The headline “World trade war looms over microchip accord” seems like it could come from any news source today, but it in fact appeared in Nature back in February 1987, when the US had signed bilateral agreements with Japan to promote its own semiconductor exports and limit imports from the latter. European governments, in turn, were angry at what they saw as the cartelization of the global market. The then-European Economic Community (EEC) threatened to take the US and Japan to the then-General Agreement on Tariffs and Trade (GATT) for violating international trade procedures. Like today, concerns on all sides were linked to the crucial role of microchips in military and civilian industries.

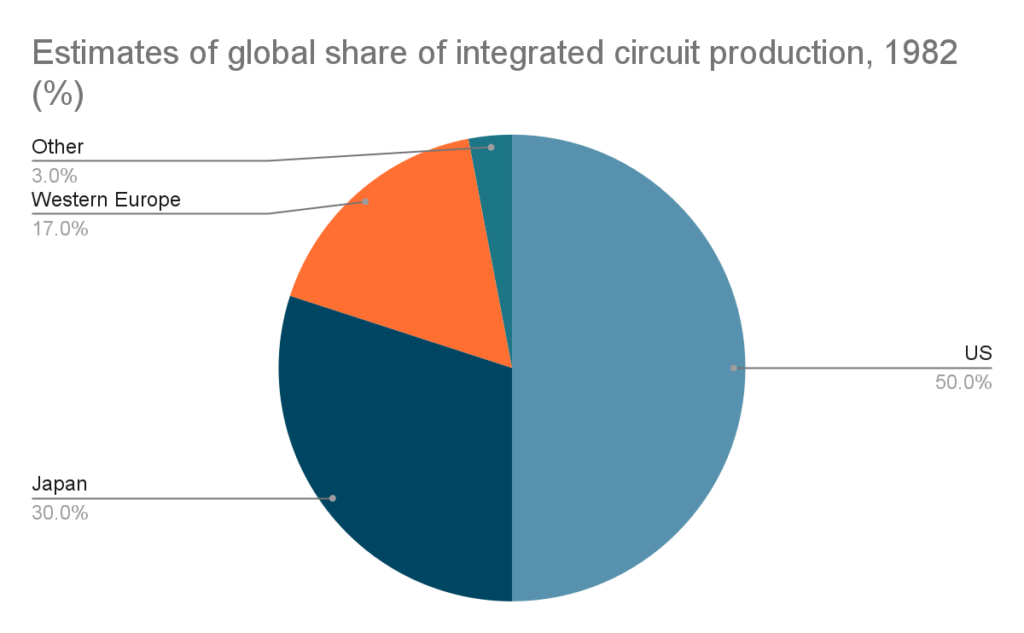

According to an OECD report, in 1982 Western Europe lagged behind both the US and Japan in terms of integrated circuit production and consumption. The US, by far the frontrunner, made up 50 percent of world production and 49 percent of world consumption. But Japan had also overtaken Europe, particularly in production. It made 30 percent of semiconductors, compared with 17 percent in Europe; and consumed 26 percent, in contrast to Europe’s 20 percent. Moreover, Western Europe had become dependent on semiconductor imports. In 1981, European firms only had 30 percent of their local market, while the United States dominated with a 62 percent share. While Japan had increased its share by 5 percent between 1977–82, Europe had lost 3 percent.

European countries responded to their relative weakness by developing their own microchip—what became known as the Eurochip. In the late ‘80s, this came alongside a program to promote a competitive microelectronic production known as ESPRIT. Neither of these initiatives were successful. While they did encourage the emergence of important technology firms—such as STMicroelectronics and Vodafone—these were engaged in developing components far from the technology frontier. Even when funding was sufficient, it was not adequately tied to deeper transformations in the electronics sector. Ultimately, the programs fell short of their ultimate goal: addressing European microchip dependence.

The experience of the 1980s should serve as a cautionary tale for contemporary European policymakers and industry leaders. As a result of the failure to catch up, and thanks to the evolution of an increasingly sophisticated semiconductor market globally, the EU has remained a dependent consumer. While Taiwan certainly dominates the market for <10 nm production, US and Japanese firms retain significant market shares across the rest of product lines and nodes in the value chain (10-22 nm, manufacturing equipment and inputs, and wafers). According to 2022 data, the US also leads research and development (R&D) investments by a high margin (amassing 60 percent compared to the EU’s 6 percent). The EU only has a significant presence (greater than 5 percent) within the manufacturing equipment market. External dependency concerns lie in the fact that the EU is today the third-largest global consumer, with 20 percent of the total end-market share, while firms and governments plan to expand connected industries.

An informative counter case is offered by Taiwan. Its current dominance in semiconductors began in the 1970s, with a state-directed effort to develop novel capabilities in microelectronics. Rather than catering to locally established firms, government agencies negotiated knowledge and investment transfers with foreign partners. This quid pro quo eventually led to the founding of key microelectronics firms, such as the Taiwan Semiconductor Manufacturing Company (TSMC) and the United Microchip Corporation (UMC).

Examining ESPRIT’s weaknesses and the alternatives posed by the Taiwanese example offers lessons for contemporary industrial policymaking. Key among them is that the success of industrial and technology plans depends on path-dependent political settlements, which describe firm capabilities to protect rents and resist necessary change. During the 1980s, the deference shown to a “neo-protectionist bloc” of technology firms contrasted sharply with the imposition of strong private firm conditionalities in Taiwan, Japan, and the US. Unlike in Europe, their industrial strategies managed to successfully develop semiconductor capabilities by leaving strategic decisions in the hands of public sector agencies.

After decades of complacency and austerity, the embrace of explicit industrial strategies in the EU marks a significant break. For decades, on both sides of the Atlantic, commentators have focused on high taxation, over-regulation, risk-aversion, conformity, and other “cultural” explanations for the lack of EU technological leadership. Now, the realities of Covid-19 and conflict have re-legitimized the coordinated steering of investment and production. At the national level, the European Union has loosened competition regulations to allow targeted stimulus. Supranationally, it is preparing to launch the European Chips Act. As it does so, looking to a previous era of industrial policy is instructive.

Euroesclerosis and the industrial policy “bloc” of the 1980s

At the end of the twentieth century, Western Europe was plagued by euroesclerosis and europessimism. Decades before the clichés about big tech conglomerates starting in suburban garages, anxieties regarding the perceived dynamism of US multinationals were rooted in ideas of cultural stagnation in Europe. In his 1968 reflection on the perceived technological gap between Europe and the US, OECD secretary general Thorkil Kristensen attributed North American inventiveness to “the wide open spaces which attracted men of courage.” It was ample natural resources, large domestic markets, and cowboy managerialism that had resulted in North American business achievements. Interestingly, Kristensen dismissed the impact of federal investments in military and aerospace procurement, which were then heavily involved in the race to the Moon.

More conscious of the innovative potential of The Apollo Project was American consultant John Diebold, who in the same year recommended the establishment of a permanent European technology and industrial policy that could compete with larger research and development budgets in North America. To this day, however, Europe has neglected the formation of a unified industrial policy, leaving technological development in members states’ hands. Industrial policy more broadly fell out of favor precisely when the European Union intensified its integration. As documented by Cherif, Engher and Hasanov, the 1980s saw the first decline in growth narratives about “economic structure”—a weakening of academic and policy interest in sectoral analysis for productive transformation. In its place came a nascent narrative of “structural reforms” (focused on institutional and regulatory elements), which became dominant alongside “Washington Consensus” principles. The Structural Reform and Consensus principles are based on the general idea that “private industry is managed more efficiently than state enterprise.” Therefore, liberalizing sectors is justified. A European example of the triumph of this narrative is the 1990 Commission communication, entitled “Industrial Policy in an open and competitive environment.” Here, it is argued that “sectoral approaches to industry policy can work during a period but they entail inevitably the risk of delaying structural adjustments.” By the end of the Eurochip decade, the EEC did not envision a permanent industrial policy agency. Rather, its industrial strategy focused on unleashing competition and accelerating the disappearance of unproductive firms.

In the midst of this overall shift towards the open markets and competition, which were embedded in the Maastricht treaty of 1992, ESPRIT represented an important instance of supranational and sectoral industrial policy in reaction to perceived loss of European strategic autonomy. At the commanding heights of European industry, no work was more influential than Servan-Schreiber’s The American Challenge, and its successor, The Global Challenge, focusing on Japan’s technological leadership. Servan-Schreiber suggested that European integration ought to generate an expanded market home to continental business giants, “supranational champions.”

But the world of business had its own dividing lines. In his analysis of the European Round Table (ERT—representing Europe’s top firms) Van Apeldoorn identified two distinctive blocs among European business groups leading up to the 1980s. Neoliberals in finance, energy, chemicals, and agri-food sectors, whose rents were protected through the Common Agricultural Policy, advocated for market openness and deregulation to compete as exporters. Neomercantilists, on the other hand, were represented by former national champions across diverse sectors who were concerned with cheaper imports from newly industrialized countries (NICs) and the loss of domestic markets. Manufacturers of electronics, small appliances, cars, and other components were sensitive to the rise of Japan and the Asian Tigers.

As Khan’s framework of political settlements reminds us, the ultimate shape of ESPRIT was shaped by the bargaining power and technical capabilities of these competing tendencies. Contrary to popular perceptions of neoliberal hegemony, it was the neomercantilists who, in alignment with policymakers, formed an industrial policy bloc with a particular interest in microelectronics. They were the ones enraged about US-Japan collusion and, in response, backed Eurochip 1.0.

Reacting to US and Japanese industrial policy

Western Europe’s anxieties in the mid-1980s went beyond microchip market shares. The technological rise of Japan mobilized European businesses and policymakers across the board. While Europeans had grown used to North American dominance through firms like IBM and their subsidiaries, Japan’s foothold in high tech sectors was unexpected. While semiconductor divisions for German firms in 1980 struggled to break even, Japan went from a USD 142 million deficit in 1976 to a surplus of USD 239 million in 1981 in the trade of integrated circuits. This transformation was spearheaded by Japan’s Ministry of International Trade and Industry (MITI).

The US Department of Defense, in addition to its permanent spending in high tech procurement, launched the very-high-speed integrated-circuit (VHSIC) program in 1980, and the Strategic Computing Initiative (SCI) in 1983. With sizable budgets for the ensuing decade, these targeted microelectronics and incentivized competitive innovation for grants between established firms and start-ups. Moreover, the Strategic Defense Initiative (Reagan’s “Star Wars”), albeit focused on adjacent technologies like lasers, had impacts on emerging computerized communication and artificial intelligence clusters of innovative small and medium enterprises (SMEs). SEMATECH would come in 1987, an even more ambitious effort to dynamize semiconductor production in the US. Crucially, this industrial policy persisted even as the Washington Consensus reigned; rather than dismantling industrial policy, Reaganism delegated it to “a decentralized system through which public agencies would, in fact, invest in potential winners.” Building on the experience of ARPA (Advanced Research Projects Agency) and the NIH (National Institutes of Health), the US was able to spread productive research and coordination across states, municipalities, universities, research centers and technology parks. This “hidden developmental state” responded to a distinctively North American political settlement around industrial policy, which bypassed the ideological veto of conservative groups against federal interventionism.

In Japan, the MITI continued in its role as prime mover of new industrial and technological capabilities, planning various projects at the technology frontier in the 1980s. These included optoelectronic components (vital for today’s quantum computing), New Function Elements (including radiation-proof circuits), then-supercomputers and the leading Fifth Generation Computer (5G). The 5G project aimed to combine advancements in chipmaking with other hardware and software development. All the Japanese projects had a timescale of a decade, with public laboratories hosting long-term, flexible collaborations between top computing companies. Conditionalities contributed to the spread of good practices, centered in management training and firm restructuring.

The political settlement underpinning these policies responded to the classic, developmental state approach to industrial policy. While formally not in charge of private firm activities, the government employed veto and agenda-setting mechanisms to dictate priorities. Almost half of the budget was apportioned by the state, and in any case private financing originated in large banks closely regulated by the Ministry of Finance. This leverage was crucial as, in some instances, banks even forced corporate clients to join MITI research cooperatives in exchange for credit lines. In addition to these initiatives, reforms in competition law and early privatization allowed US and Japanese telecommunication firms to integrate across industry functions and invest more aggressively in global markets.

These initiatives had an unsettling effect over European business and political elites. Within the European Council, the neomercantilist position was chiefly espoused by the French delegation in the early 1980s, who advocated for the creation of a Common Industrial and Research Area. This included building capabilities in new products by lowering internal barriers, mobilizing industrial policies, and guaranteeing preference in domestic markets. Nowhere were these measures expected more urgently than in information technology, particularly in its key component: semiconductors.

The French position was logical. Given the previous success of US and Japanese industrial policy efforts in other sectors, they had reasons to be worried. Furthermore, the efforts to take the US-Japan microchip agreement to the GATT had mostly stalled. The Europeans had based complaints on a predicted price rise for inputs in Europe because of the duopoly. However, several months after the agreement between the US and Japan came into force, microchip prices declined. Japanese chipmakers, responding to US pressure to limit their market share in North America, began to prioritize European sales. The European Electronic Components Manufacturers Association (EECMA) complained to the European Commission against this perceived “dumping” of semiconductors. Thus, ESPRIT was born.

ESPRIT emerged from the first Framework Programme, the key research and innovation mechanism of the EU today. Its formation came as a result of the ineffectiveness of national plans and Commissioner Davignon’s good relationship with firms. From the 1978 Forecasting and Assessment in the Field of Science and Technology (FAST) working group, to the Joint European Planning Exercise in IT in 1980, reports showed key weaknesses in private sector technological capabilities. The public-private working group identified five large areas of intervention: advanced microelectronics, advanced computing, software technologies, office automation, and integrated computer systems for industry. Despite its acronym, more than two years elapsed between the Commission’s first communications and Member State acceptance at the Council of the shared policy. This inaction allowed policy to be greatly shaped by incumbent firms in electronics, the neomercantilist bloc sensitive to external market pressures. From 1981 to 1982, companies like Siemens, Philips, and CGE (members of a “Big Twelve Roundtable”) lobbied Davignon and Member States to define the scope and mechanisms of shared technology policies. If they developed the plan, Davignon would find the funding.

How did plan development work in practice? Interviews conducted by Sandholtz suggest that senior executives from Big Twelve firms held one-day conferences at corporate offices, where companies set up shop in meeting rooms and circulated possible pilot projects for the Commission’s consideration. This privacy was preferred: at wider technical panels with universities and research laboratories, firm executives felt unease at the degree of information sharing.

The finalized ESPRIT pilots faced limitations. First, the European Community regulations set strict limits on direct state support of firm activities, favoring precompetitive research and limiting commercial considerations in project design. Second, given Member State mistrust, pilots were initially designed with one-year time limits, a significantly brief period for industrial and technology policy processes. Fifteen final projects were approved across the five areas of intervention, with budgets shared equally by the Commission and the firms.

Even though technical approval for ESPRIT was achieved in November 1983, it took almost half a year to actually disburse its budget. Its allocation reveals a consistent bias in favor of established firms. The Big Twelve firms designed the program and sat in the meetings with the IT task force that identified key sectors and technologies, including specific microchip product lines and components. In fact, according to Peterson’s post-hoc analysis, more than 80 percent of initial contracts were distributed among these twelve firms. These companies still garnered more than 50 percent of the ESPRIT budget in 1986. Their oversized ability to capture funds did not abate in ESPRIT’s second formulation, running from 1987 to 1992. Emulating the success of the Big Twelve Roundtable in electronics, another twenty firms from various industries created the “Gyllenhammer group,” including Volvo, Volkswagen, and British Aerospace, among others. They were national champions, but also key clients of the Big Twelve: they purchased semiconductors for product and process innovations. Together, the projects presented by Big Twelve and Gyllenhammer attracted between half and two-thirds of total Commission support between 1987 and 1992.

Naturally, smaller member states like Belgium rejected a project that seemed focused on subsidizing firms from the “Big Three” (France, Germany, UK), and sought support and reassurance for smaller firms. This resulted in an improvised, “B channel,” with even fewer conditions for the participation of SMEs. Overall, across big and small projects, there were limited supervisory powers on the Commission side once funds were disbursed. A complex mechanism was in charge of supervision, composed by the Commission’s Information Technologies Task Force, the Esprit Management Committee (EMC) representing member states, the ESPRIT Advisory Board representing participants on a consultative basis, and the ESPRIT Steering Committee, representing the Big Twelve. This plural design was conceived to allay the fears of smaller states and firms. However, as documented by a British executive at the time, key European firms retained actual control. For instance, the Big Twelve outlined the work plans that were only later amended by the other panels: barely any projects were rejected in the first phase of ESPRIT.

The 1980s European attempt to imitate Japan’s success thus led to quasi-cartel formations, forgetting the equal importance of selective competition alongside cooperation in the developmental state model. Equally, European policymakers failed to consider a key element of the US strategy: building local capabilities with multiple non-firm actors, to whom training, education, research and other activities can be eventually delegated.

An absence of public sector strategic insight, which could have guided cooperative, competitive, and institutional goals, was prevalent across subsequent Framework Programme agendas. Eureka, the EEC’s response to the US “Star Wars” initiative of the late 1980s, was hastily improvised a week after Reagan announced incentives for the relocation of European firms. As a result, its design also depended on Big Twelve firms. Eureka really began with a memorandum drafted by Siemens, Philips, GEC and Thomson, urging “market-oriented” criteria closer to “saleable products and systems.” Several projects had already been confirmed under Eureka even before Member States agreed on the program’s design six months later. In April 1985, France, the UK, and Germany agreed to disagree on which technologies would be covered by Eureka. Rather than defining clear criteria for potential technologies, national champions would define projects, from welding lasers to pollution trackers. The only basic requirement was that collaborating firms had to be based in at least two European countries.

The positive impact of these programs on European innovation is undeniable, particularly where supranational funding was successfully integrated with domestic industrial plans. STMicroelectronics, Infineon, and NXP, the few significant European chipmakers today, benefited from these 1980s plans. European initiatives also provided an umbrella for national projects. The British Alvey initiative, implemented in parallel with ESPRIT, generated advancements in object-oriented programming (further developed by Microsoft), and the basis for a “cellular radio service” that would later become Vodafone. Moreover, European programs helped overcome a common accusation levied at continental firms. EEC companies had tended to favor collaborations with US and Japanese companies, with local research networks operating as disconnected enclaves. Trans-European coordination increased through ESPRIT, Eureka, and subsequent plans.

At the same time, ESPRIT did not achieve its goal in microelectronics and was not always conducive to competitive innovations, despite ample national and supranational encouragement. Above all, integrated circuit firms had limited incentives to defy market tendencies and remain attached to the long-term targets defined by Commission and state-funded projects. As noted today, the German-Dutch Philips-Siemens 1985 Mega-Project prioritized the production of 1-megabit RAM chips, which were already a mass-produced global standard in 1986.

The obsession with national champions also precluded fruitful exchanges with Japanese and North American firms, since access to funding was earmarked for European firms. But the Big Twelve jumped the boat whenever it was convenient, with little ability for the Commission to adapt programs or impose penalties. For instance, when offered a potential external collaboration with IBM and Toshiba to develop 64Mbit microchips, which ran against funding rules, Siemens simply pulled out from the JESSI program altogether. The Dutch member of the chip Mega-Project, Philips, entered a severe crisis in the early 1990s, partly as a result of poor management, whereby product development groups lacked contact with commercialization areas. The Philips divisions that were responsible for static random access memory (SRAM) research were disconnected from commercially-minded product divisions.

In contrast with state-directed organizational change emphasized by Japanese industrial policy, European programs had little interest in internal firm affairs. Towards the 1990s, Commission and state funding began to focus on other technologies, such as renewables and biotechnology. Once public funding dried up, the firm lost interest in subsidizing loss-making long-term research activities and closed its microelectronics labs. This demonstrates the importance of organizational path-dependence and rent-accrual. While it does not fully explain the relative failure of 1980s semiconductor policy, the European Big Twelve had excessive influence over policy design and implementation.

In fact, European deference towards incumbent firms in shaping industrial policy was a key departure from the norm elsewhere. US and Japanese microelectronic strategies developed against the given political settlement, bypassing the vetoes of political and private sector incumbents. Crucially, independent agencies which can rely on long-term support from both executives and industry are a common feature of successful catching-up efforts—not least in Taiwan, the world’s key site for semiconductor manufacturing.

The classic work Governing the Market, by Robert Wade, details how Taiwanese officials set their sights on developing semiconductor production capabilities in the early 1970s. The state-owned Electronic Research and Service Organization (ERSO) was created in 1974, with the mandate of identifying foreign investors to kickstart a domestic electronics industry. ERSO’s accountability mechanism was directly linked to specialized cabinet members. In terms of decision-making, the prerogatives of local private firms were ignored. “Directional thrust” remained firmly in the hands of ERSO, which identified application-specific integrated circuits (ASICs) as useful outputs that could lead to further cross-industry specialization. UMC, ERSO’s subsidiary, achieved the partial relocation of Taiwanese Silicon Valley firms, bringing back domestic private equity with technical expertise acquired in North America. While mass-produced business areas were sold to better-positioned Korean and Japanese investors, ERSO’s patient and selective interest in application-specific chips remained at the forefront. Efforts eventually attracted the interest of none other than Philips, which enabled the investment and technology transfers that facilitated the creation of the TSMC in 1987. Today, UMC is a key semiconductor supplier for many fabless firms, vital for car manufacturers worldwide. TSMC is, of course, the key high-performance microchip producer in the world, “a linchpin of the global economy.”

Towards Eurochip 2.0

Industrial policies must be adapted to political settlements across borders, recognizing the importance of organizational capabilities of some large firms to capture rents and resist change. In the US, Japan, and Taiwan, long-term formulation of strategic goals and independent but accountable public agencies in the driving seat facilitated strong conditionalities on private investment. The US and Japan, either through Defense research networks or MITI-owned laboratories, retained leadership—and often equity—in the hands of agencies which were not subject to short-term market signals or political backlash against industrial policy. Conditionalities alongside external supervision incentivized private sector commitment to integrated circuit development even when projects stagnated, limiting short-term speculation and early exits. One of the benefits of this approach is that projects do not simply follow the latest market trends. Rather, whether in ASICs, lasers, or optoelectronics, working groups tried to identify technologies at the frontier.

The type of unquestioned industry leadership and cooperation promoted by the Commission, on the other hand, prioritized investments that would already take place in the absence of government support. As summarized by Martin in the mid-1990s:

To develop internationally competitive national or European firms would have required a “tough love” policy that combined financial support and brokering of alliances with an insistence on restructuring and vigorous product-market rivalry. European governments offered only love, and for a time diverted their home firms’ attentions inward rather than outward in a way that slowed down unavoidable structural change.

Today, Eurochip 2.0 seems to be repeating some of these mistakes. The announcements linked to the European Chips Act offer little details on quid pro quo mechanisms, with a focus on the figures and large-scale targets. This comes with a risk that the resulting projects will resemble the opaque structure of existing IPCEIs (Important Projects of Common European Interest). This will mean sectoral overspread, established firms capturing funds, and little to no encouragement for innovation. The “neomercantilist bloc” in the making risks imposing an inefficient outcome. While technological capabilities will necessarily be built from established productive networks, industrial policy plans should not simply allow existing political settlements to determine project pathways.

As in the 1980s, only some technologies will be helpful for European businesses, public services, and citizens. Specific, long-term, and measurable deliverables must be applied to whichever public funding fuels private initiative. A healthy combination of transparent and clear indicators, supervisory mechanisms (equity, conditional loans), and countervailing powers can shape a more productive coalition around Eurochip 2.0. For example, the Institute for Industrial Reconstruction’s role in Italy’s economic miracle can help inspire equivalent innovation “systems of state-owned enterprises” at the European level. Partially publicly-owned companies and projects can add competitive pressures in those sectors where rent captures are easier. Alternative perspectives around mission-oriented policies, community-wealth building, and others can contribute to the pluralization, diversification, and localization of project impacts. The goal should not just be to follow the market and leave existing firm leadership intact, but to ensure that innovation can solve the many challenges which will continue to appear on the European horizon.

Filed Under