“Plumbing” is the metaphor of choice for describing how sanctions work. Sanctions are intended to stop the flow of money to the targeted government; reserves are frozen, trade is blocked, export revenues dry up, and government budgets are drained. Even the evasion of sanctions is discussed in hydraulic terms. When asked about the circumvention of sanctions against Russia earlier this year, Linda Thomas-Greenfield, the United States representative to the United Nations, replied that the Biden administration was “looking at that leakage.” “Every place we see leakage,” she said, “we’re stopping it up.” (On some occasions, the image becomes literal: EU export controls ban the export of “bidets, toilets, cisterns, and similar plumbing fixtures” to Russia.)

The plumbing metaphor reflects a highly mechanical and often misleading understanding of economic coercion. In a recent statement, Treasury Secretary Janet Yellen acknowledged that while US sanctions on Iran “have created a real economic crisis in the country,” the measures have not “forced a change in behavior.” Yellen’s admission speaks to a broader and growing concern over the efficacy of sanctions. Even measures that demonstrably hurt the targeted economy—by blocking flows and draining budgets—may not lead to a change in the behaviors that spurred their imposition. In sanctions policy, the targeted economy is treated as a static system—a machine. But to really understand sanctions, we must investigate how actors in a complex system relate to one another, and how changes in those relationships can change the system itself. The distributional effects of sanctions matter most.

Iran has been subjected to the world’s most extensive sanctions program for the better part of the last decade. Its experience is instructive: while sanctions were intended to target the country’s elite, the wealthiest households have fared far better than the poorest during the period. In fact, it appears that sanctions rigged the game, enabling a structural transformation of the economy that helped Iran’s richest households take a greater share of the nation’s wealth.

Distributional effects

Broad economic sanctions are intended to reduce the integration of the targeted economy (or key sectors in that economy) with Western economies (or the global economy more broadly). Targeted sanctions have the same goal but aim to impact specific firms or individuals. In the last two decades, over 9,000 entities have been designated by the Treasury Department’s Office of Foreign Assets Control (OFAC). Isolation is meant to lead to negative economic outcomes for the targeted state, sector, entity, or individual, in turn reducing the target’s power. But changes in relative power are often outside the scope of sanctions programs.

In a recent paper, Reiner Eichenberger and David Stadelmann identify ten channels by which sanctions “shift the relative power between citizens and autocrats in favor of the latter.” For this reason, they argue, “autocratic leaders may quickly learn to love economic sanctions, especially if sanctions are used as a substitute for military action by the sender.” Even when cut out from the global economy, a powerful state can continue to dominate the regional economy, a powerful sector can still dominate the domestic economy, a powerful firm can still dominate a sector, and a powerful individual can still dominate a firm or government institution.

The US first imposed sanctions on Iran in 1979 in response to the Islamic Revolution and the Iran hostage crisis. These sanctions were expanded by the Clinton administration in 1996 to block most US companies from the Iranian market. Despite the American embargo, Iran’s economy continued to benefit from foreign investment, largely European, until concerns grew over the possible proliferation risks posed by the country’s nuclear program.

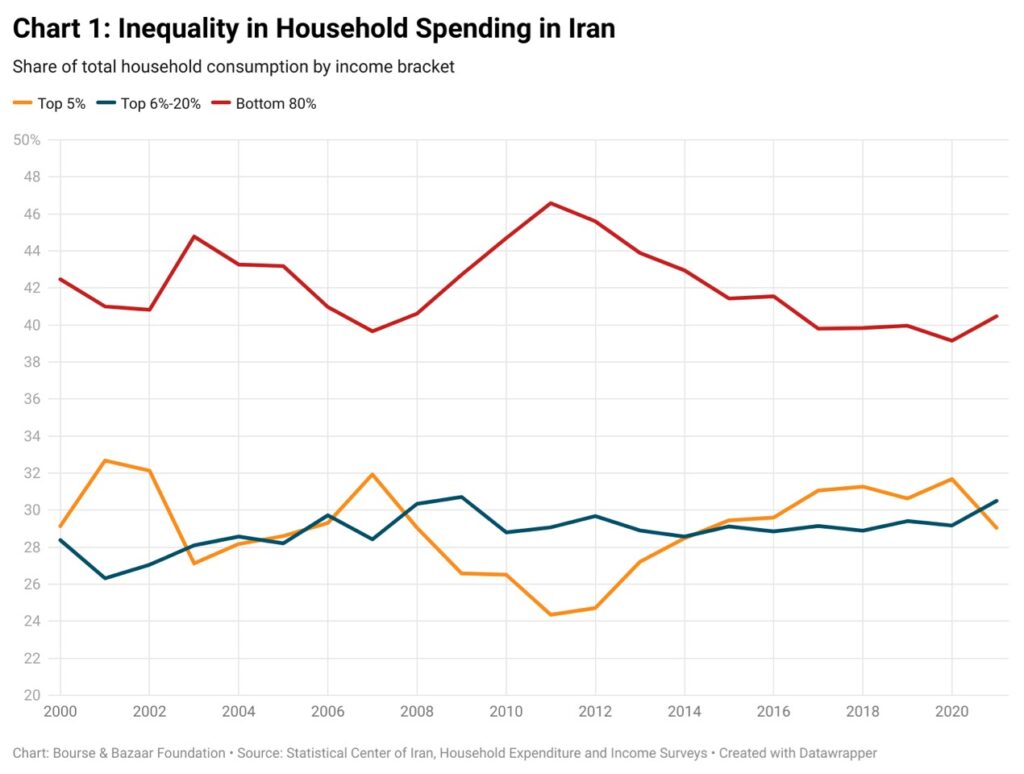

We use household expenditure to examine the circumstances of the top 5 percent of households in Iran since 2002, covering a two-decade period of shifting sanctions policy.1 In 2008, the United Nations Security Council passed Resolution 1803, which marked the beginning of a multilateral sanctions campaign targeting Iran’s economy. Still, between 2007 and 2012, thanks in part to redistributive government policies, the income share of Iran’s rich—those in the top 5 percent of households—decreased while those in lower income groups made substantial welfare gains; Iranian society was becoming more equal. In part, state elites had decided to redistribute in response to the 2009 Green Movement protests, which had put pressure on the conservative Ahmadinejad government to double-down on its populist agenda.

In 2012, however, things changed. The Obama administration expanded its sanctions to disconnect Iranian banks from the global financial system and block Iranian oil exports. This threw Iran into its first recession in nearly two decades, leading to a period of fiscal austerity that coincided with an increase in the top 5 percent’s income share. At the same time, those at the lower end of the income scale saw their consumption decline. By 2020, the top 5 percent accounted for a staggering 35 percent of total household expenditures in Iran. This figure was on par with the early 2000s, suggesting that the major redistributive projects introduced in the interim period—monthly cash transfers, the workers’ Justice Shares program, the Mehr mass housing project, and the Rouhanicare healthcare program—failed to sustainably reduce and contain inequality as sanctions squeezed Iran’s economy.

While the implementation of the Iran nuclear deal in January 2016 saw the lifting of EU and UN sanctions and the rollback of most US secondary sanctions, this relief was short lived. In May 2018, the Trump administration reimposed secondary sanctions on Iran as part of its unilateral withdrawal from the nuclear deal. Once again, Iran’s economy was thrust into a recession, soon made worse by the Covid-19 pandemic. By the end of 2022, economic data pointed to a painful, decade-long period of stagnation in Iran. But upon closer review, the adaptation of the Iranian economy to sanctions has been surprisingly dynamic. Amid the high-level impacts of contracting GDP, declining trade turnover, and a weakening currency, Iran’s wealthiest households have nonetheless won substantial economic gains under sanctions.

As illustrated in Chart 1, the rise in inequality after 2013 can be mostly attributed to the sharp increase in wealth in the top 5 percentile, with those in the bottom 80 percentile of income distribution taking the hit. The expenditure share of the top 5 percent is likely an underestimate. Individuals tend to underreport their income and expenses on household budget surveys, especially at the top of the income distribution. As per the survey data, the median household in the top 1 percent spent $109,000 (PPP adjusted) in 2021. There are certainly Iranian households spending many times that figure who are not represented in the survey sample—the income distribution has a long tail. By comparison, the top 6–20 percent of households in the income distribution only managed to retain their spending share. All other households were worse off in 2021 than in 2011, before Obama’s sanctions changed Iran’s economic trajectory.

Rising profits

Iranian politicians, pundits, and the public often blame corruption for the growing gap between rich and poor. But not everyone who is getting richer is engaged in corruption—the top 5 percent of the income distribution comprises approximately 1 million households. Growing inequality is the result of a structural transformation in Iran’s economy, spurred by sanctions.

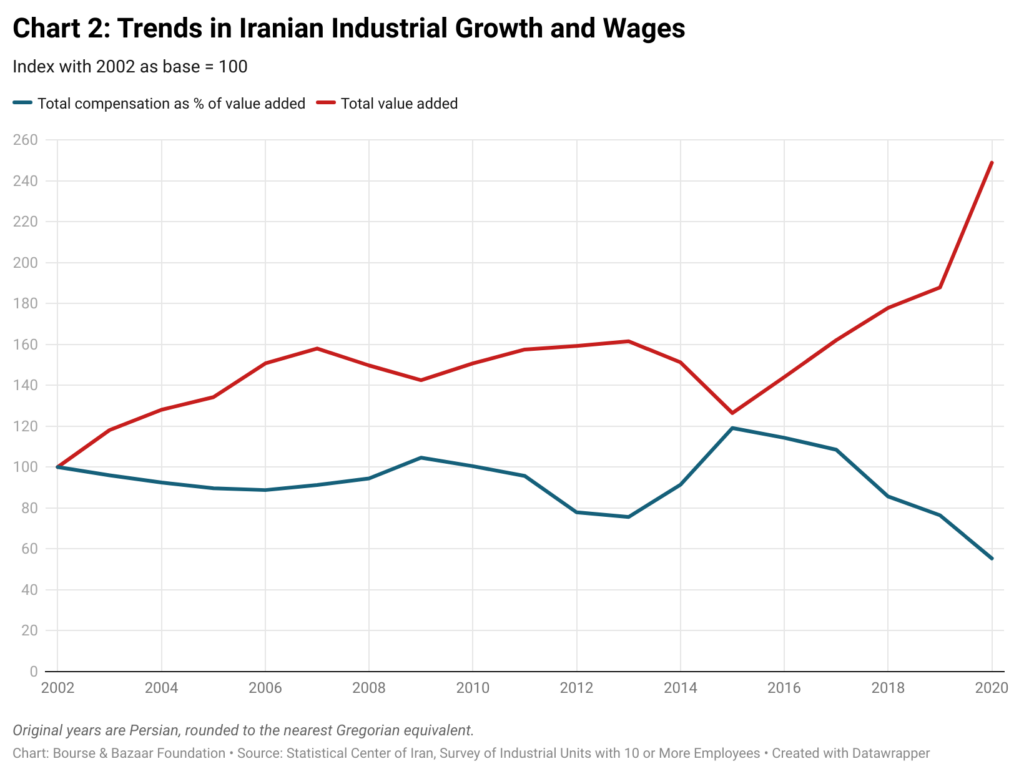

Compelling evidence for this structural transformation can be seen in data from Iran’s industrial sector. After a few difficult years in the early to mid-2010s, manufacturers found ways to grow under sanctions, burnishing the fortunes of Iran’s shareholder class. Sanctions did lead to a drop in investment as the cost of capital surged and most manufacturers were constrained by their existing capital stock. But sanctions also fundamentally altered price structures associated with production and international trade. Manufacturers took advantage of import-substitution and renewed export competitiveness to expand production in certain fields. In real terms, total value added in large-scale industry has doubled since 2015.

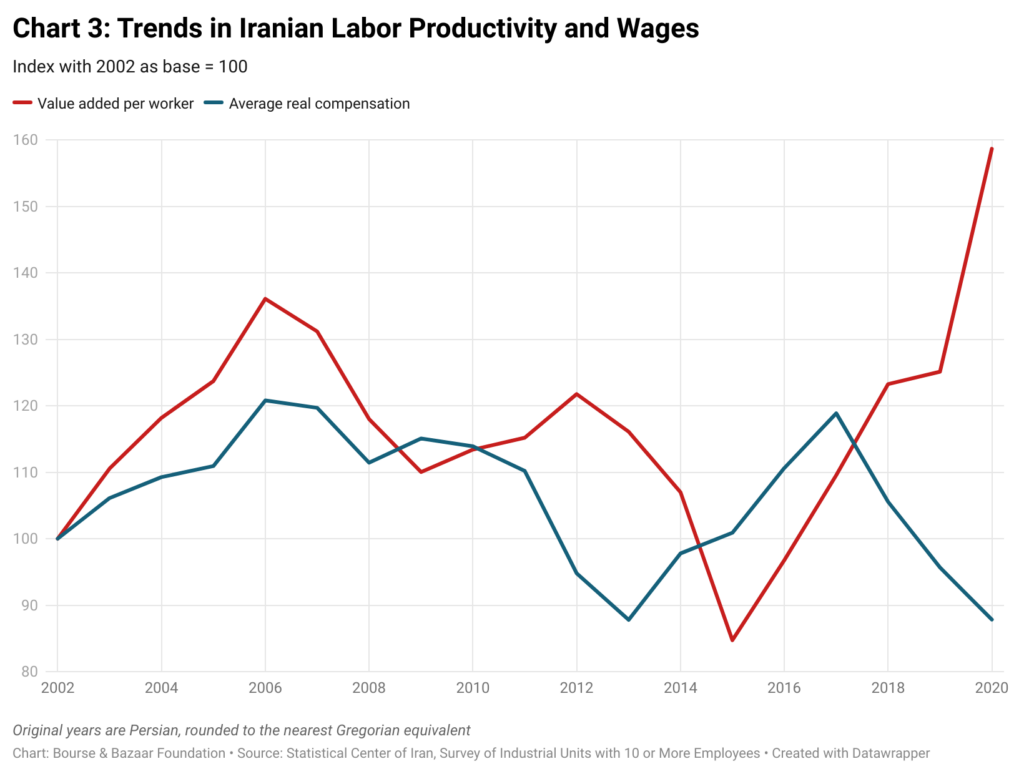

Firms seeking to boost output to capitalize on the new price structures could not simply invest in new technology. Instead, manufacturers prioritized efficiency and repressed wages, enabling them to take home a larger share of the revenues as profit. Chart 2 shows that the imposition of sanctions in 2011–13 and 2018–20 is associated with a sharp reduction in the wage share in total value added. Total labor compensation as a share of total value added dropped to a low of 14 percent in 2020, down from an average of 24 percent in the 2000s. Chart 3 depicts the dynamic in more detail: sanctions substantially reduced workers’ real pay. Average compensation in large industrial enterprises in 2020 stood 22 percent below its 2000s average. At the same time, sanctions raised average labor productivity—not primarily through mass lay-offs in the industrial sector, but rather by increasing output per retained worker. Industrial workers in Iran have become more productive, but most of their additional output is accruing to the owners and managers of capital.

This insight is corroborated by financial disclosures showing Iran’s publicly traded firms have become more profitable, even as the economy has experienced high inflation. Since President Trump reimposed sanctions, the average profit margin of firms listed on the Tehran Stock Exchange (excluding the financial sector) has risen to 26 percent, up from an average of 11 percent in the four years leading up to March 2018, a period in which inflation was elevated but under control.

Sparking increased profits and growing inequality, sanctions facilitated a structural transformation of the Iranian economy that favored those who control capital. Sanctions entrenched and empowered Iran’s elite by halting the economic redistribution that had been underway prior to 2012. These distributional effects may help explain why, as Yellen put it, “a real economic crisis” has failed to coerce Iran to change its behavior. The people most desperate for sanctions relief are those with the least influence in Iran’s political economy, and their influence continues to diminish because the pain of sanctions is distributed unequally.

The Statistical Center of Iran publishes its own tables on household expenditure according to deciles, but these tables fail to reflect the true extent of inequality given how in a developing country such as Iran, even the top decile of the income distribution comprises much of what is generally understood as its “middle class,” namely households led by state employees and professionals living in big cities.

↩

Filed Under