They say a picture is worth a thousand words. Two types of images are key to understanding current debates about economic globalization: the hockey stick chart, representing the stunning and inexorable growth of some phenomenon; and the cross chart, whose lines represent changes in relative power and prosperity.

There are good and bad hockey sticks, and the job of policy makers the world over is to harness the former while curbing the latter. But the domestic and international politics of addressing these hockey sticks is complicated by their intersection with distributive conflicts—which can be seen in the form of crosses.

In Six Faces of Globalization: Who Wins, Who Loses, and Why It Matters, we identify a series of narratives that dominate Western debates about the virtues and vices of economic globalization. These storylines are important because they offer different interpretations about what the problems are, how they came about, who is responsible, and what should be done. Here, we highlight some of the key hockey sticks and crosses on which these narratives rely.

No single narrative or image can capture the multifaceted nature of complex issues like economic globalization and the climate crisis. Understanding different perspectives and how they interact is crucial.

Prosperity

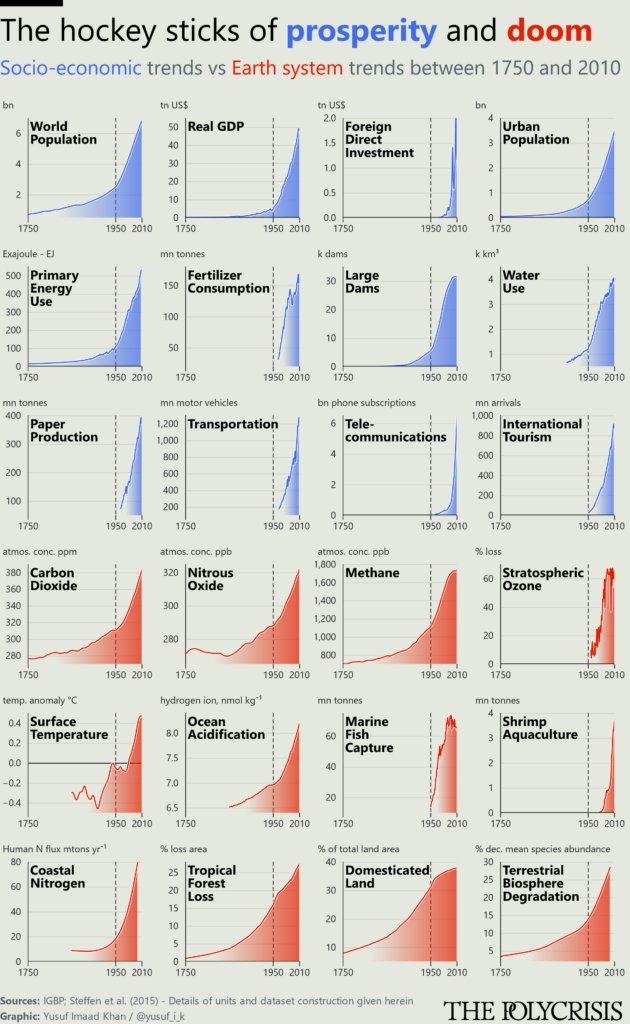

Advocates of economic globalization invariably make some version of the following argument: Economic activity was stagnant for most of humanity’s existence until, sometime around the nineteenth century, a combination of technological innovation and international trade unleashed productivity, creating unprecedented riches. This is the hockey stick of global prosperity, as measured by GDP and shown in Figure 1. Whatever the costs and failings of globalization, proponents argue, we must be careful not to mess with this incredible success.

We call this the “establishment narrative.” It is the perspective you would typically hear from mainstream political parties in the West, scores of political and economic commentators, and international economic institutions like the World Bank, the International Monetary Fund, and the World Trade Organization. It is a story about win-win outcomes and trade’s potential to bring peace and prosperity to the world.

The caveats are that governments must design domestic policies to help workers adjust to the changing international division of labor and to redistribute wealth so that everyone gets a bigger piece of the expanding pie. But the bottom line of the establishment view is clear: we must have more technological innovation and economic integration to stay on the ever-rising hockey stick of global prosperity.

Doom

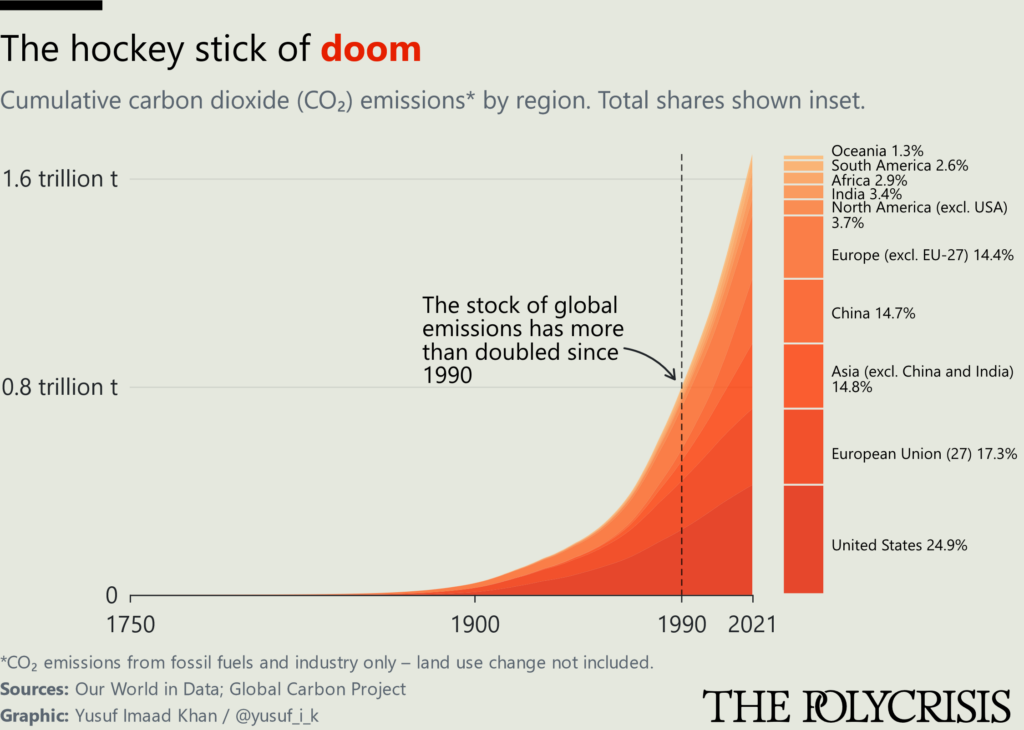

The hockey stick of doom, which charts skyrocketing carbon emissions in Figure 2 below, shows that the prosperity celebrated by the establishment narrative is built on unsustainable foundations. The storyline supported by this chart, which one could call the “Anthropocene narrative,” focuses on how globalization has facilitated the diffusion of carbon-fueled patterns of production and consumption, which are fast making large sections of the planet uninhabitable. This narrative is a pessimistic story about neglected environmental externalities in the quest for economic growth.

Proponents of this narrative argue that, instead of relentlessly maximizing economic growth, we must reorient our economies toward the goal of surviving and thriving within the limits of our planet’s resources. Unless we change course, we will find ourselves in a lose-lose situation of rising temperatures, extreme weather events, and collapsing biodiversity. We will also perpetuate serious injustices and inequities: even though everyone is at risk of losing, those who are most vulnerable and least responsible for the problem are losing first and worst.

As record drought, heat waves, fires, and floods batter the planet, the “Anthropocene narrative” is rapidly gaining mainstream acceptance. The hockey sticks of prosperity and doom mirror each other. The charts in Figure 3 capture the trajectory of the Anthropocene, with a series of blue hockey sticks showing rising economic activity followed by a series of red hockey sticks showing destructive earth systems trends.

Hope

For some, the answer to this dilemma lies in “degrowth.” On this view, we need to recognize that never-ending economic growth is unsustainable and therefore commit to reducing our consumption to an ecologically sustainable level. The aim is to curb the hockey stick of prosperity, at least for rich people and rich countries, in order to bend the hockey stick of doom.

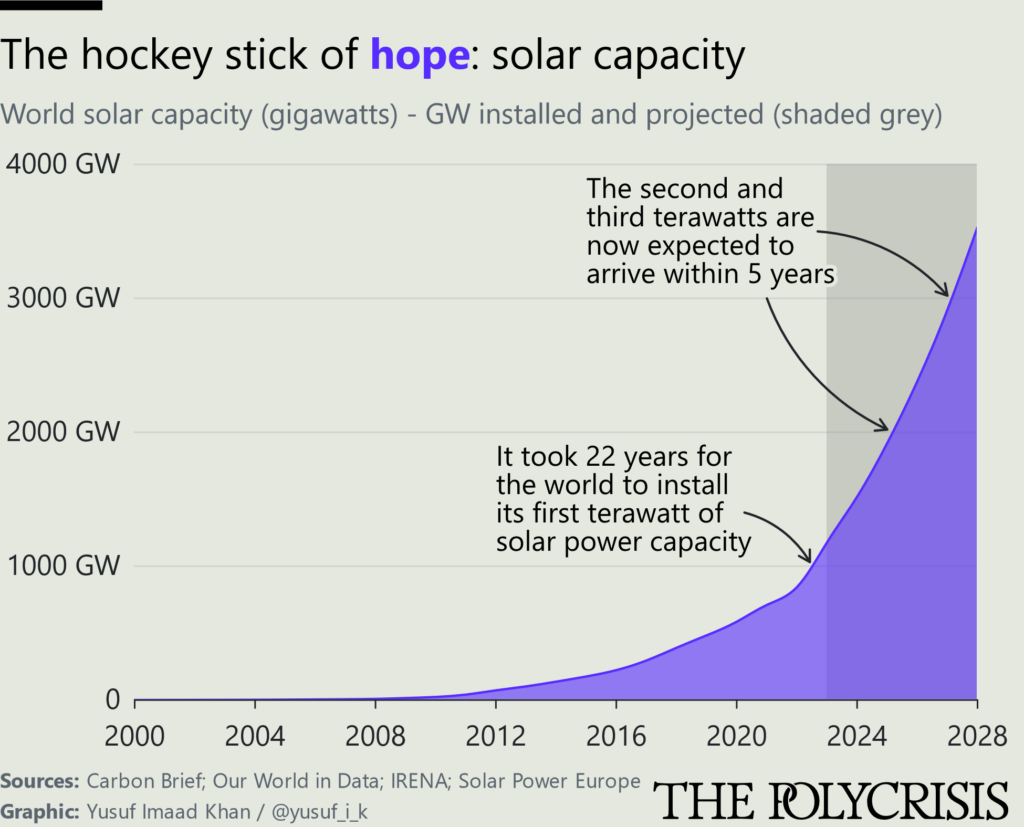

Others maintain that trade and technology can point the way out of this mess. Proponents of the “green growth” approach marshal the hockey stick of hope, which represents the rapidly accelerating uptake of solar power and other green technologies. As Figure 4 shows, it took more than two decades for the world to install its first terawatt of solar power, but the second and third are set to follow within five years. At this rate, markets (with the support of states) can innovate us through our problems, argue proponents of this view, who often come from the pro-trade-and-technology establishment camp.

The hockey sticks are important, but they obscure distributive conflict. Not only will the impact of climate change be starkly uneven; the green transition is also beset by questions about the global division of labor and the distribution of economic power. China has led the world in the production of solar panels, helped by its unrivaled manufacturing capabilities, access to global markets, and generous state subsidies. The extraordinary growth of Chinese electric vehicle manufacturing and exports suggests that China will be the breakout star in this market, too. For Western politicians who worry about their manufacturing base and see their countries in competition with China over the technologies of the future, this hockey stick of hope comes with considerable anxiety.

To understand this reaction, we need to explore the ways in which the hockey sticks of economic globalization intersect with the crosses of relative power and prosperity. Runaway growth, skyrocketing emissions, and technological tipping points are one side of the story; distributive conflict is the other.

Global power

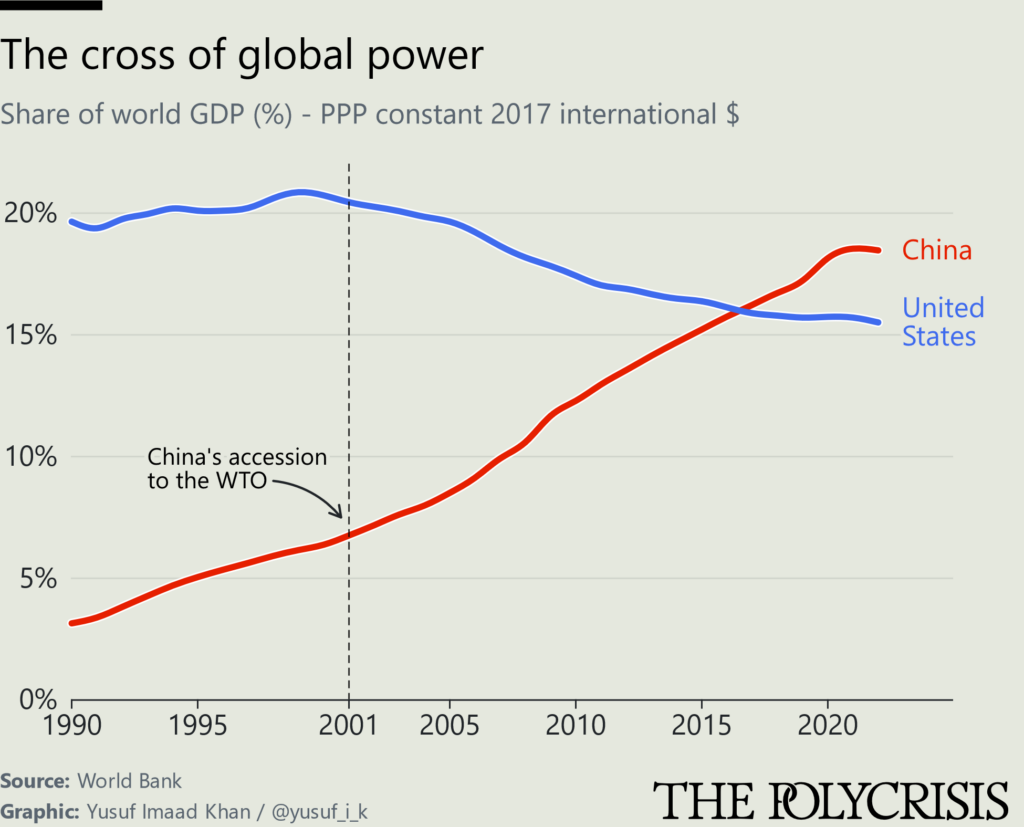

Although the US and China have each gained from the economic globalization of the past decades in absolute economic terms, in relative terms China used the period to close the gap on its Western rival economically, technologically, and militarily. The new economic powerhouse fueled multiple decades of global economic growth by playing to its strength in cheap manufacturing, while gaining access to global markets and capital through its accession to the World Trade Organization. China’s domestic champions grew in size and strength, and moved up the ladder of technological innovation, and China’s military spending increased significantly.

The cross of global power captures this change, showing China’s relative rise against the US as measured by each country’s share of global gross domestic product in terms of purchasing power parity (Figure 5). This cross propels the “geoeconomic narrative,” which treats economic security as national security and frames China as both an economic competitor and a security threat to the US and other Western nations. Instead of focusing on win-win outcomes from economic integration, this narrative emphasizes the vulnerabilities created by economic interdependence with a strategic rival, such as lack of self-sufficiency and exposure to weaponized interdependence.

Those wary of China’s growing economic and technological prowess fear that their strategic rival will gain an advantage in key technologies and markets of the future, such as artificial intelligence, quantum computing, green technologies, and biotech. To avoid this, Western governments are pumping billions of dollars into the development of their own domestic industries while at the same time curtailing the export of key technologies like semiconductors, and attempting to secure continuous access to critical inputs, such as lithium and rare earth metals. But Western governments do not only strive to maintain an edge in the technologies of the future; they also hope that rebuilding their manufacturing base will help them mitigate the political and social fallout from deindustrialization and runaway inequality.

Work

Donald Trump did not win the US presidency in 2016 because the average American was concerned about falling behind China in quantum computing or artificial intelligence. Rather, his appeal rested in part on his repeated promise to bring back blue-collar industrial work that helped build the twentieth-century American middle class: car manufacturing, steel smelting, and coal mining. The steady decline of manufacturing jobs in the US and other high-income countries accelerated in the early 2000s after the “shock” of China’s entry into the WTO. The decline was mobilized in service of the “right-wing populist narrative” championed by Trump, the Brexit movement, and other right-wing parties all over the developed world.

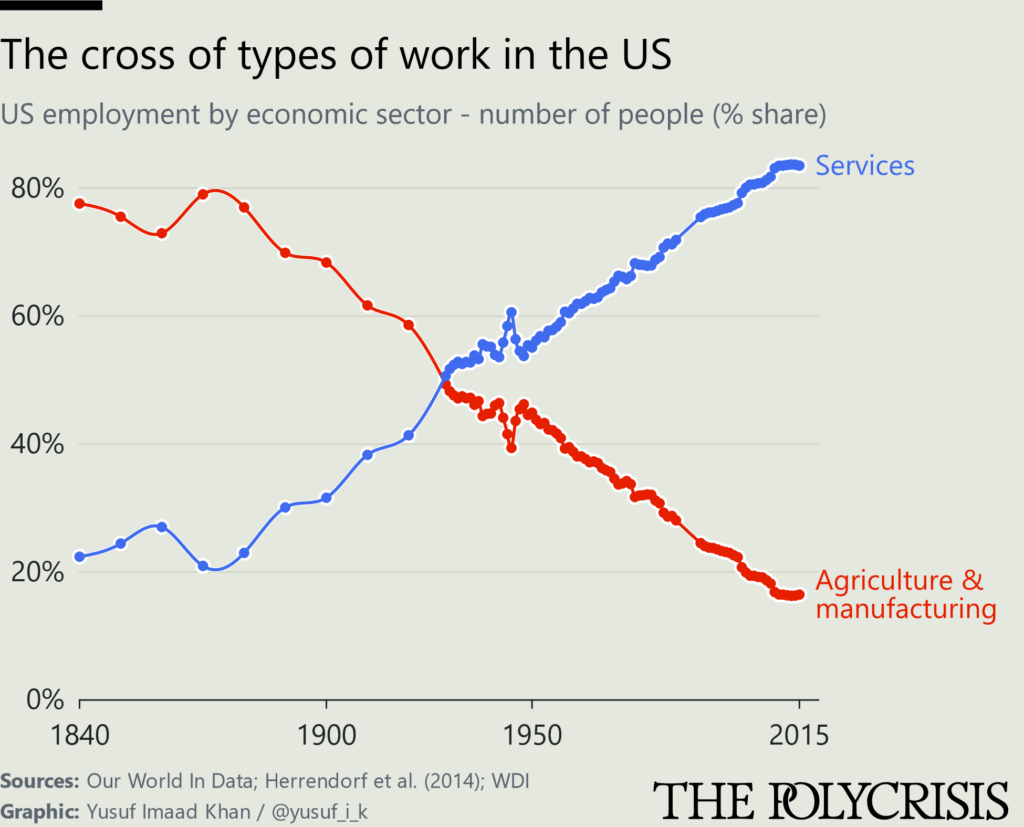

This shift in labor markets is exemplified by Figure 6, which captures the changing shares of economic sectors in the US over the past two centuries. In the 1840s, almost 80 percent of employment was made up of agriculture and manufacturing, while just over 20 percent came from services, such as finance, business, education, information, legal and health services. By 2015, those positions had more than fully inverted, with services now making up more than 80 percent of jobs and agriculture and manufacturing constituting less than 20 percent. Technological innovation and trade transformed the US and other Western countries into knowledge economies. Why did this change give rise to such discontent, especially in the United States?

Deindustrialization had a highly asymmetric impact on different regions in the US. The regions hit particularly hard by the loss of well-paying factory jobs were ones that offered few alternatives; in these cities and towns, the closure of factories permanently depressed economic activity, bringing deaths of despair in its wake. Not all workers and their families were able or willing to move to the metropolitan areas where new service sector jobs were being created. Moreover, the decline of manufacturing disproportionately affected white men without a college degree, eroding the power of the traditional industrial male breadwinner in favor of what right-wing populists view as a “woke” urban elite.

Income

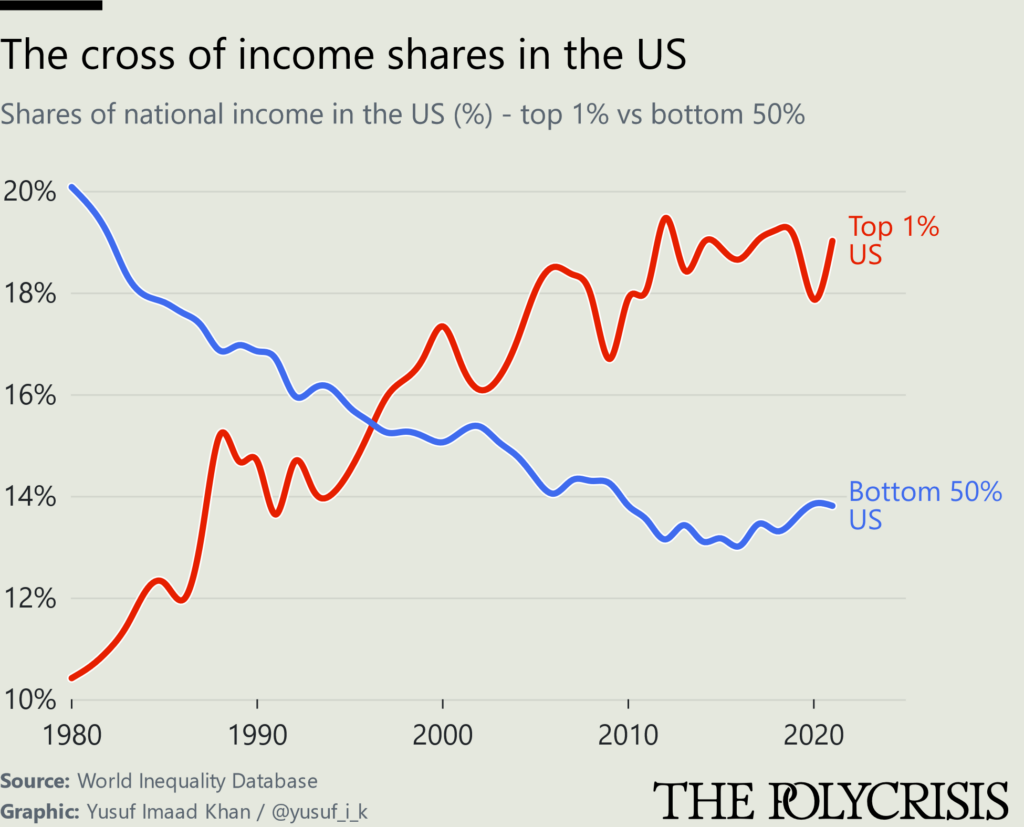

A major left-wing narrative of the twenty-first century has focused on a different image: the cross of income shares shown in Figure 7, which demonstrates the share of US income flowing to the top 1 percent rising inexorably as the income enjoyed by the bottom 50 percent declines steadily. According to the “left-wing populist narrative,” this cross captures the various ways in which national economies have been rigged to channel the gains from globalization to the privileged few, exacerbating inequality. From stagnating minimum wages to a predatory financial system, this narrative sees the economy as systematically skewed against the interests of the working and middle classes.

Taxes

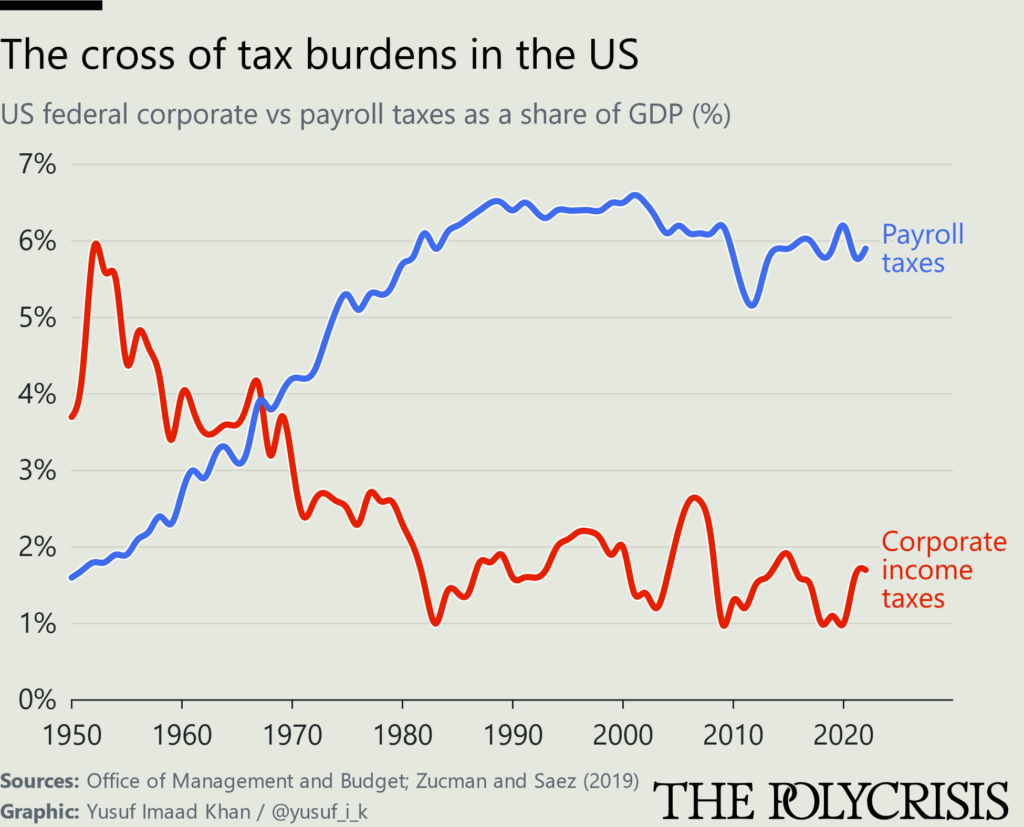

Not only have the rich been able to appropriate the lion’s share of the gains from globalization; corporations have also exploited the pressures of globalization to get governments to shift the burden of taxes from mobile factors of production, such as capital, to relatively immobile factors, in particular labor. While corporate profits have soared, corporate tax rates have collapsed, producing a cross in tax burdens borne by workers and companies in high-income countries over the past fifty years, as shown in Figure 8.

This dynamic is at the heart of what we call the “corporate power narrative.” For this narrative, the real winners from economic globalization are footloose multinational companies that have been able to take advantage of global markets to produce anywhere, sell everywhere, and pay back as little as possible through taxes. Proponents of this narrative accuse multinational companies of using their power to shape domestic and international rules in areas that advantage them, such as trade and investment, while lobbying against effective rules on subjects that might disadvantage them, especially taxation. In doing so, corporate power entrenches inequality.

Complexity and connections

Our debates about economic globalization tend to be siloed or polarized. Proponents of a given narrative will typically focus on one aspect of economic globalization, calling attention to the importance of a particular hockey stick or cross that epitomizes their cause, while largely ignoring the others. If we want to understand the complexity of the issues facing us—such that we can move toward useful interventions—we need to find ways of simultaneously keeping all these hockey sticks and crosses in our minds.

Filed Under