Amidst the turbulence of the Second World War, hundreds of delegates from the Allied Nations met in Bretton Woods, New Hampshire to construct a post-war economic system. While it might strike one as odd that post-war choreography began in 1944, a year before the war ended, the truth is that states were planning peacetime from the moment the war began. The West feared replicating the blunders of the Treaty of Versailles and wanted to establish the next post-war order with prudence.1 One principal task for Bretton Woods attendees was to implement an international monetary system. Several proposals existed, including Keynes’ Bancor, which would have established an International Clearing Union to issue a supranational currency, oversee currency exchanges, and correct global imbalances. The war had weakened Europe, however, and strengthened the US. US negotiators exploited their influence. While the adoption of the dollar as the global reserve asset would give the US a significant upper hand, Europeans eventually relented because they could still convert dollars to gold and were assured that the arrangement was temporary.

Twenty-seven years later, a new crisis fractured the postwar economic peace enjoyed by the West. Rising inflation drove many countries, particularly European ones, to convert their US dollar reserves into gold. President Richard Nixon faced a choice between devaluing the dollar or pumping it up through perilous austerity measures. Global markets predicted that Nixon’s political savvy would drive him toward the former, but he shocked the world by taking a surprise third route, severing the dollar from the gold standard. There is a great deal of disagreement as to his decision’s long-term ramifications, but little debate about the global economic turmoil that immediately followed. Through it all, the dollar’s global hegemony endured, and it remains to this day.

With every global crisis since, the world has felt afresh the failure to create a truly international monetary system. After the global financial crisis of 2008, many discussed how dollar centrality and the overvaluation of the dollar contributes to the deindustrialization, trade deficits, and over-financialization of the US economy, even as the Federal Reserve continues to serve as the world’s central bank, giving it immense structural power.

Today, the correlated crises of the Russian invasion of Ukraine and mounting inflation further expose the dollar’s global dominance. Neither Russia nor any other country can free itself from the dollar. The Federal Reserve’s measures to tighten monetary policy and raise interest rates are strengthening the dollar at the expense of many other global currencies. Those who borrow in dollars—particularly countries like Sri Lanka, Lebanon, and Argentina—are feeling the global imbalance of monetary power most acutely.

The dollar may face its greatest challenge of the past century from the extraordinary polycrisis now unfolding, which is already reshaping the world economy.

The climate crisis

The climate crisis offers a new angle from which to evaluate US dollar hegemony, since carbon emissions are tied to economic activity.

Dollar hegemony constrains the rest of the world’s ability to finance the green transition because other countries have less control over their own monetary policy.2 My research3 suggests that dollar hegemony is an external constraint on US decarbonization, as well. This is because dollar hegemony:

1. drives up the carbon-intensity of the US growth model;

2. obscures the responsibility for emissions in trade; and

3. undermines American green manufacturing in the global arena.

America’s growth model is driven more by household consumption than exports.4 The dollar’s role as the world’s reserve currency helps increase household consumption domestically. How does that work? The high demand for the dollar, and its resulting overvaluation,5 raises the relative price of American goods in global markets, costing US exports in market share and competitiveness. As a result, the US has become the largest global importer and source of demand.6 In effect, the world transfers its consumption to the US.

Most crucially, household consumption in the US is comparatively carbon-intensive. On average, American households consume more electricity, drive more, and enjoy cheaper fuel per capita than comparable wealthy democracies. Much of that energy consumption comes from fossil fuels. Plotting US trade data against carbon emissions confirms the wider world’s role in American consumption—more imports, more emissions.

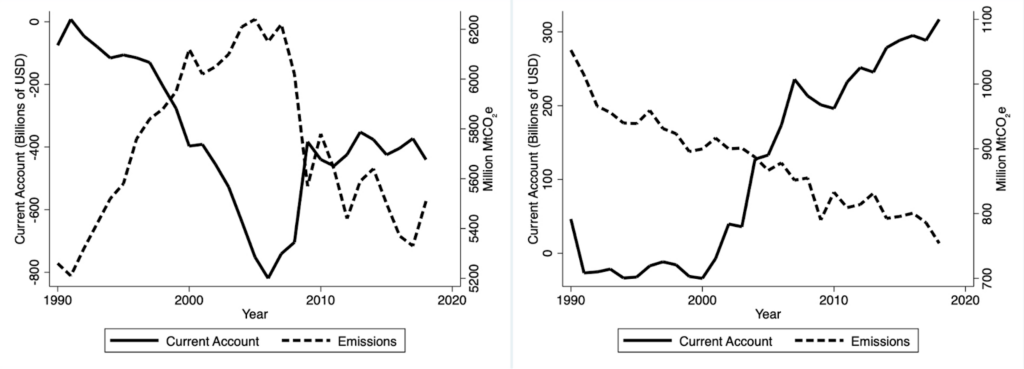

Germany, the paragon exporter, complements this dynamic perfectly. The German growth model suppresses wages and household consumption to maintain export competitiveness.7 Thus, when plotting the German current account balance against its emissions, one sees emissions decrease with trade surpluses.

US (left) vs German (right) current account balances and emissions compared

To make this comparison even more concrete, let us examine the relationship between the two countries within a single sector: German-manufactured cars, exported to its most valuable trading partner, the US. Suppressing consumption means that German domestic emissions are lower, and that Germany enjoys a trade surplus. This allows Germany to hold US reserve assets as surplus, which, in turn, drives up American deficits, consumption, and emissions. Americans then drive the imported German cars with vigor, spewing carbon into the atmosphere and increasing domestic emissions. Thus, Germany has lower emissions in part because the US imports them.

In green manufacturing, too, dollar centrality undermines the United States’ capacity to remain competitive. The overvaluation of the dollar (remember, due to high demand for it as a reserve asset) has led to the general decline in manufacturing and the overvaluation of US goods on global markets. Comparatively weak resource endowments in the critical minerals needed for green technology8coupled with overpriced green manufactures do not bode well for the United States in its effort to lead the green transition.

We are already witnessing this dynamic at play—US solar panel manufacturers are unable to compete with Chinese ones. China produces the majority of solar panels in the world and President Biden recently suspended added tariffs and duties on Chinese solar-panel imports to accelerate decarbonization. Naturally, American solar producers are unhappy with the decision because they cannot hope to compete with Chinese prices. Yet given China’s semi-monopoly over the critical minerals needed for green tech and their competitive pricing, rapid decarbonization sometimes requires open trade partnerships.

Reform?

There are two approaches to tackling the dollar hegemony carbon problem. The first is structural and long-term, and the second is targeted and short-term. The obvious structural solution resembles Keynes’ Bancor—a new supranational currency that restores global currency balances and equity. Such a currency would clarify the interdependence between growth models and emissions in trade. It would also empower peripheral countries with more monetary autonomy to decarbonize.

Global coordination seems unlikely in this historical moment, however, and the climate crisis requires immediate action. Targeted measures can correct some global monetary disequilibria and complement green industrial policies and decarbonization. For instance, bilateral discussions between the US and its key trading partners on embedded emissions could achieve results in a short period of time. Countries that export to the US benefit from export growth but are not held accountable for the emissions that result from American consumption. Countries with trade surpluses in US assets such as Germany and China could invest that surplus in national green infrastructure projects, a crucial step, because without decarbonizing household consumption, domestic investment will increase domestic consumption-based emissions.9 Investment would also relieve some external pressure on US consumption and, by proxy, decrease emissions driven by excess demand for US assets.

American demand and household consumption, then, will experience some relief. The value of the dollar will be less inflated and other countries investing in infrastructure will demand US goods. Being priced more competitively bodes well for the success of American green manufactures.

Bilateral discussions between powerful and rich countries do little for the peripheral countries that will bear the worst effects of climate change. They are also disadvantaged by the inequity and hierarchy in the international monetary system. Due to dollar hegemony, banks in these emerging-market economies rely on US dollars to pay loans, debts, and interest. As the Fed raises rates to curb inflation, a stronger dollar means the value of their dollar-denominated liabilities is increasing as the value of their national currencies decrease, along with their capital flows and banking leverage. A stronger dollar also means weakened manufacturing and trade in many of these countries. Global investors have become risk averse and are diverting capital from emerging economies to US dollar-denominated safe haven assets. At the very worst, countries at the periphery risk a banking recession coupled with severe liquidity constraints, all due to a strong dollar. Thus, remedying monetary disequilibria and inequality is crucial.

One obvious step in this direction in the short-term would be to expand climate-specific trusts and special drawing rights issued by the International Monetary Fund to support adaptation and decarbonization in emerging market economies, especially those most climate-vulnerable. At this point, special drawing rights are allocated to countries based on quotas and voting power; in practice, this means the wealthiest countries in the world receive the lion’s share of the funds. The brilliant leadership of Mia Mottley, Prime Minister of Barbados, should serve as a model to other lower- and middle-income countries that are in debt distress and whose future is thrown into doubt by climate change. Mottley negotiated the restructuring of her island’s debt and asked that billions from special drawing rights be redistributed to the countries that need them most. The funds would be used to invest in climate resilience and develop the green infrastructure crucial to their future survival.

These measures can correct some of the structural hierarchy and disequilibria in the international monetary system. Like green industrial policy, monetary balance is essential for global decarbonization. The policymakers at Bretton Woods were prudent enough to plan the future before the war ended. Contemporary policymakers can better plan the green transition amidst our crises today.

Frieden, Jeffry A. 2020. Global Capitalism. New York City: W. W. Norton & Company.

↩For more see further discussion in Pettifor’s The Case for the Green New Deal. Also see recent scholarship by Althouse and Svartzman on global imbalances and finance-dominated capitalism. My work is complementary but focused primarily on the US dollar.

↩For the working paper, please email daniel_driscoll@brown.edu.

↩Baccaro, Lucio, Mark Blyth, and Jonas Pontusson, eds. 2022. Diminishing Returns: The New Politics of Growth and Stagnation. Oxford, New York: Oxford University Press.

↩Note that a significant portion of US dollar-denominated asset creation takes place offshore in private hands. This may further increase global dependence and demand for US dollar-denominated assets. It also may contribute to the currency’s overvaluation.

↩Klein, Matthew C., and Michael Pettis. 2020. Trade Wars Are Class Wars: How Rising Inequality Distorts the Global Economy and Threatens International Peace. Illustrated Edition. New Haven: Yale University Press.

↩Baccaro, Lucio, and Chiara Benassi. 2017. “Throwing out the Ballast: Growth Models and the Liberalization of German Industrial Relations.” Socio-Economic Review 15(1):85–115.

↩Riofrancos, Thea. 2022. “The Security–Sustainability Nexus: Lithium Onshoring in the Global North.” Global Environmental Politics 1–22.

↩What is the point of rebalancing if it only shifts emissions to another country?

↩

Filed Under