Editor’s note: The author would like to acknowledge the work and influence of the Institute for Sustainable Futures, Professor Thomas Graedel, and in particular Professor Julie Michelle Klinger, whose essential book Rare Earth Frontiers undergirds much of the ongoing work and discussion on the politics of rare earth mining.

The transition to a post-carbon energy economy will require extraction. As the sun set on the Bernie Sanders campaign, and with it the prominence of the Green New Deal in the contest for the presidency, the Trump administration issued an executive order encouraging private US exploitation of mineral resources in space. Whatever the shape of the coming transition away from fossil fuels, the need to understand the social and distributional costs of a changing energy infrastructure has never been greater. In a new report, I survey the state of minerals production, near-future ploys for extra-terrestrial mining, and the persistent externalities of extraction.

Recent years have seen growing attention to the material requirements of information technologies, and especially to the social and environmental harms of sourcing rare earths and cobalt. Researchers highlight, for example, the dependence of electric vehicles and wind power infrastructure on rare earths, or batteries on lithium. But these discussions have tended to omit questions regarding the necessity of extraction, relying instead on a more familiar idiom of consumer and corporate responsibility. Both the Trump administration’s vision of celestial expansion and some visions of a post-carbon future depend, stated or not, upon a continuing regime of mineral extraction and outsourced harm.

In the financial press, concerns around the ethics of mineral sourcing are accompanied by anxieties around supply security: are there enough of these so-called “critical” metals to sustain a complete zero-carbon energy transition? Are they abundant and accessible enough for such a transition to be economically viable? As one paper puts it, transitioning “from a fossil-based to a [renewable energy]-based system does not alleviate the problem of resource depletion, it merely shifts it from fuel to metal.”1 While predicting future demand is difficult, the general consensus is that the supply of several metals—such as cobalt, nickel, cadmium, copper, and tellurium—will need to increase substantially to accommodate a renewable energy transition. Predicting the resources (the total quantity available) and reserves (the amount that can be economically extracted) of a given metal is also imprecise, sometimes changing overnight by orders of magnitude as the price of a metal goes up or as new extractive or refining technology is developed. These patterns follow that of oil: turn-of-our-century predictions of impending “peak oil” seem silly at the end of a fracking boom that pushed oil extraction to an all-time high. Nevertheless, current predictions estimate that most metal resources will last at least a century, though some, such as copper, may be exhausted sooner.

But more worrisome than questions of supply are the social and environmental harms of mining. Environmental impacts may include habitat loss, deforestation, high water usage, water and air pollution, soil contamination (in the US, metal mining is the greatest producer of toxic pollutants), and greenhouse gas emissions (10% of overall GHG emissions stem from the mining sector globally). Many of these effects are a result of regular mine operations, and standard mitigation infrastructure, like tailings dams, fails quite frequently. The results amount to a litany of devastation, like the 2000 Baia Mare tailings spill in Romania, dubbed “the worst environmental disaster since… Chernobyl”, and the 2015 Fundão tailings dam collapse that destroyed an entire village. At the time, the Fundão collapse was “Brazil’s worst ever environmental disaster”; that title now goes to the 2019 Córrego do Feijão tailings dam collapse. Just 90km from the Fundão tailings dam and owned by the same company (Vale), this disaster killed almost 300 people.2

The damage of these projects long outlives their duration. Toxic leakages can continue for a century after a mine’s closure, and the remediation work that is supposed to follow comes with extraordinarily high costs which are often borne by the public. For a sense of scale: one mining area in Ganzhou, accounting for just over 8% of Chinese rare earth production, was estimated to have a remediation cost equivalent to 25% of the market capitalization of the five major Chinese rare earth companies—or 75% of all Chinese production.

Areas designated as “protected” by governments and international conservation bodies, often including Indigenous lands and nature reserves, are supposed to be spared damaging effects. But mining concessions frequently overlap with protected areas,3 and even when they don’t, proximity can be just as damaging. Pollution doesn’t respect the boundaries of mining concessions, and neither does the infrastructure required for extraction—roads, processing facilities, and so on all contribute to deforestation well beyond the concession boundaries. In total, about a quarter of protected areas (in countries for which there is data) around the world overlap with or are within 1km of at least one mining concession.

As demand for metal grows, we should expect these harms to worsen. While there appears to be enough metals in the ground to sustain anticipated demand increases, the dynamics of the industry are such that only the most profitable—that is, most accessible or highest in concentration—deposits are mined first, and over time, operations must dig deeper and/or process lower-quality ore, requiring more energy, water, and occasionally more toxic processing. One estimate suggests that the environmental impacts of copper could double or triple by 2050 because of this dynamic.4

The distribution of these harms is also unequal. The Australian Lynas Corporation, the largest rare earths firm outside of China, operates the Mount Weld rare earth mine in Australia, but exports the most toxic part of the production cycle, ore processing, to Malaysia. Locals in Kuantan, the site of the processing plant, have resisted the project, arguing that its construction was a way for the firm to shift the environmental and health harms from the Australian public onto them. (In August of last year, the Malaysian government renewed its license to Lynas for the plant, citing the need to counterbalance China’s dominance in the rare earths market.)

The race to the bottom in mining and processing shapes these dynamics. The Mountain Pass mine in California was once the world’s major producer of rare earths, accounting for 70% of global production until the early 2000s. The mine was eventually shuttered following environmental regulations and worries around its radioactive leakages. To fill the gap, the Chinese government expanded rare earth production, accepting the harms as an acceptable cost of economic growth. However, when China started imposing tighter quotas around rare earths due to environmental and health impacts, the US, Japan, and the EU—needing access to cheap rare earths but not willing to bear the costs themselves—summoned the World Trade Organization to rule against the quotas.

The other harms of mining are myriad. One notable example is a 10-year civil war around the Panguna copper mine in Papua New Guinea, which resulted in about 20,000 dead. While conflicts are frequently on a smaller scale, they are no less violent. Mining activity encroaches upon resources that people require; in Chile’s Salar de Atacama, the “world’s driest desert” which also supplies one-third of the world’s lithium, 65% of the region’s precious water goes towards lithium production instead of the local population. Inadequate land rights allow mineral wealth to be monopolized by states and companies rather than those who live on the land. In Brazil, Indigenous land rights extend to only the top 40cm of the land; the federal government owns anything deeper and sells the rights to mining companies. Mining concessions are often extracted under duress as “sweetheart deals” that disproportionately benefit the mining entity, such as those signed in the Democratic Republic of Congo—now notorious for its horrendous mining conditions—immediately following its devastating wars.

Growing concern around supply security has caused rich nations to rethink their dependence on others. In line with the rhetoric of energy independence that accompanied the shale oil boom, the US is now prioritizing domestic production of “critical metals” for national security goals. This shift has led to the reopening of the California Mountain Pass rare earth mine. The fracking boom may provide a useful parallel here too: energy independence has come hand in hand with increased domestic environmental and health costs, as well as political conflict over land rights. In a race to achieve critical metal independence, we are likely to see the tandem production of harms, disproportionately distributed to marginalized communities both domestically and internationally.

Under the Sea, Beyond the Stars

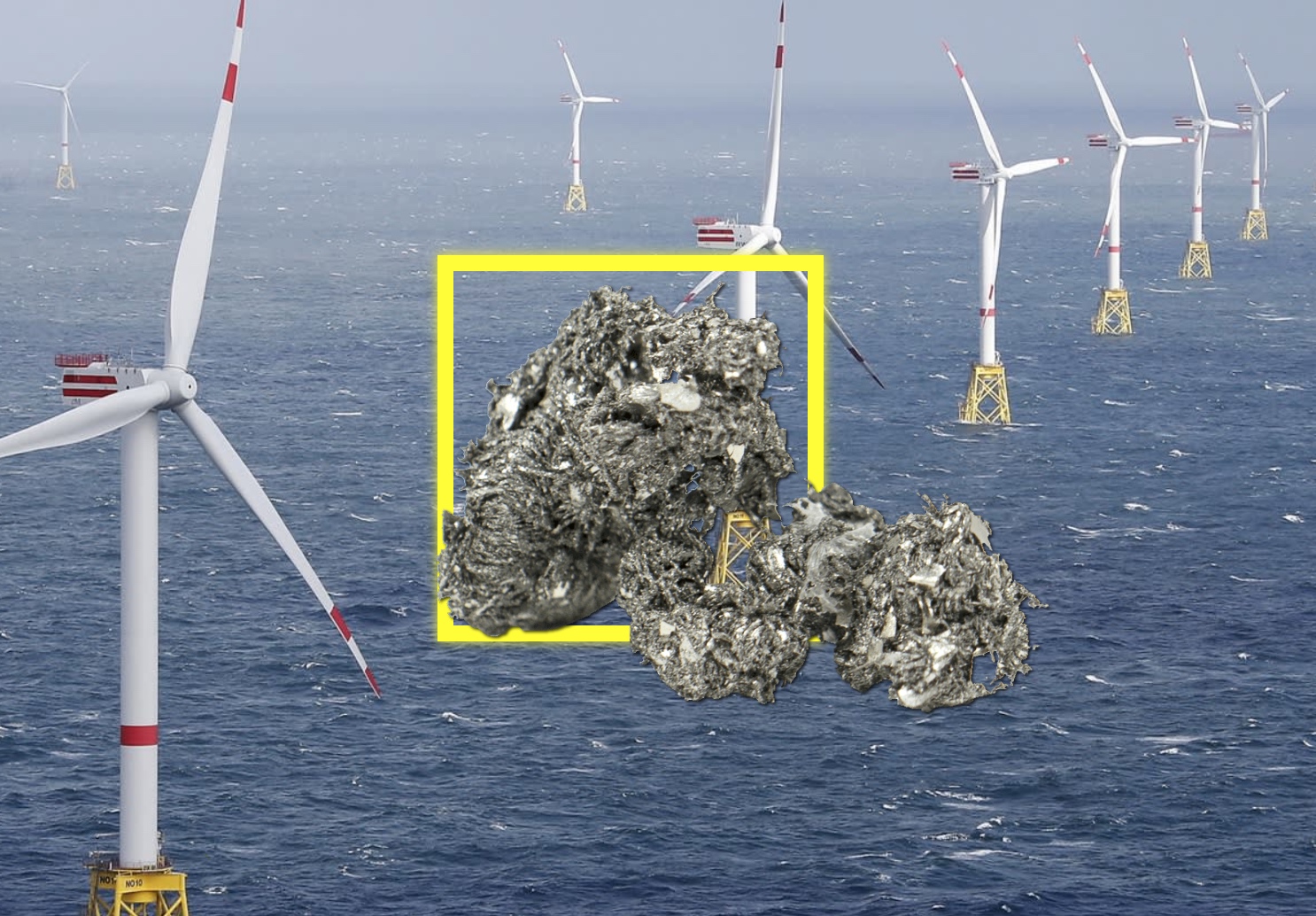

Supply security issues and social and environmental harms have inspired a spate of private industry interest in sites far removed from the immediate human impacts of terrestrial mining: the deep sea and outer space. Both deep sea and outer space mining companies frame their missions in terms of social necessity: a green future, they say, cannot exist without them.

Of the two, the deep sea is more technically feasible in the short term. The International Seabed Authority (ISA), contra its United Nations mandate to protect the sea as the “common heritage of mankind”, has already been granting exploration and mining leases for the seabed in international waters. The promise of deep sea mining appears tremendous: one square kilometer of Pacific deep sea mud is estimated to contain enough rare earths to satisfy one-fifth of the world’s annual demand. For island nations this could introduce a lucrative new revenue stream; for Japan, the prospect of reduced reliance on China for metals is especially appealing.

The resource security appeal of deep sea mining is accompanied by a set of purported environmental and social benefits. There is, for example, less radioactivity involved with deep sea rare earth deposits. And no one lives in the deep sea, so presumably there are no people to displace or to suffer as collateral damage in the process.

Of course, while no one lives in the sea, many peoples’ lives depend on it. Reports looking at the potential harm of deep sea mining invariably conclude that preventing biodiversity loss is an “impossible aim”,5 not to mention downstream effects on the ocean’s role as a source for food, medicine, industrial compounds, and so on. There is also the possibility of disrupting other ecological functions the ocean plays, perhaps most alarmingly as one of the most important carbon sinks on the planet.

If deep sea mining shows that the near-term offers only the possibility of shifting harms, rather than their reduction, then perhaps, several Silicon Valley billionaires imagine, we should shift those harms off-world entirely. Just as waterways were once thought of as endless repositories for refuse, outer space, already rapidly accumulating space junk, is similarly becoming an imagined dumping ground. In Jeff Bezos’s words:

We send things up into space, but they are all made on Earth. Eventually it will be much cheaper and simpler to make really complicated things, like microprocessors and everything, in space and then send those highly complex manufactured objects back down to earth, so that we don’t have the big factories and pollution generating industries that make those things now on Earth… And Earth can be zoned residential.

The claimed environmental benefits would be nice, but what is undoubtedly of more interest to Bezos and other space mining companies is sheer profit. The abundance of metals in asteroids and other celestial bodies is massive. One estimate places the concentration of platinum group metals at up to 100 times that in terrestrial deposits, depending on the composition. Its promise is so great that some worry the rapid influx of previously scarce metals will destabilize markets and cause the global economy to collapse. Preventing this would require holding reserves in orbit and slowly releasing supply into the terrestrial economy. This is not really a radical departure from how supply control works now:

One attorney working for an anonymous firm explained that keeping resources in processed form in Earth’s orbit would effectively be the same as keeping them locked in a vault on Earth—they could be “kicked” down and retrieved only at the firms’ discretion without breaking any current global trade agreements.6

This rosy view of abundant space metals also figures prominently in post-scarcity utopias, like Aaron Bastani’s “fully automated luxury communism.”

There are some obvious advantages to mining in space, the most touted being that the pollution takes place off-world. There are some earthbound impacts, namely around launch and reentry, but even taking these into account, the overall impact is estimated to be substantially less than terrestrial mining. One analysis suggests that terrestrial platinum mining emits over 250 times more carbon emissions than the asteroid mining equivalent,7 though this is dependent on the payload size, the amount of transit between Earth and space, energy sources, and so on. But substantial space mining operations would require a great deal of terrestrial infrastructure that doesn’t exist yet, the construction of which includes all attendant political questions and environmental harms that brought us here in the first place.

Beyond these concerns are others regarding the logistics of these operations. There are roughly two methods for asteroid mining: intercept the asteroid and mine on-site, which is more challenging and expensive, or capture it and bring it into Earth’s orbit. This latter option, though more feasible than the alternative, introduces a new concern: the possibility of impact. For this reason, limiting captured asteroids to 20m or less in diameter is recommended so that, were something to go wrong, it would disintegrate in our atmosphere before crashing into Earth. These calculations are not entirely comforting: in 2013, the Chelyabinsk meteor damaged over 7,000 buildings and resulted in the injury of at least 15,000 people in a relatively sparsely populated area. It was 20m in diameter.

Many interested in space mining point to inadequate property rights as a barrier to the industry’s development. The 1967 Outer Space Treaty recognizes space as a commons—no nation or private interest can lay claim over a celestial body. As the recent Executive Order demonstrates, this hasn’t stopped the US. As early as 2015 the SPACE Act attempted to unilaterally impose property rights onto space at the behest of space mining companies. The Trump administration’s recent executive order encouraging space mining puts it rather bluntly: “the United States does not view space as a global commons.”8

The immediate concerns around land and deep sea mining are their social and environmental harms. While space mining would still involve substantial materials, energy, and labor—and all of their consequent impacts—the bigger question is around its near-term feasibility. The recent set of space mining companies have all folded or been acquired for their ancillary technologies (the most puzzling of which is Planetary Resources’ acquisition by the blockchain company Consensys). Space mining may have a role in future mineral extraction, and maybe there’s a way to do it “right”, but we shouldn’t bet the planet on it.

Reduce, Reuse

If these harms largely stem from mining new materials, then a reasonable solution may be to make the most out of the metals already in circulation. We should, as one paper puts it, “minimize the seemingly bizarre situation of spending large amounts of technology, time, energy, and money to acquire scarce metals from the mines, and then throwing them away after a single use.”9

Metals are infinitely recyclable, and ideally we would be able to re-use all of the metals that are thrown away. Recycling is not “free”—it requires energy and labor—but its emissions, energy and water use, and waste are all substantially lower than mining. Yet there are a number of logistical and physical problems that complicate this otherwise clear advantage. Collection and separation are two major issues. Some waste is amenable to “mass recovery”, such as steel beams in buildings which are basically one metal and can be collected en masse when buildings are dismantled. But the shift in how we use metals now—as electronics components, which have metals in only trace amounts mixed with other metals, plastics, and so on—introduce much more complicated collection and separation challenges. Like plastics, recycling electronics components requires individual compliance to send their electronics to proper recovery facilities. But while there is relatively well-established plastics recycling collection infrastructure (which still sees low participation rates), few equivalents exist for electronics. Instead there is a network of informal and highly toxic e-waste circulation and recovery, most famously in Ghana and China. And while automated sorting is a key feature in many sorting facilities, the highly mixed nature of electronics means that automated solutions result in high levels of material loss. Only human labor is capable of adequately separating materials in electronics; the high cost of human labor makes the whole thing uneconomic.

Logistics aside, a deeper issue with recycling is that its benefits diminish with expanding demand for metals. Growing demand for metals will always require more mining. Movements like right-to-repair suggest a better approach. Repairing and reusing products has the lowest impacts compared not only to mining but also to recycling. But such practices are limited by both anti-repair policies and product design, such as proprietary screws and thinner device profiles.

Conclusion

The threat of climate change is global, yet so far the lion’s share of proposed solutions remain, at no fault of their own, stuck in the parochial realm of domestic political constraints. We will transition to renewable energy—but it may be through means whose consequences fall on the global poor. Our vision for decarbonized future must consider how these harms can be ameliorated.

Read the full report here.

- Moreau, Vincent; Dos Reis, Piero C.; Vuille, François. 2019. “Enough Metals? Resource Constraints to Supply a Fully Renewable Energy System.” Resources 8, no. 1: 29. ↩

- Curtis, M. (2019). The Rivers are Bleeding: British mining in Latin America. R. Cifuentes, Trans.). War on Want. ↩

- See the full report for visualizations of these overlaps. ↩

- Kuipers, K. J., van Oers, L. F., Verboon, M., & van der Voet, E. (2018). Assessing environmental implications associated with global copper demand and supply scenarios from 2010 to 2050. Global Environmental Change, 49, 106-115. ↩

- Niner, H. J., Ardron, J. A., Escobar, E. G., Gianni, M., Jaeckel, A., Jones, D. O., … & Van Dover, C. L. (2018). Deep-sea mining with no net loss of biodiversity—an impossible aim. Frontiers in Marine Science, 5, 53. ↩

- Klinger, J. M. (2018). Rare Earth Frontiers: From Terrestrial Subsoils to Lunar Landscapes. Cornell University Press. ↩

- Hein, A. M., Saidani, M., & Tollu, H. (2018). Exploring Potential Environmental Benefits of Asteroid Mining. arXiv preprint arXiv:1810.04749. ↩

- See the EO here and the accompanying fact sheet here. ↩

- Reck, B. K., & Graedel, T. E. (2012). Challenges in metal recycling. Science, 337(6095), 690-695. ↩

Filed Under