Recent coverage of insurance markets has highlighted the industry’s involvement in the so-called “climate risk doom loop”: looming climate risks and worse disasters are raising the price of insurance for real estate and infrastructure assets, exacerbating their owners’ vulnerability to future disasters and feeding into higher insurance prices in the future―or the withdrawal of insurance coverage altogether.

Rising insurance prices and the credible threat of insurer divestment from higher-risk areas will constrain investment in both homes and businesses across vulnerable communities. Yet more people are moving into higher-risk areas, and some politicians fear backlash if they let insurance companies deny these communities coverage. In response, state leaders in California and Florida have sought to prevent divestment by directing their insurance commissioners to adjust pricing regulations, invite competition in insurance markets, or derisk insurers by imposing disaster-risk fees on all insurance purchasers regardless of risk.

Private investors, meanwhile, believe the insurance industry should follow price signals: if firms can identify the climate risks an assets could face, and investors price those risks into building and maintaining costs, then market actors will invest prudently.

I argue that insurance is a woefully inadequate financial tool for coping with the impacts of climate change. Improving insurance markets does little to address the fact that the core drivers of the “climate risk doom loop” rest in the design of capital markets, which are structured to direct investment away from vulnerable communities when they most need it.

Coverage gaps

Insurance companies profit from the difference between the amount customers pay for protection against loss and the amount they pay out in case of the few losses that occur.1 Climate change closes this spread: everyone faces a similar set of possible disasters, the risks of which are rising every year.2 Furthermore, by propping up fossil fuel assets, insurance companies are worsening this trend. As Lois Parshley at Grist puts it, insurers have started paying dearly for increasingly frequent disasters:

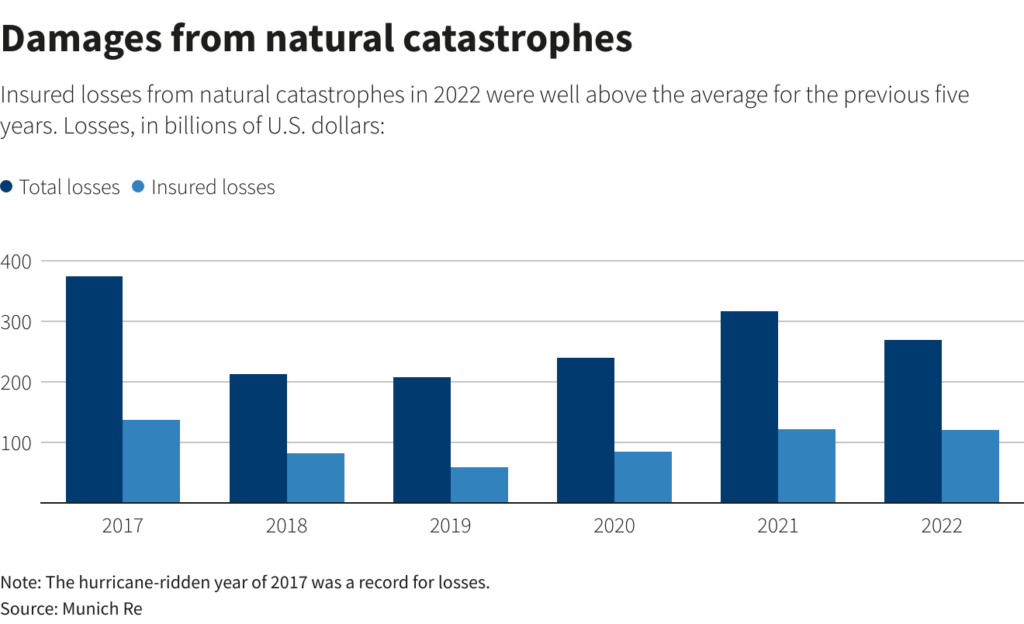

Insured losses from natural disasters in the US now routinely approach $100 billion a year, compared to $4.6 billion in 2000. As a result, the average homeowner has seen their premiums spike 21 percent since 2015. Perhaps unsurprisingly, the states most likely to have disasters—like Texas and Florida—have some of the most expensive insurance rates. That means ever more people are forgoing coverage, leaving them vulnerable and driving prices even higher as the number of people paying premiums and sharing risk shrinks.

Insurers usually buy insurance for themselves from multinational reinsurance companies, which can spread risk geographically. But, as Parshley notes, “this vicious cycle also increases reinsurers’ rates. Reinsurers globally raised prices for property insurers by 37 percent in 2023, contributing to insurance companies pulling back from risky states like California and Florida.”

The result is a massive “coverage gap” in disaster-prone areas. Climate risk analytics firm risQ judges that less than 10 percent of US single-family residential flood risk is insured by the National Flood Insurance Program, a federally backed flood insurance policy; except in census tracts with the absolute highest flood risk, a binary “in or out” flood risk designation system ends up excluding most lower-income households from access to this federal assistance. The nationwide coverage gap has seen uninsured losses from catastrophes consistently dwarfing insured losses:

Figure 1: The coverage gap in 2022

Insurance markets thus illustrate the correlated and compounding nature of climate risks. As carbon emissions continue to accumulate, more people are put at risk of climate disaster, while the damages from those disasters intensifies. Vulnerability will drive disinvestment, which in turn exacerbates vulnerability. Communities around the world that have been made vulnerable by racialized and exploitative processes of industrialization are impacted first and worst.3 Tinkering with insurance markets will not solve their real issues—we must patch the gaping holes in the financial system itself.

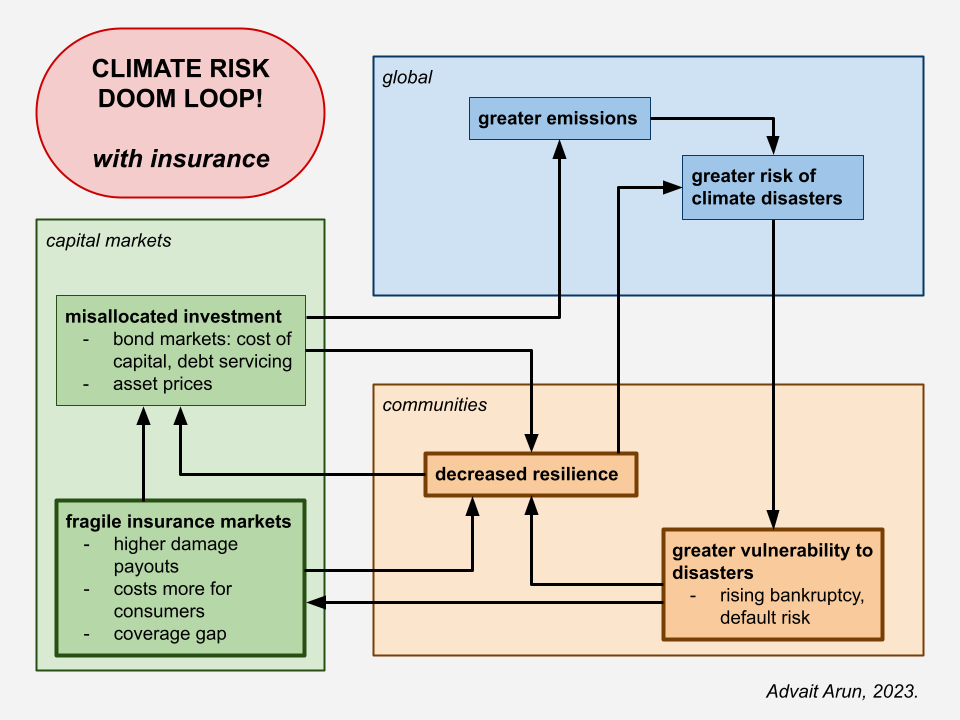

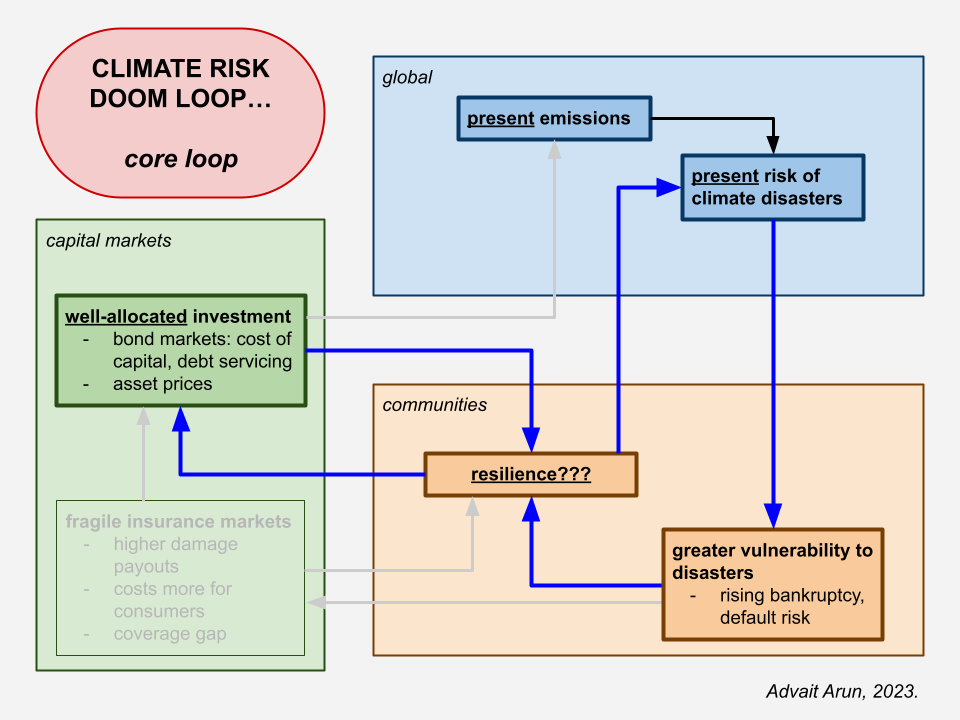

The climate risk doom loop

In this stylized model of the climate risk doom loop (Figure 2), insurance markets reinforce communities’ vulnerability to climate shocks by raising the cost of investing in resilience. Rising emissions drive up the risk of climate disasters, to which communities are made more financially vulnerable. Less resilient, they face a more expensive insurance market, which drives capital investment away and further decreases resilience, which in turn makes climate disruptions more disastrous.

Figure 2: The climate risk doom loop

Insurance markets, however, are only a subordinate component of a deeply unequal economic structure.

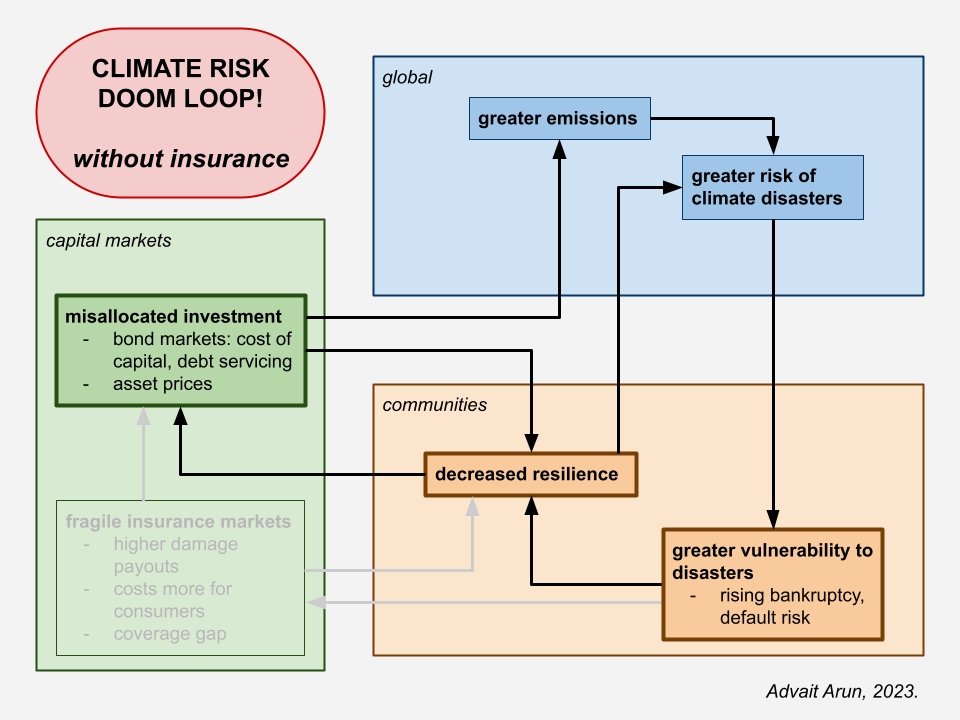

Figure 2: The climate risk doom loop without insurance

The fulcrum of this feedback loop is the capital market, which, as it is presently constituted, allocates investment away from communities with decreasing resilience and toward fossil fuel assets that keep emissions climbing.

This is true both locally and globally. American cities and emerging markets alike face fundamentally similar shortages of liquidity, due to private investors’ bond market discipline, US monetary policy cycles, and, downstream of both, political pressure to maintain balanced or otherwise “responsible” budgets. It does not help that American cities and emerging markets are on the front lines of the climate crisis.4 Absent more forgiving sources of liquidity than municipal and sovereign debt markets, their governments could functionally go bankrupt. At least in the United States―if the histories of New York City, Washington DC, and Puerto Rico are any indication―this could lead to governance by control board.

Given the present state of financial markets, climate disasters do not need to occur for communities to face liquidity shortages, while those that do will definitely be worse off during climate disasters. Insurance markets are embedded within the capital markets that provide liquidity to governments and investors alike. The deeper issue is the design of these capital markets, not of an individual flood insurance policy.

The price signal

Investors and businesspeople do not talk of reforming capital markets. Instead, many are focused on improving market participants’ information about climate risks, in the hopes that better price signals can drive decarbonization. For example, in September, at the Climate and Capital Conference, run by the New York Stock Exchange, I heard more than a few price-signal evangelists invoking the mystifying authority of artificial intelligence and machine learning to claim that they could transmute the most complex environmental datasets into quantifiable financial indicators.

This faith has driven financial firms to invest heavily in climate risk modeling. On its own terms, risk modeling lets market participants judge vulnerability so that people can move themselves and their cash to less vulnerable places and into less risky assets. To some degree, these models do help insurers understand the risks they face; risQ’s research on flood coverage gaps, for example, is both necessary and useful.

But—as work from Madison Condon, Kate Mackenzie, Lee Harris, and Geoff Mann has shown—relying on this strategy promises only false precision. Put simply, the sheer complexity of our biosphere defies financiers’ efforts to turn fundamental uncertainty into probabilistic risk measurable at the level of individual assets. Total reliance on these measurements puts lives and communities at risk.5 Instead, what is needed is an alternative vision for investing and protecting homes, businesses, infrastructure, and communities.6 What could that look like?

While state governments and policymakers are not wrong to encourage insurance companies to get smarter about risk management, or to mandate that services are provided equitably and affordably, insurance markets are, at their core, designed to spread risks―not attenuate them. The only way to stop insurance markets from collapsing in on themselves is to invest in risk reduction.

Alternative visions

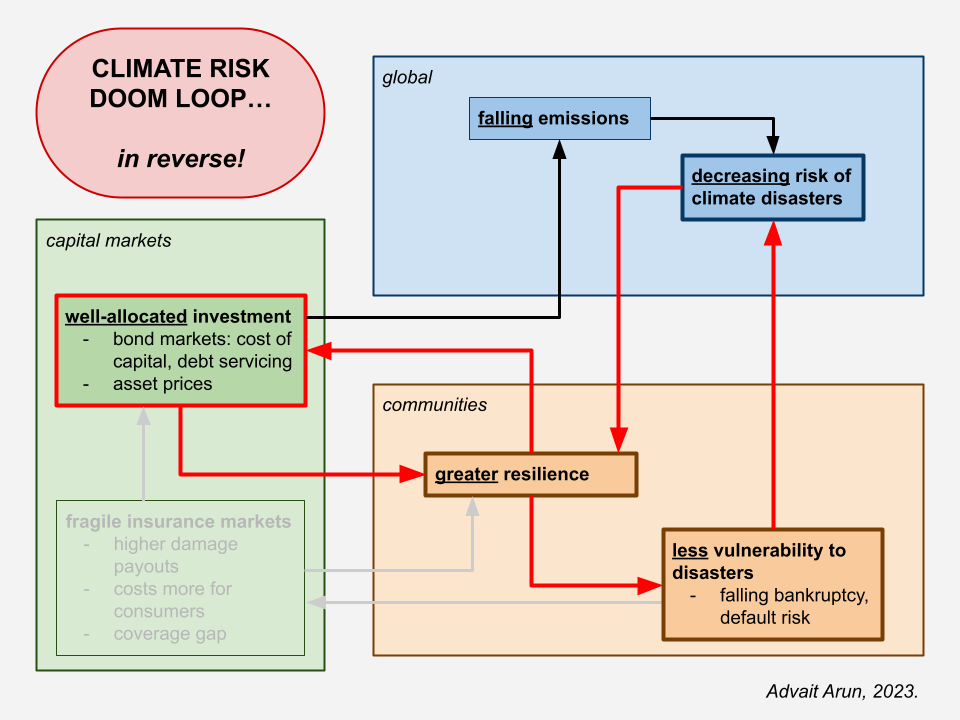

Private investors’ refusal to provide liquidity to assets and governments in riskier geographies will exacerbate their vulnerability to climate disaster. Their structural divestment―and their emphasis on achieving a level of precision in their investments that does not exist―is what keeps the doom loop spinning. We lack a global investment architecture that is safe for spending on social and environmental priorities. Change how capital markets allocate investment, and we can reverse the climate risk doom loop:

Figure 4: The climate risk doom loop in reverse

Investments in emissions reduction and community resilience reduce the growing risk of climate disasters, and the latter, at least, makes communities less vulnerable. Because the private sector is unable to allocate sufficient investment toward these priorities, we should look to a state-driven public investment and just transition program. Such a program must center both institutions and financial policies that loosen liquidity constraints on investment in communities made vulnerable by the financial system. This means discarding austerity measures, which, along with falling state investment, has empowered right-wing actors, who are firmly opposed to climate justice. The state must also prevent Wall Street from disciplining the public sector—institutions like a National Investment Authority could protect necessary investments, transforming public debt into safe assets where private capital might be parked. Successfully executing this economic transformation requires policymakers and organizers to politicize financial policy as one of the core distributional justice issues of our time.

As major buyers of municipal and sovereign bonds, insurance companies have financed investments in the very communities they are insuring. This symbiosis implies that insurance markets and governments can support rather than undercut each other as they threaten to do today. It also reminds us to treat insurance as a secondary driver of communities’ financial stresses, given the havoc that climate disasters can wreak on bond markets writ large. Rising bankruptcy risks from increased potential relief spending and a declining tax base will force governments to pay higher bond coupon rates and save more for debt servicing, sharply constraining local fiscal space. Falsely precise climate risk measurements could arbitrarily worsen or ameliorate these dynamics, too. These problems are not created by insurance markets, but rather endemic to the financial system.

While a massive public investment program in resilience could eliminate communities’ vulnerabilities in the face of climate disasters, the stock of global carbon emissions is already so high that investment in emissions reduction may not decrease the risk of climate disasters for quite some time. Our climate risk doom loop will continue even if policymakers allocate significant investment toward emissions reductions:

Figure 5: The core of the climate risk doom loop

The likely persistence of this feedback loop raises the question: what if some localities are just too disaster-prone to warrant expensive resilience investments? Even if large investments in emissions reduction and resilience infrastructure can meaningfully slow the rate of increase climate disasters, policymakers may have to seriously consider planning for managed retreats and migrations from higher-risk regions―and the political consequences of enforcing them.

Not even the most transformative state-led green investment program can promise climate resilience for every geography. Still, ensuring that investment in decarbonization happens in the first place is important, especially for those in high-risk areas. Truly achieving resilience in this uncertain century starts with empowering communities with a financial system that no longer works against them. Breaking the climate risk doom loop is the best disaster insurance policy money can buy.

A simple way to describe insurance goes something like this: lots of people face a common risk, like a car crash, with some small chance that this event actually happens to them. Importantly, a risk like a car crash will impose a huge financial burden on most people. So everyone pays an insurance company a small amount monthly, and, in return, in the event that a payee gets in a car crash, the insurance company pays for the damages they faced. The insurance company makes money off the spread between (1) regular payments from everyone, most of whom do not get into car crashes, and (2) the cost of damages incurred by the few people who did get in a car crash.

↩The incentives are complicated. Some insurance companies fail to cover certain kinds of flood and storm damages and sometimes pretend that certain damages were caused by pre-existing issues and not by disasters. Still, there is only so much corner-cutting that can cut costs.

↩On how racial capitalism and imperialism create financial and environmental vulnerability and produce insecurity, I recommend Olúfẹ́mi O. Táíwò’s Reconsidering Reparations and Amitav Ghosh’s Nutmeg’s Curse.

↩Thanks to Tim Sahay for highlighting this connection. It’s also worth noting that climate disasters are highly inflationary and, absent better coordination and distribution of resources, present a threat to peoples’ purchasing power. But these shocks are also great at boosting the earnings of companies that support disaster relief.

↩Condon’s research in particular highlights how privatized the infrastructure for climate risk data collection and computation is. The sheer computational power required to do climate risk modeling in the first place, beyond threatening false precision for certain kinds of risks, has driven oligopolistic consolidation of the climate risk modeling industry, and makes it prohibitively expensive for communities to access the data collected about them.

↩This argument is adapted from one of my favorite criticisms of carbon pricing writ large: “As a policy, carbon pricing has the politics backward. It starts by changing the incentives to pollute. Theoretically these incentives will undermine carbon polluters’ economic and political power. But this puts the cart before the horse: we need to disrupt the political power of carbon polluters before we can meaningfully reshape economic incentives.”

↩

Filed Under