On September 28, 2023, the Bank of England opened permanent liquidity facilities to nonbanking financial entities—such as pension funds, insurers, and investment funds—many of whom are part of the interest rate swap (IRS) market. The move is unprecedented. Historically, the Bank of England and other Western central banks have assisted banks in managing their cash outflows by creating facilities catering to liquid assets’ usability. IRS are contracts to exchange cash flows based on interest rate differentials. When introduced in the 1980s, these were not were not considered a cash management tool, and swap market participants were excluded from liquidity programs. Why the sudden shift?

In what follows, I reevaluate the function of IRS in the global financial system. Swaps are widely conceptualized as hedging instruments, where a fixed-rate payer/floating-rate receiver can offset bond devaluation caused by interest rate fluctuation. They are also understood as a speculative tool which investors use to establish a leveraged position with regard to a bond without holding any positions in the underlying asset.

But the Bank of England’s actions suggest that alternative mechanisms are at work. Drawing on a forthcoming interview with one of the world’s largest IRS dealers, Ralph Axel, I make the case that IRS perform a far more significant function than hitherto realized—they are used to fill funding gaps and compensate for failures in the repurchase agreement (repo) market.

Considering IRS as synthetic repos opens up new possibilities for understanding funding liquidity and designing alternative funding solutions. The two main types of liquidity are market liquidity and funding liquidity. Traditionally, market liquidity is measured multidimensionally and by attributes such as immediacy, depth, and breadth. At the same time, when it comes to funding liquidity, economic theories only look at one measurement: the availability of funds. But given that investors heavily rely on swaps, funding liquidity needs to be comprehensively evaluated, considering the availability of cash, associated costs, duration of the loan agreement, and the nature of fixed versus floating rates.

Looking at funding liquidity from multiple angles provides a more nuanced understanding of the state of the repo market. The repo market has traditionally been a reliable source for providing all elements of funding. However, investors are demonstrating a preference for swaps, in order to access some aspects of funding liquidity. This shift suggests that swaps have become a viable alternative to traditional wholesale money markets and that not all dimensions of liquidity can be obtained through the repo market alone. Examining the swap market structure can provide valuable insights into the overall funding landscape.

This development has significant implications. In particular, the shift away from the repo market has led to a greater dependence on private credit and market-based finance for funding liquidity. In developed economies such as the US and the UK, most derivatives and swap activities are carried out by non-banking financial institutions such as pension funds, alternative investment funds, and hedge funds. These institutions offer elements of funding that cannot be obtained from the repo market, demanding the support of central banks as lenders-of-last-resort. This, then, is the shifting microstructure underpinning the Bank of England’s recent policies.

Swaps as modern repos

A swap is a portfolio of multiple and sequential “Forward Rate Agreements” (FRAs). As shown in the figures below, an FRA is an agreement between two parties on a fixed interest rate to be paid/received at a future start date against a reference (floating) rate.

In practice, the FRA comprises two parallel loans: a fixed-rate loan, and a floating-rate loan. Let’s say bank A promises to pay Bank B a rate of 5 percent on a $200 million three-month deposit to be received in two months. When the time comes, Bank A will have to make that cash payment to Bank B should the three-month rate remain below 5 percent. However, should the three-month rate rise above 5 percent, Bank B will have to make a cash payment to Bank A. The amount of the cash payment thus equals the difference between 5 percent and the three-month rate on the day the FRA settled, multiplied by $200 million and a quarter of a year.

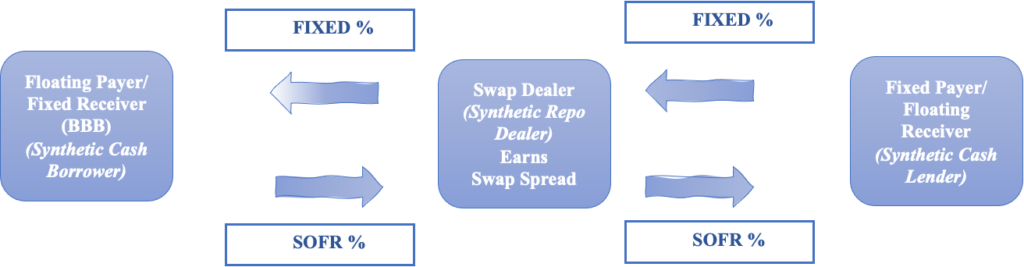

Conversely, a repo is a loan secured by collateral in the form of securities. One side lends money, and the other side lends (or reverses out) securities. Perhaps counterintuitively, this loan effectively mirrors the structure of the IRS through the exchange between a floating and fixed-rate entity. The swap’s fixed-rate payer is comparable to the repo’s cash-rich lender (such as a money market fund or MMF), and its floating-rate payer replicates the cash-borrowing agent (such as a hedge fund). This parallel is exhibited in the two figures below:

Figure 1: Financial Flows of a Swap

Figure 2: Financial Flows of a Repo

In this way swaps can enable the lending of excess fixed-income securities. If a triple-A-rated corporation enters into a swap contract with a triple-B-rated corporation, the former can trade its greater access to fixed-income securities for the latter’s better rates in the cash market.

Crucially, the swap’s replication portfolio (cash loans + coupon bonds) generates cash flows similar to those of a holding repo. Investors swap fixed-income securities for cash in an overnight or term (i.e., three-month) repo. Furthermore, like the sequential exchanges in a swap, repo contracts usually roll over for some time. Analytically, individual swap settlements can thus be interpreted and understood as synthetic repos.

The beauty of a synthetic repo analogy is that it clearly shows the funding utility of swaps. The two parties, intermediated by a swap dealer, may use swaps to lend their surplus balances. In the case of the fixed-payer, this means that the party, similar to a typical hedge fund in the repo market, has “too many” bonds in hand, and relatively speaking, fewer cash reserves.

Why are swaps substituting repos?

Repo markets are one of the largest sources of funding and risk transformation in the U.S. financial system. But despite their size, repo rates have proven to be increasingly unpredictable and subject to extreme intraday spikes. A notable example occurred on September 17, 2019, when the intraday repo rate rose thirty times the same spread the preceding week.

This sudden spike was in part the result of short-term disruptions, including the settlement of Treasury debt issuances on September 16. But it also reflected structural changes that have decreased the flexibility of repo markets to offer attractive funding solutions. One of the major factors for this was the modification of the business models of large banks in the aftermath of 2008. Since they were obligated to hold higher levels of reserves and liquidity due to regulatory programs such as the Liquidity Coverage Ratio (LCR), banks have shifted their priorities from external to internal lending, in turn making them less flexible in their offerings of money market loans, including repo lending.

In the repo market, banks prefer to hold reserves instead of Treasuries to satisfy their High Quality Liquid Asset (HQLA) requirements. In response, repo market makers have shifted their priority from external to internal lending. These banks increase their flexibility in sourcing funds internally, becoming less flexible in repo lending as they stop obtaining cash from other parts of the firm.

Internal frictions that curbed banks’ desire to offer attractive money market loans caused the spillovers from the repo market to the Foreign Exchange (FX) swaps market. Some spillover between these markets naturally resulted from foreign banks choosing to source U.S. dollars in FX swaps instead of repo. But the FX swaps market is heavily intermediated by the same banks active in repo. These banks increased lending in FX Swaps relative to repo despite a smaller rate increase, implying that frictions in banks’ ability to optimally reallocate funds in the wholesale money market led to these adjustments. Like the FX swap market, the interest rate swap market is another synthetic funding market that accommodates spillovers and investors from the repo market.

Beyond mimicking repos, then, swaps also have several advantages over them. Most importantly, their engineering opens diverse opportunities to shift funds across the financial system. A company that has decided to borrow at short-term floating rates can either issue short-term debt, like commercial paper or issue long-term floating-rate debt. While both options offer the desired interest rate exposure, commercial paper comes with the risk of limited access and liquidity issues. Long-term floating-rate debt solves the liquidity issue, but the market is relatively small and illiquid.

A solution for these corporations is to issue fixed-rate debt and then receive fixed and pay floating in a swap. The net effect of the fixed debt and the swap is floating-rate funding. It’s far more appealing to issue fixed-rate debt and then receive fixed and pay floating in a swap—fixed debt combined with the swap effectively gives floating-rate funding. In addition, these transactions also avoid noting liability on company balance sheets, and give companies access to narrower bid-ask spreads, since the width of the dealers’ bid-ask spread in the swap is inherently constrained. Swaps offer a more flexible way to shift funds across the financial system.

Regulatory challenges

Swaps can be reconstructed indirectly (or synthetically) by holding two instruments: a floating-rate loan (such as a short-term bank loan) and a fixed-income security (such as a coupon bond). Importantly, these two instruments are explicitly involved in constructing the repo as well. In other words, individual swap settlements can be thought of as synthetic repos.

This insight—that swaps’ cash flow replicates repos—provides a valuable shortcut to swap market structure and broader financial stability. Importantly, the market’s reliance on swaps for providing funding makes the Fed’s crisis-fighting task more complex. In a wholesale money market, the funding provision is relatively straightforward. In the repo, for instance, funds move from the cash-rich (such as MMFs) balance sheet to cash-deficit (such as hedge funds) institutions. The intermediation happens via the balance sheet of a repo dealer. In this setting, during financial distress, central banks inject cash into the system either by becoming the dealer of last resort (and trade directly with the dealers) or by becoming the lender of last resort (and lend to the so-called cash-rich players.)

However, a swap-centric funding market structure is considerably more complex and less transparent. Notably, it is entirely off-balance sheets. The role of players and the direction of funding are also blurred within this marketplace—unlike in the money market, where access to cash determines who the lender is, in swap-centric financing, the lender is determined based on her “comparative advantage” in the capital and money markets. Synthetic lending happens by those with comparatively better access to the floating-rate market. The problem is that these institutions, by definition, are less credit-worthy and have lower credit ratings than their counterparts. In other words, the lenders of synthetic funding by construction are the low-quality firms with higher credit risks.

Synthetic funding also adds additional layers to funding provision. Money markets are a direct source of funding, but they may not always offer reasonable rates. On the other hand, synthetic funding can provide more flexible solutions, such as better rates or the conversion of fixed to floating rates, and vice versa. This flexibility is crucial for investors, especially when borrowing against future income becomes difficult due to unattractive funding liquidity rates or other factors. In such cases, the money market can provide imperfect solutions. However, combining money market funding with swaps can make the rates and other attributes, such as fixed vs. floating of the fundings, more appealing and better aligned with the future cash inflow stream of borrowers. The repo-swap combo is an ideal funding solution for investors in such situations.

The substitution of the IRS for repos represents a new market structure, which involves more complex funding and higher reliance on risky firms to provide affordable liquidity. It can, therefore, create important practical and political obstacles for the Fed during a period of funding squeeze—it is unclear whether the Fed’s established role as lender or/and dealer of last resort is enough to backstop such a complex and opaque funding system. The present gap in policymakers’ understanding of these developments can lead to binding regulatory consequences that impair funding conditions or make them unequipped to fight the next funding crisis.

Filed Under