous aid packages that fail to materialize in similar fashion after the first year of college. Whether intentional or not, this scheme is taking the non-profit and public higher education space by storm, entirely at the expense of students. Students must transfer out or drop out entirely, impeding college completion and placing a significant strain on first-year students, especially those who are low-income. Fortunately, however, the analysis sees less expensive institutions receiving the overwhelming majority of transfer students each year, especially public institutions which offer students the best chance to recuperate their educational investment.

This is not a new trend, but it has gotten worse over time as college tuition and fees have risen for first-time students (see above table). The “Price Differential” that FF students face has increased 77 percent at 4-year institutions, from $1,648 in academic year (AY) 2010–2011 to $2,745 in AY 2018–2019. This phenomenon occurs in spite of large-scale for-profit closures that boost the overall student body percentage attending relatively cheaper public colleges, both for FF and the student body as a whole. That’s because even public institutions are underplaying the costs of attending college to FF students. The figure below focuses on the selection effect at public institutions; the share of students attending expensive public colleges drops considerably when comparing FF students and the transfer and undergraduate student body as a whole.

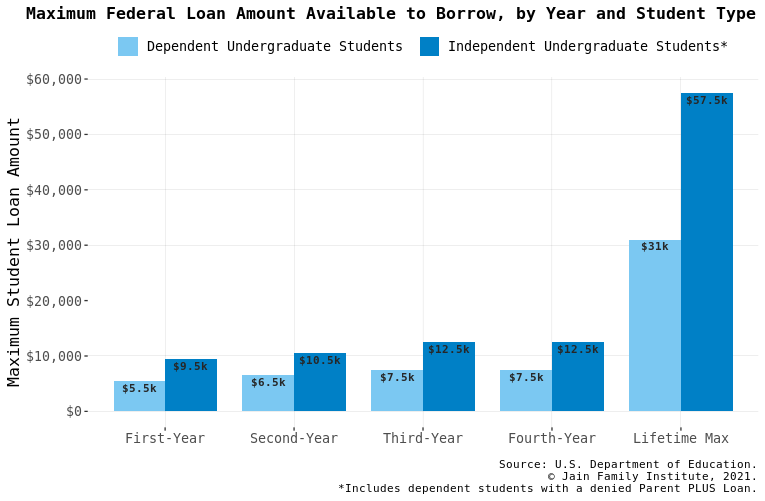

The high prevalence of large student loans amongst FF students, especially in relation to the maximum allowed for first-year dependent students, $5,500, is another sign that finances are at the forefront of college persistence—these students may have borrowed more than the maximum allowed if given the chance.

Additionally, relatively fewer students taking out federal loans after the first year of college (seen in the chart below) indicates that the neediest students are not returning for the second year of college. Those who drop out must start payments despite not obtaining the credential; $5,500 in student loans taken out for a FF student in AY 2020–2021 translates to $600+ owed in payments per year.

Returning students have already made a huge investment in time and money. Those who do remain past the first year of college and take out loans increase not just their total loan burden, but also their annual loan origination amounts, as the federal loan maximum for later years in college also increases. In fact, increased federal loan limits in later years are crucial to schools’ front-loading schemes. Aligning with increased borrowing limits in later years, schools reduce free financial aid for those years, allowing the gap to be filled by larger loan burdens on the students. Colleges capitalizing on the student loan system is the norm, even at the richest universities in the country.

Underestimating costs

Based on the above data, we know that colleges downplay the costs of college for upperclassmen, only presenting front-loaded statistics to prospective students. Unfortunately, the misleading practices don’t end there. Other major college costs, including housing, healthcare, food, travel expenses, and supplies require estimations calculated by the institutions themselves. Colleges do not have these estimations audited and, in a bid to present as more affordable, generally underestimate these costs, if they provide them at all. Some expenses, like healthcare and computer purchases, are entirely excluded; estimates for line items like books, supplies and transportation are typically not sufficient to cover real world costs; room and board costs are assumed to be \$0 if the student lives with family; and if students do not live with family, estimates assume that they are sharing a bedroom.

Using a 2017 dataset from MIT’s Living Wage Calculator, we can make local-level comparisons between off-campus cost estimations reported by schools for FF students and those reported by the calculator for a single adult with no children.5The analysis shows that 41 percent of colleges and universities in AY 2016–2017 underestimated the costs of room and board for off-campus living. For those schools, the median discrepancy between room and board estimates and realistic costs was $1,488 for public colleges and $2,045 for private colleges. Given that 53 percent of FF students that received Title IV federal aid (loans included) in AY 2016–2017 lived off-campus, and that percentage is likely higher for non-FF students, these underestimations hold deep consequences for students with financial need.

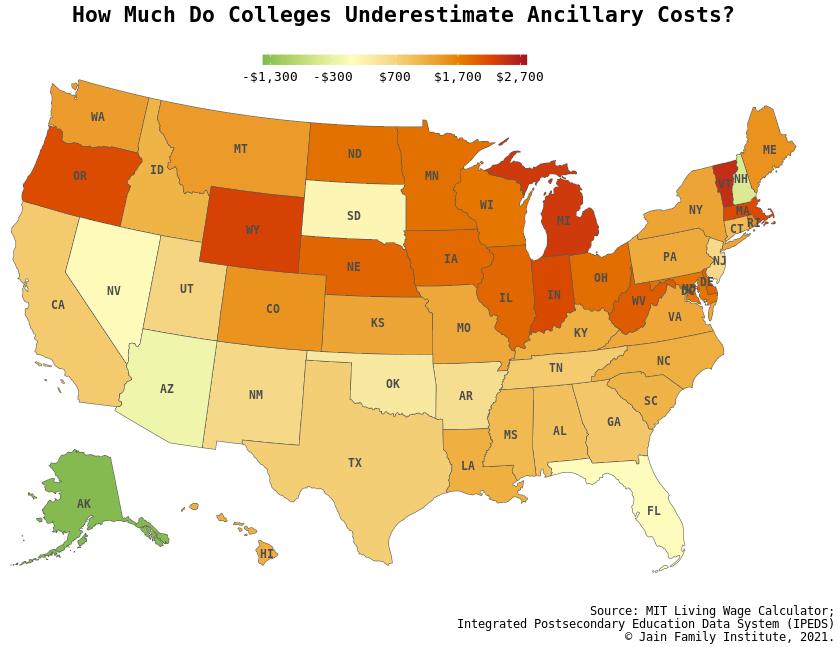

Estimated costs for off-campus “laundry, transportation, entertainment, and furnishings,” known as ancillary costs, only increased 3 percent between AY 2010–2011 to AY 2016–2017 ($3,685 to $3,797)—these are, unsurprisingly, underestimated.

In our analysis we find that 69 percent of institutions underestimate off-campus ancillary costs like transportation, clothing, and furnishings. The median discrepancy between institutions’ estimates and realistic costs is $1,665 for public colleges and $2,044 for private colleges. Of that 69 percent, over half of the colleges underestimate ancillary costs by more than 25 percent, a shortcoming of more than $1,380 dollars per academic year at nearly 2500 colleges. The discrepancies are severe, and they are not the result of student discounts unaccounted for by the Calculator. These discrepancies have an additional consequence for financing—insufficient estimates are used during the FAFSA financial aid process to determine cost of attendance. Though students can appeal to financial aid offices on need-based aid and student loan eligibility, they cannot change the school’s estimates for costs.

Net price calculators at colleges across the country generally exclude healthcare entirely, but institutions still require students to be insured, and healthcare costs continue to appear on tuition bills (a waiver is required to remove the cost). The insurance requirement may result from an assumption that enrolled students can be carried on their parents’ or spouse’s plan, but this also assumes that parents are insured, students are under 26, and parents can afford to continue paying premiums for students long after they become adults. The alternative is healthcare provided by the institution itself. These plans are very expensive, of poor quality, and generally not considered in students’ college decisions. Moreover, many institutions impose stringent requirements on external plan coverage; some students are required to pay for institutional healthcare despite being covered under family plans. With the median healthcare cost for nine months computed with the Calculator data being $1,724, the added expense imposes a significant burden on students, who don’t receive this cost estimate before enrolling.

Institutions are increasingly moving to eliminate the secondary market for textbooks. More often than not, students have to purchase unique credentials for electronic material to access online videos, tests, or quizzes that track their progress for credit. This essentially translates into a per-course fee that some worry will rise once competition from bookstores falls. Textbook publishers, in turn, fight to maintain sales by offering online learning tools via unique access codes, which also track the student progress for credit. Unlike hardcopy textbooks, e-learning codes regardless of seller cannot be resold at the end of the semester like a student would with hardcopy textbooks. E-learning tools are expensive and relatively new to the higher education scene, but estimated costs for books and supplies increased only 5 percent between 2010 and 2017 (from $1,216 to $1,274 at the same 4-year institutions). It’s unclear if these estimates include e-learning costs, however, students do take textbooks and access code costs into account when choosing courses, or even skip buying them altogether to the detriment of their grades. The dominance of access codes also implies reliable internet access, another line item not included on college net price calculators.

Conclusion

Prospective students are presented with huge amounts of data when deciding which college to attend. But much of this data is smoke and mirrors. Many colleges intentionally deceive and confuse students about the costs of college and the availability of aid. Students, especially those with fewer financial resources, unknowingly start off on the wrong foot. College brochures leave out crucial details—that borrowing students are likely to max out federal loans each year, that the only alternatives are more expensive Parent PLUS or private loans, and that the majority of students receive less generous aid packages as soon as their second year of study. Information on program-specific outcomes, like drop-out or graduation rates, is sparse and hard to access, let alone such data specific to the income level of the student. This data is absolutely necessary for prospective students to make rational decisions about college attendance. Asymmetric information between institutions and individuals is hurting the latter.

The insufficient and at times deceptive data prevents students from making the best decision about college. Even trying to establish the tuition growth rate over the past four years is difficult for someone not well-versed in college financial aid jargon. Young people have been told to make the investment in higher education, but the lack of big picture financial information to choose the right program means a much larger financial risk. Veterans, for example, are preyed upon by low quality schools, but there’s little data and policy to keep these schools accountable and to inform prospective students of poor outcomes. The Senate’s bipartisan bill to protect G.I. Bill beneficiaries, introduced in May of this year, specifically seeks to counter data gaps and provide more relevant information to veterans to strengthen successful collegiate outcomes. This is a step in the right direction, but it’s needed across the spectrum of higher education, especially when the full spectrum is operating in a for-profit manner. The call for better data is echoed in equity research and in post-graduate higher education as well.

The reality is that unforeseen funding challenges of college, including those as simple as gradual tuition increases, bring up concerns around college completion, burdensome debt accrual, or both. As a first step towards completing college and obtaining a credential in an unaffordable higher education sector, prospective students must understand and anticipate the dollars to be paid. The limited number of comparisons available in this report most likely just scratches the surface of the broad deception that characterizes college cost calculators and aid packages. Policymakers must respond to the rise in college costs and work quickly to tame the corporate profitization in its myriad of forms—it’s necessary to preserve education as a tool for individual and societal success.

Special thanks to Elizabeth Cornell-Khan, Raquel Merced, Adamma Morrison, Zyris Shakir, and Eddie Nilaj for their data research and expertise, without which this report would not have been possible.

A follow-up report, released April 2022, investigates the prevalence of misleading cost practices at elite private colleges. Read it here.

Both websites handle financial aid data that was calculated and reported directly by the higher education institutions. Though data at the student and program level is private, the institution level is made public through the Integrated Postsecondary Education Data System (IPEDS). The analysis presented here utilizes the IPEDS data and is focused on 2-year and 4-year institutions that are Title IV participants, excluding exclusively online institutions.

↩First-time means no prior postsecondary experience. It includes students who entered college in the prior summer term and students with advanced standing due to college credits earned in high school.

↩83 percent of 2- and 4-year colleges and universities in our study had a higher share of FF students receiving free grants and scholarships than the share of non-FF receiving the same type of aid. 75 percent of colleges and universities reported higher average free aid for FF students than non-FF students.

↩Annual enrollment data at colleges includes statistics on transfer students. We cannot see which colleges students are attending before transferring nor whether they took time off before enrolling at their new institution. We also cannot tell the income-level of the transfer student.

↩Comparing data from AY 2016-2017 for 2- and 4-year institutions, excluding online institutions, to 2017 MIT Living Wage Calculator data. The Calculator’s cost data is reported for a 12 month period; to properly make comparisons, Calculator data was computed to a 9 month value.

↩

Filed Under