Over the past two decades, Brazilian media and political discourse have exalted the success of a phenomenon known as “agribusiness.”1 Closely associated with the rise of commodity exports such as soy, sugarcane, and corn, “agribusiness” has come to define the nation’s dominant agrarian system. The term and its subject, however, require further clarification.2

This article delves into the current agrarian economy of Brazil, drawing attention to a trend we refer to as “reprimarization” and its implications for the national economy. This trend, seen in Brazil’s foreign trade, describes the return to focused production of resource-intensive primary goods for export. It has led to a decline in the economic importance of industry, confining manufacturing to a supporting role within what can now be called an “agribusiness” economy.

The emergence of the reprimarized economy can be traced to the early 2000s, when state policies promoted agricultural and mineral commodity exports as a prominent component of Brazilian foreign trade. This phenomenon has since transcended the conventional politics of economic policies, evolving into a consensus state policy program spanning two decades. This has borne significant socioeconomic and environmental repercussions, which have albeit largely been hidden from public discourse. Additionally, the swift financialization of agriculture has transformed tangible assets, such as commodities and land, into targets for speculative investment.

“Primary specialization” does not enhance Brazil’s autonomy in external economic relations or foreign trade. Rather, it intensifies an economy-wide dependence on primary goods exports, gradually displacing other sectors—in particular, manufacturing goods exports.

This economic dependency is evidenced in Brazil’s trade balance by the considerable growth of deficit in “services and income paid abroad” alongside the significant decline of manufactured goods. Together, these phenomena amplify the prominence of a small number of agricultural and mineral commodities. The economy surrounding these commodities—which aim to achieve the value required for the elusive notion of “external equilibrium”—employ a combination of mechanisms that exploit the environment while concentrating income and wealth in land-based resources.

The primary-export specialization process impedes alternative rural development strategies centered around agroecological sustainability and socioeconomic progress. This environmentally unfriendly and exploitative system fosters both domestic and global inequalities, marking a return to economic dependency after a sustained period of diversification.

Primary-export specialization

The past two decades have seen significant transformations of the Brazilian agrarian landscape. Innovative agrarian policies were introduced after 2000, assisting the rapid reduction of social inequality and hunger (indicators of progress which were rapidly reversed after 2016). But processes that deepened the structural contradictions within Brazilian society were underway. This initiated a pronounced regression for rural regions, long characterized by stark inequalities in land access. Data from the 2017 Agricultural Census indicate that agricultural establishments smaller than ten hectares, despite constituting half of the total units, accounted for a mere 2.28 percent of the total area, whereas establishments with 1,000 hectares or more, constituting only 1 percent of the total number of units, held 47.52 percent of the land area.3

We focus on the expansion of commodity production and its consequences for foreign trade, as well as the degree of financialization occurring within rural areas. In particular, the rise of China in the twenty-first century reshaped Brazilian foreign trade dynamics. According to Flexor, Kato, and Leite:

The global economic dynamics characterized by robust growth in developing nations, expanding trade, and low global inflation have significantly influenced the pattern of Brazilian trade . . . Over a span of two decades, China has become the primary market for Brazilian exports, with their value skyrocketing from just over US$ 1.08 billion to over US$ 67.68 billion between 2000 and 2020. In 2000, China accounted for a mere 1.97 percent of the total value of Brazilian exports, while in 2020, it represented almost a third (32.40 percent) of the total. The trajectory of Chinese product imports followed a similar trend, reaching US $34.77 billion in 2020, accounting for 21.9 percent of the total imported value and demonstrating a staggering increase of 2,752 percent over a span of twenty years.4

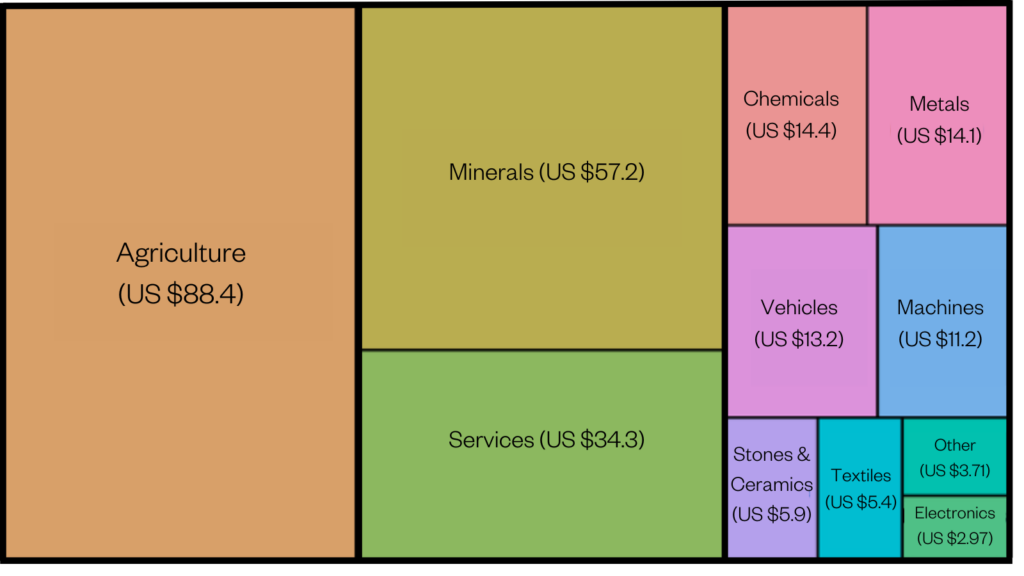

Figure 1: The primary sectors of export and their corresponding values of Brazilian exports in 2020, in billions of US dollars.

This concentration in the Chinese market was accompanied by a drastic shift in the structure of Brazilian exports. Until 2000, the foreign trade agenda still exhibited a relatively diverse range of products. But over the span of twenty years, there has been a shift towards primary goods. Figure 1 illustrates the increased significance of soy, iron ore, and oil—resource-intensive primary goods—along with a simultaneous rise in imports of manufactured goods. According to the Foreign Trade Secretariat (SECEX), starting from 2018, Brazil once again saw more than 50 percent of its exports comprising primary goods, signaling a return to a pattern seen up until the postwar period; thereafter, Brazil experienced a prolonged diversification of its foreign trade portfolio.

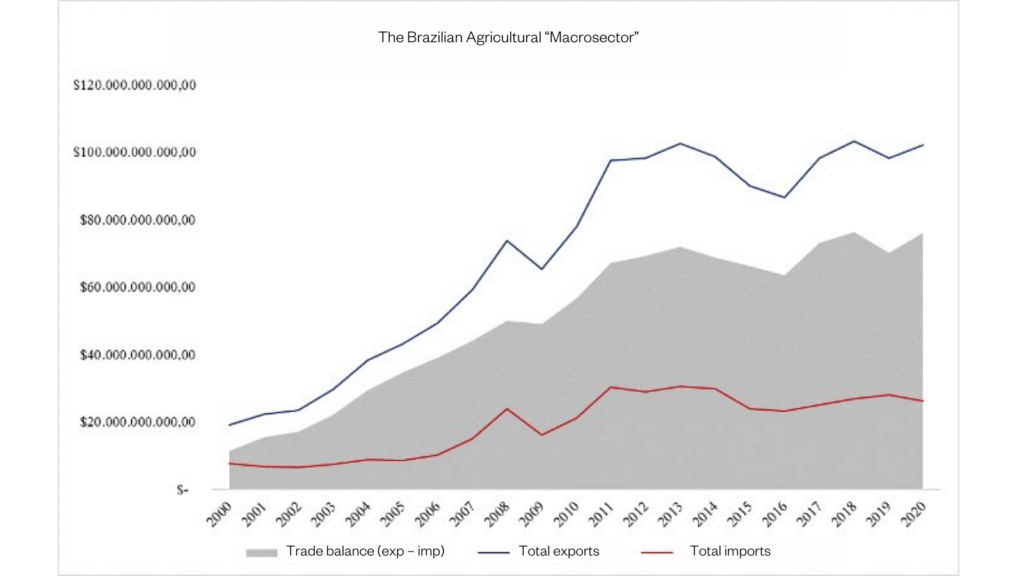

The case of soy deserves special attention. In 2000, the value of exports from the oilseed chain accounted for 5 percent of Brazil’s total exports, but by 2020, it had surged to 16.8 percent. This substantial increase can be attributed to the significant rise in Chinese imports, which accounted for over 70 percent of the total value of soybeans exported by Brazil in the previous year. A similar trend can be observed with iron ore. It is worth noting that the rural sector, including the related industrial sectors, consistently maintained a surplus in trade flow from 2000 to 2020, as depicted in Figure 2. While the overall trade balance experienced alternating periods of deficit and modest surplus, the balance of the “agricultural macrosector” revealed a substantial gap between exports and imports, further evidencing the “reprimarization” of the export portfolio.5

Figure 2: The trade balance of the “agricultural macrosector” in terms of exports, imports, and the overall balance, from 2000 to 2020, values in billions of US dollars.

The rise in commodity prices and their capacity to generate foreign exchange led Maristela Svampa to label the period as the “commodity consensus,”6 distinct from the “Washington Consensus” that characterized the structural adjustment of Latin American economies. This cycle had profound implications for the utilization of natural resources, particularly land. In addition to cost pressures, the “commodity consensus” led to encroachment upon areas designated for environmental preservation and inhabited by indigenous populations, notably in the Amazon and Cerrado biomes. Resultant territorial disputes have garnered significant media attention.

This phenomenon has also led to a decline in the land area allocated for the cultivation of staple food crops, particularly those that form part of the basic food basket, primarily consumed locally or regionally. Rice and beans have experienced considerable losses over the past two decades, partly offset by periodic increases in productivity.7 Consequently, the outcome has been higher prices for essential food items, which, alongside the dismantling of agrifood policies, has contributed to an alarming resurgence of hunger in the country. Data compiled by the PENSSAN Network indicates that approximately 60 percent of the Brazilian population currently falls under the food insecurity category, with 33 million people classified as severely food insecure.8

Financialization

We examine the contemporary Brazilian rural landscape from the perspective of the agrarian question, taking into account the phenomenon of financialization in land and agriculture. Rural credit policies are key to supporting agribusiness production. They allocate subsidized public funds to specific activities; crops like soy, coffee, sugar cane, and corn receive around 80 percent of the resources from the National Rural Credit System. The emergence of a new financial framework can be traced back to 1994 with the introduction of the Rural Product Note, involving both physical and financial settlements, with the latter implemented in 2000. From 2004 onwards, the range of financial instruments gained momentum with the introduction of various types of agribusiness securities (such as Agribusiness Receivables Certificates, Agribusiness Letters of Credit, etc.), tapping into derivative markets and expanding the pool of investors beyond the rural sector.

Since 2019, a series of legislative and financial innovations has fostered the expansion of private financing instruments for Brazilian agriculture, which had historically faced limitations in terms of funding capacity. These transformations positioned agriculture as an attractive financial opportunity. The new financial instruments became vital for mobilizing private capital, with land acting as a fundamental anchor for sectoral development. Recent legislation in Brazil further reinforces this trend, and significantly broadens the scope of possibilities, effectively linking the issue of food security with the newly financialized dimension of agriculture.9

The Agro Laws,10 along with the Law of Investment Funds in the Agribusiness Productive Chain (Fiagro), resulted in the establishment of the Solidarity Guarantee Fund, the Rural Heritage in Allocation Assets, the Rural Real Estate Note, and amendments to the Rural Product Note. The new business strategies prioritize the interests of investors and shareholders, shifting the agrarian economy from a productive logic to a financial one. Foreign land ownership has accompanied this transition, with a notable amount of land controlled by international capital, including investments facilitated by pension funds.

A 2010 opinion from the Attorney General’s Office of Brazil established limits on the amount of land that could be directly acquired by individuals, companies, or governments, reviving a specific law on the subject from 1971 that had fallen into “disuse” during the 1990s and 2000s, when global demand for land reached unprecedented levels. This has prompted a variety of state attempts to regulate land acquisition. Currently, several bills awaiting Congressional approval consider the opening of the Brazilian land market to international investors. However, the Agro and Fiagro Laws, by permitting external investments, to some extent circumvent the existing restrictions within the legal framework for land acquisition. This situation has been further exacerbated by the land regularization instruments introduced during the Temer Government (2016-2018). 11 The state has experienced a significant setback in its ability to regulate land, given the increased flexibility around defining the “social function” of rural properties.

Implications of “reprimarization”

The late 1990s to the early 2000s saw the emergence of three interrelated economic processes: commodity predominance, the formation of political alliances to promote and protect the agribusiness system, and the implementation of specific economic strategies to generate surplus through private profit margins and the intrinsic value of natural resources. These processes continue to shape Brazil’s primary sector, with far-reaching implications for the broader political and economic system.

First, the shift in Brazilian foreign trade is characterized by an extraordinary expansion in the export of agricultural and mineral commodities, accompanied by a relative decline in manufactured product exports. Additionally, there has been substantial growth in the deficit of “Services and Income Abroad.” Second, in the early 2000s, the state established a de-facto agreement with the self-proclaimed “Agribusiness System or Economy,” representing a primary-value cycle. This agreement entailed differential promotion and protection networks, encompassing agro-industrial complexes, large-scale land properties, and a recalibrated public finance system, all geared towards advancing this process of economic valorization.

Lastly, there have been major changes in how economic surplus derived from the primary sector is generated and distributed, at the expense of the broader economy and society. Still, these changes have been largely obscured from the public through political diversions. These processes operate in conjunction—“at any cost”—to subordinate the entire economic system to the expansion of commodity exports. However, our analysis of this phenomenon cannot be limited to the primary-export system alone. The system has triumphed as a result of a political economy pact in which the dominant party or coalition in control of the government is bound by the exclusive objective of maximizing commodity exports. Indeed, commodity exports have transformed into a political achievement designed to garner popular support.

The political economy pact

These three processes are not novel in the relationship between the Brazilian State and the oligarchic rural sector. In fact, they echo the primary valorization of coffee during the period of the Taubaté Agreement, from 1906 to 1930, a model which reemerged in the postwar period, until 1961. During this time, the state took on the arduous task of managing unsold public coffee stock that resulted from anticipated overproduction, and thus incurred substantial costs.

This predictable overproduction led to the collapse of the coffee appreciation cycle. In response, the rural conservative classes initiated the “conservative modernization of agriculture” during the military government in the early 1960s. Between 1965 and the early 1980s, these classes forged strategic alliances to diversify exports, which were still heavily reliant on coffee, and cater to the growing demands of urban and industrial expansion during that period.

This period also entailed close relationships with the Brazilian state, which sought modernization through the provision of generous tax and credit benefits to support the technical innovations of the “green revolution” in agriculture. Simultaneously, the state maintained a conservative approach by preserving the agrarian structure established by the Land Law of 1850, despite the military regime enacting the Land Statute in November 1964,12 known as a dead letter law, which did little beyond serve political appearances. The “conservative modernization of agriculture” witnessed a decline from the mid-1980s to the late 1990s, paving the way for the emergence of the “agribusiness system” with an explicit strategy focused on generating high and continuously growing export surpluses of commodities.

The agricultural modernization of the 2000s, however, differed in key respects13 by abandoning the export diversification approach centered on manufactured goods. While the military dictatorship provided fiscal, credit, and exchange incentives for commodity exports, and it adopted the technological package from the earlier “green revolution” era, it still maintained import substitution objectives around essential inputs and capital goods for agriculture. Since the early 2000s, the state has weakened, if not entirely abandoned, regulations on production and supply for the domestic market, particularly for basic food items.

Most notably, over the past two decades, agribusiness has managed to establish an ideological propaganda apparatus to construct a mythical narrative around the agribusiness pact. Continuous advertising and marketing strategies promoting the system accompany the Parliamentary Front for Agriculture in government, the PENSA Institute and its network of supporters in academia, and the Annual Crop Plans of Agriculture, the technical and financial structure of the state. Agribusiness has maintained a firm grip on the Federal Executive Power for six presidential terms, since the second term of President Fernando Henrique Cardoso. The agribusiness narrative benefits from a dedicated media outlet, the Canal Rural TV, which consistently aligns itself with its ideology.

The construction of agribusiness as a myth serves to occupy a position akin to that of an idol in the public imagination.14The influence of religious elements in shaping economic policy is tied to the agribusiness economic cycle, distinguishing it from predecessors such as the coffee cycle. This influence extends beyond advertising messages—the Evangelical Parliamentary Group, for example, is fully integrated with the Parliamentary Front for Agriculture and aligns with the broader agendas of the agribusiness system.15

Structural issues related to inequality, poverty, and the deepening climate crisis are largely absent from the system’s parliamentary agenda. Instead, the discourse is permeated with notions of economic utilitarianism, the promotion of wealth, and a theology of prosperity. The expansion of commodity production has led to increased inflationary pressures from the rising costs of basic food products, deindustrialization, foreign trade imbalances resulting from the surge in non-commodity imports, income and land inequality, and most notably, ecological crisis from a system responsible for the majority of greenhouse gas emissions in the Brazil. While these symptoms do receive media attention, they are rarely linked to the agribusiness system and its strategy for rural growth. The system is shielded from scrutiny in electoral debates, as major candidates bow to the pressure of the prevailing ideology centered on agribusiness’s national importance.

Global markets and the state

As new investment flows connect the rural and urban sectors through financial capital, the global land market indirectly links a retired professor from New York to land expropriation undertaken by new rural real estate firms in Piauí, Brazil. Such links, previously inconceivable, now characterize global land dynamics. Whether prompted by the food crisis in the mid-2000s, the growing demand for biomass, China’s significant presence in international trade, or energy and international financial crises, the Brazilian agricultural sector is currently witnessing a renewed expansion of areas allocated for commodity production. This reinforces large-scale agricultural productivism, with increasingly sophisticated and costly technological advancements. This model, however, engenders social and environmental conflicts in rural areas, straining existing conceptions of rurality that were previously centered around the promotion of family farming and territorial development.

These conflicts require us to reflect on the role of the state and its regulatory capacity regarding land markets and commodity production. Thus far, the state has been incapable of effectively controlling land transactions, lacking the capacity to enhance transaction registration, monitor price fluctuations, prevent land concentration in conflict-prone regions, and reassess government agencies’ financial and technical support of sectoral expansion.

We now see a growing alignment between the productive strategies of firms and agri-food chains and the trend towards the financialization of agriculture and land. This convergence demonstrates the significance of new financing instruments, the increasing involvement of international investments in land acquisition and control, the dynamics of land prices in comparison to other financial assets and inflation, and the evolving roles of new social and governmental actors. The contemporary political economy pact is distinct from the twentieth-century booms in Brazilian agricultural exports, and it has become central in constructing and maintaining the hegemony of agribusiness.

This essay was originally published in Portuguese in Revista Rosa in December 2022. It was translated for Phenomenal World by Isabella Barroso.

In Portuguese: agronegócio.

↩For a more in-depth discussion of the employment and meaning of the term “agribusiness,” see G. Delgado, Do capital financeiro na agricultura à economia do agronegócio: mudanças cíclicas em meio século (1965-2012) [From Finance Capital in Agriculture to the Agribusiness Economy: Cyclical Changes in Half a Century (1965-2012)]. Porto Alegre: Ed. UFRGS, 2012; B. Heredia, M. Palmeira and S. P. Leite, “Sociedade e economia do agronegócio no Brasil [Society and economy of agribusiness in Brazil].” Brazilian Journal of Social Sciences, 25 (74), 2010, pp. 159-96.

↩See: Brazilian Institute of Geography and Statistics, 2017 Agricultural Census. Rio de Janeiro: IBGE, 2019.

↩G. Flexor, K. Kato and S. P. Leite, ““Transformações na agricultura brasileira e os desafios para a segurança alimentar e nutricional no século XXI [Transformations in Brazilian agriculture and the challenges for food and nutrition security in the 21st century].” Texts for discussion, 82. Rio de Janeiro: Fiocruz, 2022. Projeto Saúde Amanhã.

↩Ibid.

↩M. Svampa, “Consenso de los commodities y lenguajes de valoración en America Latina [Consensus of Commodities and Valuation Languages in Latin America].” Nueva Sociedad, no. 244 (30:46), Mar/Apr, 2013.

↩G. Flexor, K. Kato and S. P. Leite.

↩Brazilian Research Network on Food and Nutrition Sovereignty and Security (PENSSAN Network), II Inquérito Nacional sobre Insegurança Alimentar no Contexto da Pandemia da Covid 19 no Brasil [Second National Survey on Food Insecurity in the Context of the Covid 19 Pandemic in Brazil] — II VIGISAN: Final Report. São Paulo, SP: Friedrich Ebert Foundation, PENSSAN Network, 2022.

↩G. C. Delgado, “Condomínios imobiliários financeiros: senhas especulativas e graves ônus sociais [Financial real estate condominiums: speculative passwords and serious social burdens].” ObservaBR. São Paulo: Perseu Abramo Foundation, 2021.

↩Namely No. 13,986/2020 and No. 14,421/2022

↩This led to the enactment of a specific law (Law 13,465/2017) and three decrees (9309, 9310, 9311 of March 2018).

↩Law nº 4.504/1964

↩G. Delgado, op. cit., 2012.

↩This builds on a long tradition of idolatry and fetishism in Latin American political theory. See P. Richard (org.), La lucha de los dioses: los ídolos de la opresión y la búsqueda del Dios Liberador. San José: Departamento de Investigación Ecuménica, 1980. They explore the theological underpinnings behind the utilization of economics and politics as means to attain consensus and ideological validation for contemporary capitalism. Within this context, the notions of idolatry and fetishism come to the fore as significant elements.

↩See, for example, C. Pompeia, “O agrobolsonarismo [Agri-bolsonarismo].” Piauí Magazine, 184, 2022, pp. 24-8.

↩

Filed Under