If they are remembered at all, the 1950s are now thought of as a lost golden age of stable growth and political economic consensus. But the second half of the decade saw rising prices, tightening financial conditions, diminished industrial employment, and stagnant investment. With knowledge of the turbulence that followed, historians have increasingly interpreted the economic history of the late 1950s not as a minor aberration to a stable political order but as revealing structural pathologies latent in the twentieth-century industrial economy. If contemporaries did not yet use the word “stagflation,” they might as well have, referring to the decade’s rising prices with terms such as “new inflation” and “recession-cum-inflation.”1

Gardiner C. Means was one of the most astute analysts of the policy dilemma created by this anti-inflationary monetary policy. Means owed his original prominence to The Modern Corporation and Private Property, which he co-authored with Adolf Berle in 1932. This surprise best-seller popularized the idea that corporate capitalism—specifically, its tendency to separate ownership and management—represented a radical transformation in social organization. The book placed the question of corporate power on the agenda at the depths of the Great Depression, and Means parlayed this commercial and intellectual success into a position at the Department of Agriculture in the first Franklin Roosevelt administration. The New Deal’s response to that conjuncture was in part shaped by his distinctive analysis: the length and depth of the 1930s recession was, he argued, a consequence of an imbalance in relative prices between economic sectors—a diagnosis which prescribed national economic planning to raise agricultural prices and allow farmers to afford an expanded volume of industrial production.

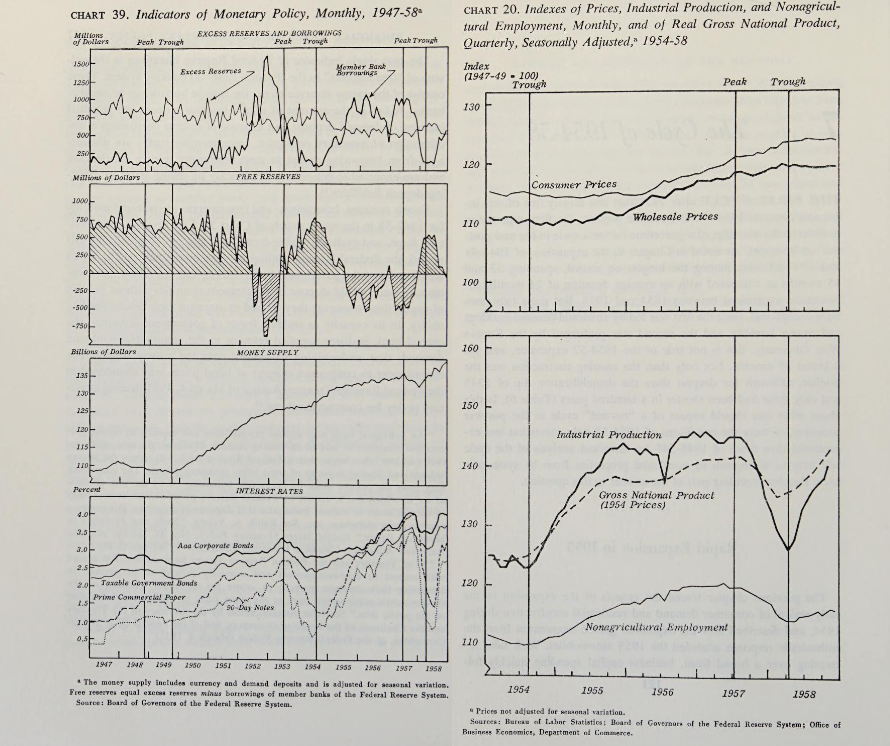

Twenty-five years later, Means brought his familiarity with corporate pricing patterns to the distinctive problem of the postwar economy. Between 1955 and 1960, in response to rising prices, the Federal Reserve tried to fight inflation by engaging in their first sustained monetary tightening since before World War II. But monetary austerity constrained investment, employment, and growth. It also achieved at best mixed success on the price front; while production and employment flagged, prices did not fall. As unemployed workers, struggling farmers, and Cold Warriors with an eye on Soviet growth rates acutely felt the costs of the Fed’s tightening, Democratic Party strategists sought to unite these groups into a coalition that could in 1960 break the eight-year Republican hold on the White House. Reflecting these social and political energies, Congress held a series of continuous hearings between 1957 and 1961: in the Senate on “Administered Prices” (1957-61), in the House on “Proposed Price and Wage Increases” (1958 and 1959), and in the Joint Economic Committee on both “The Relationship of Prices to Economic Stability and Growth” (1957-58) and “Employment, Growth, and Price Levels” (1959-60).

The star witness of each of these hearings was none other than Means, then serving as Associate Director of Research with the business-sponsored Committee for Economic Development (CED). “Clamping down on the volume and availability of credit [is] too blunt an instrument for dealing with this type of price rise,” the editors of the New York Times noted in response to the hearings. “If applied with sufficient vigor [tightening] can slow down the whole economy and produce widespread disemployment.” The excerpts below, taken from his various lectures and testimonies to Congress in this period, republished in 1961 and republished here for the first time in over six decades, offer a glimpse of the expansive possibilities at the beginning of the 1960s. This represented a time when a business-sponsored economist could reject the efficacy of monetary deflation in pursuit of price stability and suggest reforming corporate behavior as the solution to the problem of inflation in the American economy.

The program suggested by Means was not seriously taken up—neither by the incoming Kennedy-Johnson administrations, who preferred voluntary guidelines to new legal institutions, nor by the Nixon administration and those who followed, for whom federal price regulation proved a taboo too strong but for the most extreme and temporary emergencies. As the resultant de facto policy instrument, however, monetary policy geared to internal prices had cascading consequences: from attracting foreign capital into dollars and shifting exchange rates, to precipitating financial crises in Third World sovereign debt and domestic Savings and Loan depository institutions. Means’s diagnosis of the roots of inflation in corporate behavior point away from the necessity of such monetary measures.

As Americans in the twenty-first century return to the dilemmas of a high-pressure economy, Means’s insights into the methods and implications of corporation pricing make him once again our contemporary.

— Andrew Yamakawa Elrod

The excerpt below is taken from Mean’s various testimonies to Congress in 1957 and 1959, and republished in 1961.2

Monetary policy and administrative inflation

Just what was the effect on inflation of the tight money policy from 1955 to early 1958? In late 1955 and early 1956, it may well have served to prevent a demand inflation which would otherwise have occurred, although demand, in fact, did not rise to the extent required for full employment. In the latter part of 1955, there was a high demand for credit, partly to finance the heavy volume of auto purchases and partly to finance capital expansion by business. This tended to lift interest rates above their 1953 levels. . . . However, this action did not prevent administrative inflation.

After early 1956, the situation was quite different. By the spring of 1956, manufacturing demand was easing off, particularly for durable goods other than steel, which was being accumulated in anticipation of a strike. As we have seen, at no time after the spring of 1956 was demand sufficient to push manufacturing production significantly above its highest 1955 level in spite of surplus labor and productive capacity. The further tightening of monetary policy after the spring of 1956 was thus effective in limiting demand. But, because there was no initial excess in demand, the further tightening of policy inhibited growth in the presence of unused resources, while administrative inflation continued.

Then, in the summer of 1957, when there were ample signs that demand was steadily weakening relative to normal growth, the extreme tightening of money was a shock to the business community that could well have initiated the sharp recession which followed and, along with the previous tightening, have been its primary cause. The recession brought a fall in market prices which masked the continued administrative inflation but did not halt it.3

The conclusion seems inescapable that a tight monetary policy cannot stop administrative inflation without creating excessive unemployment, and may not be able to do so even then. In the last three years, the effort to control administrative inflation by a tight money policy appears to have cost the nation at least $70 billion of national production (at 1958 prices) which would have been available if that demand had not been so curbed by the tight money policy that a significant amount of manpower and industrial capacity was idle. Whether the administrative inflation during the period would have been greater if a full-employment monetary policy had been pursued is open to debate.

It is easy to see why the Federal Reserve Board continued its tight money policy after the spring of 1956. The wholesale price index continued to rise and the consumer price index began to rise in the summer of 1956. In traditional economic theory, rising prices are an indication of excess demand. An undiscriminating analysis of price movements seemed to confirm the general character of the inflation. And the concept of an administration inflation was not then [in 1956] current.

However, suppose that the Federal Reserve Board had been given an analysis showing that after the spring of 1956 there was no demand inflation, that neither labor nor plant capacity was being fully utilized, and that administrative inflation was under way. Consider the dilemma which would have faced the Board: Should demand be expanded so as to bring about full employment while administrative inflation continued; or should demand be contracted in an effort to prevent administrative inflation even though this meant excessive unemployment?4 This would have been an awful choice and there is a good deal of question whether such a momentous decision should rest with the Federal Reserve Board . . .

A Congressional directive to the Federal Reserve Board

At the present time there is great ambiguity as to the responsibility of the Federal Reserve Board with respect to inflation. The Employment Act of 1946 places on the Board (as on other agencies of Government) responsibility to aim its policies at “maximum employment, production and purchasing power.”5 It is generally accepted that there is an implicit directive to maintain price stability. Since the Board does have the powers which could prevent demand inflation but cannot control administrative inflation without creating excessive unemployment, the directive to aim at both employment and price stability involves some measure of contradiction. This contradiction could be removed by a Joint Resolution of the Congress, which would:

1. Distinguish between demand and administrative inflation.

2. Absolve the Federal Reserve Board from responsibility for controlling administrative inflation and reiterate its responsibility for aiming its policies toward achieving high employment and preventing demand inflation.

3. Accept the responsibility of the Congress to find other ways to prevent serious administrative inflation.

Since the Federal Reserve Board is a creature of the Congress, a Joint Resolution would be a command to it. Moreover, a Congressional discussion of such a resolution could be very educational even if the resolution were not passed. Such a discussion alone might be sufficient to clarify the responsibility of the Reserve Board.

With such a clarification of objectives, the Board could adopt policies which would bring about the expansion in demand required for full employment without demand inflation, while other measures were adopted to prevent serious administrative inflation. The Board already has ample powers to prevent the expansion of demand from becoming excessive and creating demand inflation.

Public hearings to check administrative price increases

There are before Congress several bills which would authorize one Federal agency or another to hold public hearings on any prospective price increase which appeared to threaten economic stability. Enactment of such legislation would provide a check on the tendency to raise prices by administrative discretion. Price and wage controls in peacetime should be regarded as a last resort, to be considered only if other measures have failed. But public hearings on prospective or actual price increases, and where necessary on wage increases, could serve a very useful purpose where there was serious danger that such increases would threaten the stability of the economy and impede economic recovery.

A large number of such hearings would not have to be held in any one year. Authority to hold hearings could be expected to reduce somewhat the enthusiasm for raising prices, and a few important hearings could do much good. The disclosure of relevant data on costs, wages, productivity, etc., would allow the public to discuss on a factual basis the legitimacy of price increases and bring home to those in control in the concentrated industries the policies which would represent responsible behavior toward economic recovery. Such hearings would not be a powerful tool, but rather a valuable aid both in slowing up administrative price increases and in educating the public to the significant issues.

An anti-inflation tax to reduce incentives for price increases

The incentive to increase administered prices in order to increase profits could be greatly reduced by a graduated anti-inflation tax. The evidence presented before the Senate Anti-trust and Monopoly Subcommittee makes it clear that the concentrated industries are the chief source of administrative inflation. Therefore an excess profits tax limited to the larger corporations, perhaps those with assets over $100 million [today’s top TK corporations by assets have over $TK billion in assets – AYE], could be effective. Presumably it would only be operative for profits above an ample rate of return on capital and then would take an increasingly large proportion of the excess as the rate of return was higher. Such a tax would reinforce the effect of hearings on specific prices. . . .

An easier money policy

The fourth requirement in this recovery program would be an easier money policy. So long as the Federal Reserve Board thought that it was dealing with a demand inflation, it had reason to pursue a tight money policy. And when its leading economists came to recognize the administrative character of this inflation, the Board faced the dilemma already outlined. But if the Board were relieved of responsibility for combatting administrative inflation and steps were taken to check administrative inflation such as the public price hearings and the anti-inflation tax suggested above, the Board’s course would become clear. . . .

Originally delivered as a lecture during the dedication of a new Law Building at Ohio State University in April 1960, Means’s paper on the legal implications of economic power proposes a reform of corporation law governing management that he suggests would eliminate the incentives to withhold capital investment—even in the face of high prices and profits. The text has been lightly edited for clarity.6

Pricing in theory and practice

Here we come to a second failure of traditional theory—the failure of both economic and legal theory to deal adequately with market power in the presence of competition.

Up to a generation ago, economic theory drew a sharp distinction between competition and monopoly. Either an industry was competitive and the benefits of classical competition were presumed to flow, or it was subject to monopoly with results likely to be detrimental to the public interest. Legal theory paralleled this analysis and supported anti-trust laws to break up monopoly where it appeared “unnatural” and supported government regulation where monopoly appeared to be “natural.” What both systems of theory failed to recognize is that competition among the few is not likely to produce the results in the public interest which could be expected from competition among the many. Neither economic nor legal theory took account of competition among the few. Conceptually, competition was the classical competition of Adam Smith and Alfred Marshall. And the legal efforts to maintain competition were outstandingly successful in preventing monopoly and outstandingly unsuccessful in maintaining or establishing classical competition. The result is that most of manufacturing industry is today dominated by the “big three” or the “big four” actively competing with each other but with effects quite different from those to be expected from classical competition.

Both theory and current empirical evidence support quite a different approach. In the typical big business situation there are two considerations which appear to dominate the administration of prices. First, it is important to a big enterprise that, as far as possible, the minutiae of pricing decisions be delegated to subordinates with only the crucial decisions made by top management. And second, the main consideration in the actual price is not the price which will yield the maximum profit, but the price which will keep down new competition and yield the maximum value. As we shall see, maximum profit and maximum value are two quite different objectives and each involves quite a different calculus. One is focused on demand and costs; the other on rates of return which will induce or keep out new competition. In the first, the problem is to determine the maximum profit. In the second, the problem is to determine the optimum balance between a higher or lower rate of return and a greater or less risk of new competition.

As far as I know, the first logical presentation of this pricing calculus was made, not by an economist, but by a management engineer. In 1924, Donaldson Brown, then with DuPont and later a Vice President of General Motors, outlined a pricing procedure which is now extensively used by big manufacturing enterprises.

Because this pricing calculus is so different from that derived from monopoly theory and because it opens up a new possibility for corporate management, I want to list the five steps which it involves.

The first step is to determine a rate of return on capital which will represent the optimum balance between high returns and the risk of new competition. This is called the target rate of return. General Electric, General Motors, and presumably, DuPont, each appears to use a target rate of 20 percent after taxes in their pricing. [General Motors still earned 19 percent returns on equity after the Johnson administration negotiated a reduction in prices on 1966 models.—AYE] Union Carbide appears to use 18 percent after taxes, Johns-Manville, 15 percent. US Steel formerly appeared to use eight percent after taxes, but a few years ago revised its target rate upward considerably. It may now be close to 15 percent. Whatever the basis for selecting the target rate may be, forecasts of cost and demand do not enter into this step in the calculus.

The second step is to adopt a “standard rate of operation” for pricing purposes. This may be the actual average rate of operation over a period of years or a rounded figure close to the actual experience. Thus, if an enterprise finds that in the past, with the ups and downs of business activity, it has operated its plant at close to 80 percent of rated capacity, it is likely to use 80 percent as its standard rate for pricing purposes.

The third step is to estimate the average cost of production per unit, if the enterprise or the particular plant were operated at the standard rate of operation, say 80 percent of capacity.

The fourth step is to figure what price would have to be charged, in the light of these costs, if the target rate of return were to be made when the company or plant operated at the standard rate of operation. This can be called the target price.

It should be noted that up to this point in the pricing process no consideration at all has been given to the demand for the product. Only at the fifth stage is demand introduced into the calculation.

In the fifth step, the market is examined to see what volume of sales could be expected at the target price. If the market survey indicates that, under average market conditions, the sales at the target price will be just about equal to production at the standard rate of operation, then the target price will be adopted as the price.

If the market analysis indicates that a larger amount could be sold at the target price, the enterprise will not usually set a higher price since this would produce a rate of return higher than the target rate and attract new entrants. Rather, it will adopt the target price and immediately start expanding its facilities so as to supply the larger demand.

If, on the other hand, the market analysis shows that, under average conditions, demand at the target price will not allow the standard rate of operation, then the management is faced with two alternatives. It can decide not to make the product on the ground that it would not yield the target rate of return, or it can decide to set a lower price and institute a major drive to reduce costs of production of the particular product in order to earn the target rate of return at the lower price.

The sharp contrast between this pricing calculus focused on a target rate of return and the traditional calculus focused on demand and cost must be obvious. Target pricing starts with the target rate of return and works from that to costs and demand. . . . In contrast, the traditional theory starts with demand and costs. . . .

The target pricing technique may not be rigidly adhered to and different target rates of return may be applied to different lines of product by the same company. It does, however, provide a logical pricing technique and empirical studies have shown that in the United States it is [was, at least,] employed by the price leaders in many concentrated industries such as chemicals, automobiles, steel, electrical equipment, construction materials, and agricultural implements. It helps to explain the inflexibility of administered prices which has come to be such an important aspect of the American economy.

Profits and the public purpose

Of immediate importance for our present discussion is the economic power reflected in target pricing. The purpose in target pricing is to obtain a rate of return above the competitive cost of capital but not so much above the competitive cost as to stimulate new competition. The more difficult to enter an industry, the greater the discrepancy between a competitive rate of return on capital and the target rate that can be successfully achieved. A target rate of return of 20 percent after taxes would probably represent more than double the competitive cost of capital. The public utilities whose prices are regulated to allow only six to six and a half percent return have had no difficulty in raising new capital for expansion. . .

What does this mean from the public point of view? It means that the drive for profits in these great collective enterprises does not serve the public interest. In three important ways the profit objective as the guide to operations conflicts with the public interest.

First, prices result which are above the economic costs of production and profits are above the economic cost of capital. This represents a distortion in income distribution which may or may nor be socially important.

Second and more important, this exercise of pricing power aggravates labor-management relations. Excessively high earnings on capital offer a constant target which in a sense justifies pressure from labor for increased wage rates. At the same time the focus on the drive for corporate profits amply justifies labor’s adoption of the same drive to get higher wages.

Third, and in my opinion most important of all, a high target rate of return means that the collective enterprise is not making full use of its potential. If a big corporation, despite its great resources of technology and organization and access to capital and labor, will make only those things which will yield a 20 percent return when it can get capital funds for 8 or 10 percent, an economist must say that it is not serving the public interest as it should, or more exactly, as it would have to if it were subject to classical competition. And if a big corporation will replace existing plant and equipment only when the new will make 20 percent on the investment, it will fail to make full use of modern technology. . . . From the public point of view, the drive for corporate profits is not a satisfactory guide to the operation of the big collective enterprise. . . .

What, then, can take the place of the drive for corporate profits? I believe there are two institutional changes which, in combination, would provide an effective alternative.

The first depends on the target techniques of pricing. So far as the mechanics of target pricing are concerned, the actual target rate of return is not important. The pricing process would be essentially the same whether the target rate adopted was 20 percent or ten percent or eight percent. If top management found that adequate capital could be obtained . . . when an average of eight percent on capital was earned after taxes and if it adopted eight percent as the target rate, the rest of the pricing process would follow and prices would tend to correspond to average economic costs.

Under given economic conditions a lower price would result in a greater volume of sales and require a greater plant expansion. This would reflect the more effective use of resources. Also, it would give legitimacy to management in its demand that labor be reasonable in its wage demands, a legitimacy that is certainly lacking when management is under a drive to make more profits.

However, while a target rate of return geared to the actual cost of capital would be an effective guide to pricing, it would not provide the other pressures for economical operation which is provided by corporate profits. . . If the objective of the game is to make profits, then prestige and satisfaction depend on making profits. But if the objective of the game can be redefined, then prestige and satisfaction in accomplishment need not be tied to corporate profits.

Money rewards to management also do not need to be tied to corporate profits. Many corporations now have two bonus systems, one for top management that is geared to corporate profits, and the other for lower levels of management that is geared to performance. . . . I believe a system for performance bonuses for top management could also be worked out. Such a system would be tied to the setting of target rates of return on the basis of capital costs. It would presumably include bonus payments for cost reduction, product improvement, research and development, and for other such items of good management as could be effectively measured. . . .

However, there is one problem with respect to bonuses that we do need to consider. This is the effect of income taxes on bonuses.

In the past, most of the big companies have given cash bonuses to top management for increased profits. But with high income tax rates, cash bonuses have very little incentive power. A high-salaried executive is [read: was] likely to pay most of any cash bonus to the Federal government. If the president of a big company receives $200,000 as a salary [about $2 million today] (more than half already going to the government [under the 1960 income-tax schedule]) a bonus of $200,000 is likely to net him only $18,000. As a result, many corporations have adopted a stock option plan whereby the top officers are given rights to buy stock from the corporation at the market price prevailing at the time the right is given and good for a period of years. If the stock rises in price and the option is exercised, the gain from the sale of the stock after six months will be taxed as a capital gain. Such options place top management under great pressure to increase profits so as to raise the market value of the stock and obtain income not subject to the very high tax rates.

If cash bonuses for performance are to be substituted for profit bonuses and made effective with top management, changes in tax law would be needed to increase the take-home pay from such [performance] bonuses [in exchange for public regulation of target rates of return] . . . The real legal question is whether, with such legislation in operation, the adoption of the dual program by management could be overturned in the courts. As I envisage the tax law, it would provide a big inducement to management to adopt the performance bonus system, particularly if the same legislation removed for collective enterprises the capital gains provision associated with stock option bonuses. But it is difficult for me to find any great advantages to the stockholders . . .

On what basis can the stockholder be made to have an interest in putting such a dual plan into effect or be forced to accept such a plan?

Here it seems to me we break into new legal ground—or perhaps, as a non-lawyer, I should say here is where I get out beyond my depth. If I have analyzed the economic problem correctly the rates of return on capital are currently too high for the public interest to be fully served because there is neither public regulation nor a close approximation to classical competition. From the public point of view, the stockholders are getting returns out of proportion to their contribution . . . and the public problem is to bring these returns down.

One way to do this would be legislation which delineated the class of collective enterprises, denominated them as vested with a public interest and required them to use a target rate of return related to their costs of capital. Such legislation would not be nearly as difficult to police as direct regulation and would give much more freedom of action to the individual enterprise. Also, if a legitimate target rate of return was required, then it would be in the interest of both stockholders and management to adopt a performance bonus plan provided it included a bonus for making the target rate.

The question is then whether such legislation could be successfully defended in the courts. I suppose that the strongest line of defense would be that these collective enterprises are so big that competition does not adequately control their behavior and that they involve the life and property of so many people that the have become vested with a public interest and are therefore subject to regulation, and that the type of regulation involved in the legislation is a mild form indeed. Would it strengthen the legal case to point out that the stockholders had surrendered practical control over the enterprise and therefore were not entitled to more than the wages of capital? Would it strengthen the legal case, if instead of requiring the adoption of a legitimate target rate of return, the stockholders were given a choice of (1) accepting the status of a collective enterprise with all that implies, or (2) breaking the enterprise up into smaller units so that it was beneath the size and importance which gave it the vestments of a public interest?

In The Modern Corporation and Private Property, Berle and I suggested that the separation of ownership and control made both the logic of property and the logic of profits inapplicable to the modern corporation and that corporate developments “have placed the community in a position to demand that the modern corporation serve not alone the owners or the control but all of society.” I now suggest that target rates of return based on the cost of capital and suitable bonus plans based on performance would go a long way toward meeting this demand. As an economist I look to the law to make this possible.

Charles L. Schultze, Recent Inflation in the United States, materials prepared in conjunction with the study of employment, growth and price levels for consideration by the Joint Economic Committee, 86th Cong., 1st sess, 1959, Committee Print 44975, p. 49. Bernard Nossiter, “Inflation Besetting Us is of a New Breed,” Washington Post and Times Herald, February 8, 1959, reprinted in U.S. Congress, Senate, Subcommittee on Antitrust and Monopoly of the Judiciary Committee, Administered Prices, 86th Congress, 1st session, 1959, p. 5113-6.

↩US Congress, Senate, Committee on the Judiciary, Administered Prices: Hearings before the Subcommittee on Antitrust and Monopoly, 85th Congr., 1st sess., October 29, October 30 and November 4, November 5, 1957; US Congress, Senate, Committee on the Judiciary, Administered Prices: Hearings before the Subcommittee on Antitrust and Monopoly, 86th Congr., 1st sess., March 10, 11, 12, and 13, 1959.

↩In Means’s theory, “market prices” are opposed to “administered prices.” “Administered inflation” referred to an increase in the price level under the influence of the market power of corporations, easily identifiable when production and employment remained below capacity.

↩Whether unemployment might be intended as a device to lower “administered wages” is another question. There is evidence that the Federal Reserve Board of Governors thought about unemployment in these terms. Dickens, also 1990s quotes in Lichtenstein and in Barker. Edwin Dickens, The Political Economy of U.S. Monetary Policy (Routledge: 2016), pp. 67-9, 71, and 83. Nelson Lichtenstein in his forthcoming A Fabulous Failure: The Clinton Administration and the Transformation of American Capitalism (Princeton: 2023), quotes Alan Greenspan’s testimony to Congress that a “heightened sense of job insecurity [had] as a consequence, subdued wage gains,” p. 215. Cf. also remarks of Lawrence Lindsey in Tim Barker, “Preferred Shares,” Phenomenal World. Today, of course, Jerome Powell has been explicit about his goal to use monetary policy to “get wages down,” May 4, 2022 press conference, p. 6; FOMC minutes in June, July, and December, as well as Chair Powell’s February 1, 2023 press conference.

↩In 1971, Howard Hackley of the staff of the Federal Board of Governors issued a memo conceding that there were “plausible arguments” that the central bank remained bound by the Employment Act of 1946, though the Board was ready to argue the case. https://drive.google.com/file/d/1fwBWtydz_uDg8bJTtGAvYXcIbSwundva/view Thank you to David Stein for surfacing this document.

↩“Legal Implications of Economic Power,” lecture, Ohio State University College of Law, April 19, 1960, published in The Corporate Revolution in America by Gardiner C. Means, New York, 1964, pp. 155-176.

↩

Filed Under