In August 2023, a week after winning Argentina’s primary elections, now-President Javier Milei publicly stated that the Argentine peso was “worth less than excrement.” Over the next two days, the dollar-peso parallel exchange rate climbed almost 20 percent, intensifying the already rapid devaluation of the currency. Such extreme proclamations were common for Milei, who as a candidate combined libertarianism with global right-wing extremism and placed proposals to abolish the central bank and dollarize the national economy at the center of his campaign.

Milei’s rise must be understood within the context of Argentina’s extraordinary inflation in the past two years. In 2022, the annual consumer price inflation was 72.4 percent, placing Argentina among the five countries in the world with the highest inflation.1 In 2023, the situation became dire—the year-to-year CPI increased to an astounding 142.7 percent in the last measure from the Argentinean National Bureau of Statistics.

A similar trend can be observed in the dollar-peso exchange rate, which went from $173 in December 2022 to $357 in November 2023.2 The fall of the peso in the parallel exchange rate is even more pronounced. In December 2023, both the financial exchange rate and the informal exchange rate were around $1,000, representing an increase of more than 185 percent from December 2022.

The weakness of the peso and spiraling inflation spurred popular support for Milei’s dollarization proposal. The instability of the economy, however, is linked to a fundamental external problem in the Argentine economy. The challenges of Argentina’s external accounts are not due to faltering commercial or economic competitiveness. Rather, they can be attributed to the nation’s longstanding financial constraints, a byproduct of Argentina’s role in the global economic hierarchy.

Argentina’s external accounts

Several studies locate the roots of Argentina’s financial liberalization in 1976, when the military regime overthrew Martínez de Perón and commanded control of the government. In 1977, the regime implemented a financial reform that included the liberalization of interest rates, free credit allocation, and an easing of the restrictions to enter the financial market. This reform accompanied greater openness to capital and goods markets.

The fall of the military government in 1983 and the return to democracy saw Raúl Alfonsín elected as president. In a period characterized by the Latin American debt crisis and a lack of external financing for the region, Alfonsín’s economic policy was focused on solving the external debt problem; his administration largely kept the military government’s financial reforms in place.3 By the end of Alfonsín’s administration in 1989, the economy was in the throes of hyperinflation and stagnation.

It was in this context that in 1990—under the recommendations of the Washington Consensus—the state reinforced the neoliberal policies of deregulation and liberalization. After renegotiating external debt through the Brady Plan, Argentina recovered access to the international markets, using this access to sustain the one peso-one dollar parity. During the ensuing decade, the magnitude of capital flows to and from Argentina began to rapidly grow. The average annual gross capital flows from and to Argentina were $29.9 billion between 1990 and 1999, a growth of more than 800 percent compared to the previous decade. Portfolio investment—speculative in nature with a short-term horizon—became more prominent in the flows to Argentina during this period.4 In 1999, capital started to flee Argentina, a result of international financial conditions after several financial crises wreaked havoc on emerging countries around the world. This reversal of capital flows forced Argentina to break the one peso-one dollar convertibility in January 2002, with the peso devaluating more than 300 percent in eighteen months.

From 2003 to 2015, Argentina’s accumulation mode shifted to one centered by production and distribution. During these twelve years, the average annual growth rate of the economy remained around 5 percent, with growth fueled by an expansion in production of goods, specifically industrial goods. Internal demand also rose, testifying to the recovery of real wages after the default and the devaluation of the peso in 2001–2002. Importantly, this period saw the renegotiation of external debt to achieve reductions in principal and interest. But a shift occurred in 2008 with the onset of the global financial crisis. From 2003–2007, Argentina expanded investment, exports, and fiscal, and commercial surplus. From 2008–2015, the financial crisis caused capital accumulation to decelerate, the effects of which can be seen in the reemergence of the external debt constraint in recent years.5

In 2015, President Mauricio Macri—the former Mayor of Buenos Aires who won as the head of the “Alianza Cambiemos,” a conservative, center-right coalition—reintroduced deregulation policies and proceeded to liberalize the external accounts office. In the first year following the liberalization, between 2016 and 2017, net inflows from direct and portfolio investment plus loans to public and private sector totaled more than $40 billion. However, a major portion of these inflows were speculative short-term capital. In March 2018, the global financial conditions tightened through an upward shift in US interest rates and these inflows abruptly stopped—the net flows turned negative, and Argentina had to request IMF assistance. By 2019, Argentina had a massive external debt (mostly denominated in foreign currency) and received the largest IMF loan in history.6 The government introduced capital controls—a last resort measure that while successful in stopping the ongoing devaluation of the peso, only in effect after the peso had already depreciated 40 percent between July and October 2019. By the time Macri left office in 2019, following a failed reelection bid, the country was on a path to crisis.

The exchange balance

The country’s scarcity of foreign currency since 2019 has laid the groundwork for the current dilemma. In 2021 and 2022, Argentina accumulated a surplus in the current account of almost $10 billion,7 but international reserves only grew by $1.6 billion.8 The gap can be attributed to the difference between the official exchange rate and the parallel exchange rate. With capital controls in place, the official real exchange rate appreciated, and the economy saw a huge injection of money from pandemic-era social protection measures. But disequilibrium arose in the parallel exchange rate, and as a result, major exporters engaged in tax avoidance to escape to the official exchange rate market. Debt and interest payments from public and private sector loans and bonds, as well as the remission of utilities, also drained foreign currency from international reserves.

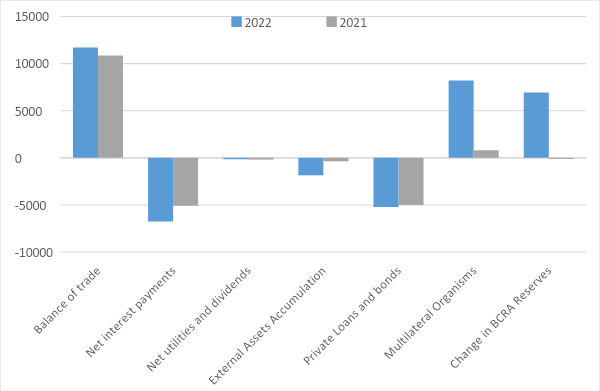

To convey these developments in detail, we draw on the “exchange balance” of the Argentinean Central Bank (BCRA). The chart below shows the evolution of purchases and sales of foreign currency carried out by private entities through the exchange market and the operations carried out directly by the Central Bank. The chart disaggregates the main items comprising the current, capital, and exchange financial accounts.

Main components of the exchange balance of Argentina, 2021-2022. In Millions of US dollars.

The figure above demonstrates that even during periods with favorable trade of goods and services, financial components of the external accounts drain the trade surplus. Although the nation saw a trade surplus of more than $22 billion between 2021 and 2022, the BCRA international reserves only grew by $6.8 billion during those years. Even more, the $6.8 billion increase can be almost entirely explained by the growth of the international reserves in 2022, a year when Argentina received net loans from different multilateral organisms.

Two financial components stand out in this analysis of the commercial surplus: net interest payments, and private loans and bonds. The net interest payments include government and private sector payments. Private loans and bonds represent the net indebtedness of the private sector. These findings demonstrate that the huge debts of the private and public sector from 2015 to 2019 still influence the external account through interest and capital payments.

The private sector was responsible for the bulk of capital payments during this time, despite the fact that between 2020 and 2022, the BCRA implemented different measures to limit the impact of private sector capital payments on international reserves. This included requiring firms to refinance at least 60 percent of debt maturities for a minimum average term of two years, and compelling firms to use their own foreign currency (liquid external assets deposited abroad) before being allowed to buy foreign currency in the official exchange rate market to pay debts. The BCRA also restricted the payment of debt from one company to another related company.

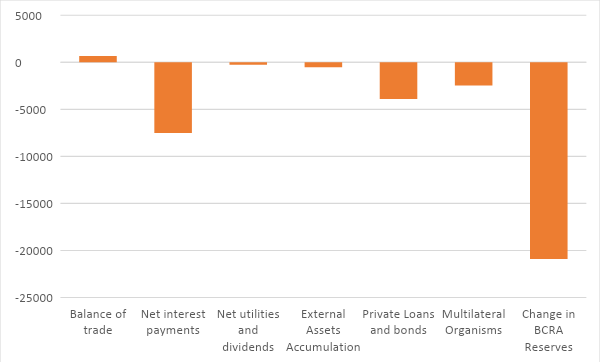

This precarious balance plunged into a full-on crisis in 2023, after a severe drought descended upon wide swaths of the country. Commodity exports—particularly soybeans—fell dramatically, with ripple effects across the economy. In the first ten months of 2023, Argentina exported $56.5 billion compared to $75.2 billion in the same period of 2022. The fall in exports significantly reduced the trade surplus, making it difficult for the BCRA to contain the exchange rate and maintain international reserves. The chart below displays the main components of the exchange balance for 2023.

Main components of the exchange balance of Argentina, January-October 2023. In Millions of US dollars.

The financial situation of 2023 closely resembles 2021-2022 with regards to net interest payments and private loans and bonds. The sum of both net interest payments and private loans and bonds in the first ten months of 2023 led to $11.4 billion drag in the Argentinean external accounts, a similar amount to 2021 ($10 billion) and 2022 ($11.95 billion). Still, between January and October of last year, the BCRA lost more than $20 billion in international reserves due to the shrinking balance of trade (which fell to $5.7 billion) after the decline in exports. The trade balance fell by $16 billion in a single year, from 2022 to 2023. Another factor contributing to falling reserves: between January and October, Argentina saw net outflows of capital from multilateral organizations, a stipulation of the EFF program negotiated by the IMF and Argentine government in March 2022.

The financial constraint

Our findings demonstrate that Argentina’s structural problem is financial, not commercial. Huge debts owed by the private and public sector, interest, and capital payments drain the trade surplus, while capital inflows tend to be short-term, speculative, and therefore volatile. This has important implications for corrective economic policy going forward. While exports are significant, solely focusing on restoring the trade balance by increasing exports will fail to resolve the financial component of the external debt.

Argentina’s external financial constraint can be linked to the transformations in global finance that have taken place since the fall of Bretton Woods. As the financialization literature has long argued, unprecedented growth in capital flows has increased their influence in the external accounts of peripheral countries over the past several decades.9 In this sense, the vulnerability of the peso can be framed in what post-Keynesian literature calls the “currency hierarchy.”10 Currencies at the bottom of the hierarchy are used as “investment currencies,” while the currencies at the top are “reserve currencies.” As a consequence, capital flows to the countries whose national currencies are at the bottom of the hierarchy—a category containing most of Latin America—are more volatile, procyclical, and dependent on international financial conditions. Reducing the external vulnerabilities of peripheral countries would require reforming the dollar-based international monetary system.

At the same time, peripheral countries differ depending on distinct structural characteristics of their economies, such as the level of financial openness and the stocks of international reserves.11 Argentina—characterized by a high degree of liberalization in external accounts and dwindling international reserves—must then adjust its domestic economic policies accordingly, implementing internal financial reforms that allow it to accumulate international reserves and strengthen the peso. Such internal shifts could occur alongside global monetary reform, saving nations like Argentina from deepening financial and social crises. With this aim, Argentina could reintroduce exchange control policies adopted by Nestor Kirschner’s administration between 2003 and 2010, such as a minimum-stay requirement for foreign capital inflows, while still maintaining the competitiveness of the exchange rate. Although domestic assets are necessary for the success of these policies, Argentina’s elite actors have tended to safeguard their earnings abroad. Domestic financial reform must therefore also include restrictions on the capital classes of peripheral countries, including a limit on foreign currency held as savings or transferred abroad by firms. Of course, enacting such measures would entail a challenging political project, especially in the aftermath of Argentina’s triumphant right-wing reaction.

Data from the World Bank, available at https://www.worldbank.org/en/research/brief/inflation-database.

↩Data from the Argentinean Central Bank (BCRA), available at https://www.bcra.gob.ar/Pdfs/PublicacionesEstadisticas/com3500.xls.

↩Basualdo, E. (2001). Sistema político y modelo de acumulación en la Argentina. Universidad Nacional de Quilmes. Buenos Aires, Argentina.

↩Juncos, I. (2021). La dimensión internacional de la financierización subordinada: El caso argentino. Revista De Economía Política De Buenos Aires, (22), 47-72.

↩Manzanelli, P. D., & Basualdo, E. M. (2016). Régimen de acumulación durante el ciclo de gobiernos kirchneristas: Un balance preliminar a través de las nuevas evidencias empíricas de las cuentas nacionales. Realidad Económica, (304), 6-40; Cantamutto, F. J., Schorr, M., & Wainer, A. G. (2016). El sector externo de la economía argentina durante los gobiernos del kirchnerismo (2003-2015). Realidad Económica, (304), 41-73.

↩In June 2018, the IMF approved a three-year Stand-By Arrangement (SBA) for Argentina amounting to US$50 billion (about 1,110 percent of Argentina’s quota in the IMF). See: https://www.imf.org/en/News/Articles/2018/06/20/pr18245-argentina-imf-executive-board-approves-us50-billion-stand-by-arrangement.

↩Data from Cepal.

↩Data from the Argentinean Central Bank (BCRA).

↩Kaltenbrunner, A., & Painceira, J. P. (2018). Financierización en América Latina: implicancias de la integración financiera subordinada. Estudios sobre finenciarización en América Latina, 33-61.

↩Bortz, P. G., & Kaltenbrunner, A. (2018). The international dimension of financialization in developing and emerging economies. Development and change, 49(2), 375-393; De Conti, B., Biancarelli, A., & Rossi, P. (2013). Currency hierarchy, liquidity preference and exchange rates: A Keynesian/minskyan approach. Congrès de l’Association Française d’Économie Politique, Université Montesquieu Bordeaux IV, 1-22; De Paula, L. F., Fritz, B., & Prates, D. M. (2017). Keynes at the periphery: Currency hierarchy and challenges for economic policy in emerging economies. Journal of Post Keynesian Economics, 40(2), 183-202.

↩Carneiro, R., & De Conti, B. (2022). Exorbitant privilege and compulsory duty: The two faces of the financialised IMS. Cambridge Journal of Economics, 46(4), 735-752.

↩

Filed Under