Lea este articulo en español / Leia o artigo em português.

Since the discovery of some of the world’s largest oil reserves in 2015, Guyana has entered a period of economic and geostrategic reconfiguration. According to the Energy Information Administration (EIA), Guyana holds the sixth-largest oil reserves in the Americas and the nineteenth largest in the world. With high quality product, below average production costs, and low local consumption, the reserves have enormous export potential—per capita, Guyana has quickly become the highest producer of oil in the world.

It remains to be seen whether Guyana can capitalize on this historic opportunity. The existing agreement signed between the Guyanese government and ExxonMobil favors the American multinational, allocating only 54 percent of revenues to Guyana and burdening the government with taxes and development costs. In July 2017, the IMF’s Fiscal Affairs Department wrote in a restricted report that the contract was “too generous to the investor” and contained “a series of loopholes,” stating that the “existing production sharing arrangements appear to have royalty rates well below what is observed internationally.”

In order to take advantage of its resource wealth, the Guyanese government must navigate a complex web of international and domestic pressures. The oil discovery has reignited longstanding imperial tensions and introduced new ones. Territorial disputes with Venezuela and regional rivalries between the US, China, and Russia have aggravated domestic instabilities. As production expands, Guyana has again become a battleground for geopolitical ambitions.1

Great power struggle

Guyana is located near the Atlantic Ocean and the Great Caribbean, in close proximity to the Panama Canal. It shares a border with Brazil, Venezuela, and Suriname—the latter two of which have persistently engaged in territorial disputes. Prior to the oil discovery, Guyana operated as a minor agricultural economy, highly dependent on export revenues from sugar, rice, gold, timber, and bauxite. Despite its location and mineral reserves, it remains the second poorest country in South America, with one third of the population living below the poverty line.2

American interests in Guyana date back to the nineteenth century, when geopolitical thinkers like Alfred Mahan characterized the Caribbean Sea and Gulf of Mexico as the “American Mediterranean.” Mahan argued that control over the region, particularly through the construction of the Panama Canal, would grant the US navy easy mobility between the Atlantic and Pacific, allowing it to quickly assemble its fleets without dividing them between two oceans, offering a safe commercial route for exports, and enabling it to block entry for military and economic rivals.

In the postwar period, this perspective was revived by Nicholas Spykman, who argued that South America is divided from “the American Mediterranean” through the Amazon Forest and Andes Mountains. Included in this conception of American territory was a large portion of Mexico, island chains along Central America, and northern South American countries like Venezuela and Colombia. With its proximity to the bi-oceanic choke point, Guyana was at the heart of this territory. It was in the US’s imperial interest to ensure that the state remained entirely dependent economically and militarily. It’s no coincidence, then, that along with Honduras, Aruba and Curaçao, El Salvador, Colombia, and Suriname, Guyana has long been forced to act as a military base and a defender of US regional interests.3 The discovery of oil has only exacerbated these imperial aspirations.

The US is not the only power invested in the future of Guyana. Guyana and Brazil share a 1605 kilometer porous land frontier in the Amazon. In the late nineteenth and early twentieth centuries, Brazilian military commanders like Mário Travassos and Carlos Meira Mattos viewed Guyana as a platform to access ports across the north of the continent, the Caribbean, and the South Atlantic. Guyana was seen as the ideal point from which to defend against US encroachments into South America. The rich strategic resources of the Amazon, it was held, would attract “external greed,” thereby necessitating close integration between the Amazon countries. In more recent decades, Brazil has acted on these goals through the promotion of a transnational development pole between Brazil, Guyana, and Venezuela. This aim, too, has been amplified by the oil discovery.

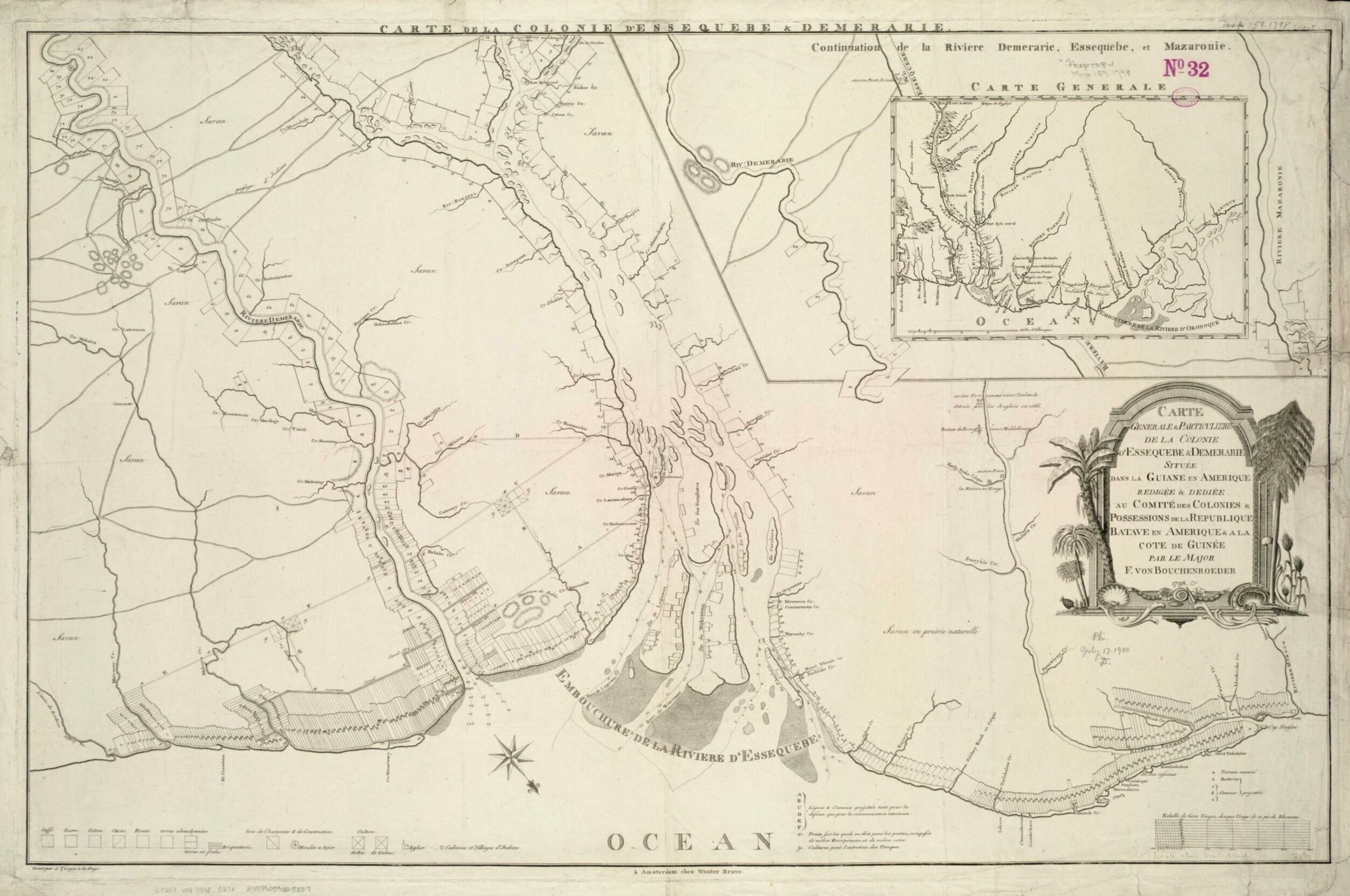

Venezuela’s highly contested relationship to Guyana revolves around a territorial dispute over the Essequibo and maritime zones dating back to 1841, when British colonial powers invaded this rich territory. Though the dispute was nominally resolved in 1899 through international arbitration, it was never fully laid to rest. Venezuelan thinkers like Ruben Castillo presented the territorial loss as a disaster for Venezuela’s security and economy. In the 1960s, a new Venezuelan reading of the 1899 case led to renewed complaints filed to the United Nations (UN) in 1963 and 1965, holding that the earlier arbitration was skewed by British tampering with cartographic evidence and an imbalanced composition of the court. The result, according to Venezuelan legal theorists, was a “compromise obtained by extortion.”

Following a commission of inquiry in 1966, Guyana and Venezuela signed the Protocol of Port of Spain, which suspended any claim to sovereignty over the territory for the following twelve years. Under the government of Hugo Chavez, a spirit of cooperation and integration ensued—including the forgiving of Guyanese debts with Venezuela and, under subsequent administrations, the exchange of rice and oil under the PetroCaribe agreements signed in 2009.4

Exxon steps in

With limited state capacity for extraction, processing, or regulation, research and exploitation of Guyana’s oil resources have been largely conducted by foreign companies—prominently American ones. ExxonMobil’s interest in Guyana dates back to the mid-1990s, when the company identified the country’s deep waters as an “area of interest for oil” after completing a series of geological surveys. In 1999, a subsidiary signed an agreement to drill, in a vast offshore concession. For years the company accomplished little, mainly because of the maritime border dispute between Guyana and Suriname, which began in 2000 and was resolved in 2007, paving the way for Exxon to restart exploration a year later.

In May 2015, Exxon announced its first major discovery in Guyana: the Liza 1 field. By 2020, Exxon had invested around $5 billion in Guyanese oil production; thus far, eighteen wells in the Stabroek block have been found, located about 200 kilometers off the coast of the capital Georgetown, in waters between 1500 and 1900 meters deep, the reserves approximately 3.6 kilometers below the seabed.5 Most of the wells are in the eastern territory of the Guyanese coast, outside of the Essequibo region.

Thus far, Guyana has not been able to meet the technological or skilled labor requirements necessary to develop its energy industry. Nonetheless, aspirations to build state capacity and increase investment have been the driving force behind domestic policy over the past decade. In 2018, the government announced its intent to form a national oil company and apply a local content policy, creating logistics centers and specialized scientific and technological institutes in addition to formulating appropriate tax legislation. Raphael Trotman, then minister of natural resources, made such plans explicit, while the ministry drafted local content policies. But no progress has been made; the prospect of a national oil company was last mentioned by the government in 2020.6 Faced with a major lack of capacity, the Guyanese government took on a $20 million loan from the World Bank in 2019, directed towards developing administrative and regulatory capacities in the oil sector, which currently depends on skilled laborers from neighboring countries like Trinidad and Tobago, Venezuela, Brazil, and the US.7 Unsurprisingly, Exxon and other large, private oil companies have been able to exploit the nascent stages of the industry by co-opting and influencing domestic politics. The existing ethnic and political divisions in the country have offered an ideal environment for such outside interventions. Since Guyana gained independence from the UK in 1966, the Indo-Guyanese population, making up 40 percent of the country and represented by the People’s Progressive Party (PPP), has contested power with A Partnership for National Unity (APNU), which represents the Afro-Guyanese population, who make up 30 percent of the country.

In May 2015, the opposition APNU party, led by David Granger, won the Guyanese general elections, ending the PPP’s twenty-three-year cycle of incumbency. The APNU’s coalition government held a fragile majority, leading by only one seat. Just nine days after the election, ExxonMobil announced the success of Stabroek oil discoveries. The following year, Granger’s government signed a new contract with ExxonMobil that revised and amended the 1999 agreement. Despite some additional earnings for Guyana, the contract overwhelmingly favored the oil company. Many Guyanese citizens objected to the lack of transparency surrounding the contract. A clause granting an $18 million bonus to the government upon the contract’s signing generated even more suspicion.

When the contract was finally released to the public, it revealed enormous missed opportunities. Open Oil, a German analytics company, estimated that Guyana would absorb no more than 54 percent of the contract’s economic resources. For comparison, Ghana’s deal for offshore oil granted it 64 percent. A thorough analysis of the contract points out that in terms of area, the Guyana lease is more than 100 times larger than the US lease on the Gulf of Mexico. The Guyanese government will pay taxes on behalf of the contractor and is responsible for reimbursing all development costs in order to gain access to investment revenues, estimated at $20 billion by 2024. A contractual provision also prohibits Guyana from unilaterally renegotiating, amending, or modifying the agreement. 45 percent of the stakes in the Stabroek block are held by a consortium composed of a private US company called Hess Guyana Exploration and the state-owned China National Offshore Oil Corporation (CNOOC); the contract requires that the consortium be indemnified if any government action impairs the accrued economic benefits.

Commercial production in Stabroek began in late 2019. Exxon was already producing 98,000 barrels of oil per day at Liza 1 in July 2020, aiming to reach 120,000 barrels the following month, and 750,000 barrels per day by 2025. If successful, these numbers would make Guyana the sixth-largest oil producer in the Americas.8 However, the Guyanese government recently estimated that the consortium produced and sold 31.8 million barrels in 2020 (87,000/day), its first full year of production, failing to meet the annual target of 100,000 barrels per day.9

Some estimates suggest that future production has the potential to quadruple the country’s current GDP, with annual inflows of $15 billion; government revenues could reach $5 billion by the end of the next decade. Bolder estimates suggest that extraction could yield between $7 billion and $27 billion in gross revenues per year over the next thirty years.10 The excitement over the discovery was so great that Neil Chapman, a member of Exxon’s board of directors, called it “a fairy tale.”11 Later in 2018, Rex Tillerson, ex-CEO of Exxon and former US secretary of state, claimed that the discoveries made it possible to “make our hemisphere the undisputed center of global energy supply.”12

These expectations have thus far shown to be over-ambitious. Exxon’s 25 percent return to investors in 2012 dropped to 6.5 percent in 2019, while its market capitalization dropped from $527 billion in 2007 to $150 billion today. With Exxon recently announcing that it would cut investments, the project in Guyana has become the key strategic asset for the company as it struggles to maintain investor confidence.

The return of empire

In the meantime, the discovery of oil has also reignited century old global and regional disputes—such as tensions between Guyana and Venezuela. In 2007, Exxon cleared the way for its initial forays into Guyana just as Hugo Chavez nationalized projects managed by British Petroleum, Exxon, Chevron, Conoco Philips, Total and Statoil—projects constituting 25 percent of Venezuela’s oil production with more than US $17 billion in investments. Exxon soon entered into extended legal disputes against the Venezuelan government around oil exploration only to be defeated in court, suffering large financial losses.13 In October 2013, a Venezuelan navy ship intercepted an oil exploration vessel owned by the Texas company Anadarko Petroleum, escorting it and arresting its crew, which included five Americans. Opposition to the US and greater appropriation of oil revenue had been cornerstones of Chavez’s platform since the CIA-backed attempted military coup in 2002.

Following Exxon’s 2015 discovery, the Venezuelan Navy declared an “integral defense zone” covering the maritime area in dispute with Guyana. The Guyanese government, supported by Colombia and Suriname, rejected this claim, promising to take the issue to the UN, Organization of American States, Caribbean Community (CARICOM), and the Commonwealth.14 The case was once again submitted to the International Court of Justice, with Guyana’s lawyers paid through Exxon profits.

Rising territorial disputes with Venezuela pushed Guyana even further into US hands, tying Guyanese defense with the economic interests of Exxon. The US has closely allied with Guyana to defend its strategic access to resources and preserve relations with an amicable government hostile to Venezuelan interests. In 2019, between May and August, the US Southern Command of the Armed Forces promoted the annual New Horizons military exercise in Guyana, providing training for its troops in engineering, construction, and medical care, involving a military apparatus disproportionate for the claimed purpose of humanitarian civic assistance. During the closing ceremony, General Andrew Croft, commander of the Southern Air Force, stated that Guyana is in a strategic location at the edge of South America and the Caribbean.15 Analysts have noted that the US military presence in Guyana is a maneuver to encircle Venezuela, adding to the US’s military presence and bases west of the country in Colombia.

The US “war on drugs”—which has ensured a permanent pretext for military action in Latin America—has also extended to Guyana. The country falls under the Caribbean Basin Security Initiative (CBSI), formed by the US to combat drug trafficking in the region.16 The 2017 US National Security Strategy, as well as the US Bureau of Western Hemisphere Affairs’ 2020 US Strategy for Engagement in the Caribbean, determine the policy of engagement to combat drug trafficking and transnational crime in the Caribbean.

US militarization has been met by the increased economic and military presence of external powers allied to the Maduro government, notably China and Russia. The “oil for loan” model committed about half of Venezuelan oil revenues to China and Russia. Although it has a marginal participation in oil exploitation in Guyana, China is nonetheless a crucial actor in the global power dispute and in South America. In July 2018, the government of Guyana signed a memorandum of understanding with China to join the Belt and Road Initiative (BRI), with several projects aimed at transforming the Guyanese city of Lethem into a major commercial center. The Chinese state oil company CNOOC is the third largest operator of the Stabroek block.17 Guyana could be considered another potential target for China’s growing need to locate natural resources outside of its borders.

Between these competing developments, northern South America has again transformed into a battlefront for the great powers. While the US and EU dominate in Guyana and Suriname, Venezuela is host to China and Russia. As the competition over resources intensifies, the Greater Caribbean will continue to be a strategic region for American power—one in which the US government is willing to employ its vast global military presence.

This essay is based on an article published in Contexto Internacional: Padula, Raphael, Matheus de Freitas Cecílio, Igor Candido de Oliveira, and Caio Jorge Prado. “Guyana: Oil, Internal Disputes, the USA and Venezuela”. Contexto Internacional 45, no. 1 (January 2023): e20210031. https://doi.org/10.1590/S0102-8529.20234501e20210031.

↩Gavin Hilson and Tim Laing, “Guyana Gold: A Unique Resource Curse?” The Journal of Development Studies 53, no.2 (2017): 229-248.

↩Luiz Alberto Moniz Bandeira, Geopolítica e Política Exterior: Estados Unidos, Brasil e América do Sul (Brasília: Fundação Alexandre de Gusmão, 2009).

↩Venezuela, Department of Public Information, I’m here to ratify the policy of brotherhood –President Maduro (2014) https://bit.ly/2m86PUX.

↩ExxonMobil, 2019 Financial and Operating Data, https://corporate.exxonmobil.com/-/media/Global/Files/annual-report/2019-Financial-and-Operating-Data.pdf.

↩Guyana, Ministry of Natural Resources, “The Government of Guyana is proactively and responsibly preparing for oil production,” (2016) https://nre.gov.gy/2016/10/07/the-government-of-guyana-is-proactively-and-responsibly-preparing-for-oil-production/; Guyana, Ministry of Natural Resources. “Making the most of our oil and natural gas,” 2017. https://nre.gov.gy/wp-content/uploads/2016/11/Guyana-Draft-Local-Content-Policy-for-the-Petroleum-Sector.pdf (Accessed on June 9, 2020); Guyana, Department of Public Information, “‘Getting it right for 2020’—Minister Trotman says all measures in place for Oil and gas sector,” February 7, 2018, https://dpi.gov.gy/getting-it-right-for-2020-minister-trot-man-says-all-measures-in-place-for-oil-and-gas-sector/; Staff Reporter, “Guyana to establish national oil company soon,” Guyana Chronicle, (May 20, 2018). https://bit.ly/2l46KBr

↩Staff Reporter, “Understanding Energy | World Bank Funding For Energy Industry Management,” Guyana Chronicle, (May 12, 2019). https://bit.ly/2kRVLey; Guyana, Department of Public Information, “Guyana to access US$1.7M advance from World Bank—to build oil and gas capacity,” https://dpi.gov.gy/guyana-to-access-us1-7m-advance-from-world-bank-to-build-oil-and-gas-capacity-part-of-preparations-for-first-oil-in-2020/; Guyana, Department of Public Information, “Guyana receives $7Billion loan from World Bank for support in finance sector,” (July 27, 2018) https://dpi.gov.gy/guyana-receives-7billion-loan-from-world-bank-for-support-in-finance-sector/.

↩ExxonMobil, 2019 Financial and Operating Data.

↩Tom Sanzillo, “Guyana’s Oil Deal: Promise of Quick Cash Will Leave Country Shortchanged,” Institute for Energy Economics and Financial Analysis, (2020) https://ieefa.org/wp-content/uploads/2020/10/Guyana-Oil-Deal_Promise-of-Quick-Cash-Will-Shortchange-Country_October-2020.pdf.

↩Evan Ellis, “Guyana at Risk: Ethnic Politics, Oil, Venezuelan Opportunism and Why It Should Matter to Washington,” Center For Strategic & International Studies (2019).

↩Kevin Crowley, “Exxon’s ‘Fairy Tale’ Discovery in Guyana May Be Just the Start,” Bloomberg (July 24, 2018) https://bloom.bg/2NKzacB.

↩Edward Hunt, “U.S. Diplomats Boost ExxonMobil in Guyana,” The Progressive (March 14, 2019) https://bit.ly/2m0n8mK.

↩BBC Brasil, “Chávez decreta nacionalização de petróleo do Orinoco,” (February 27, 2007). https://bbc.in/2kxBOt5 (Accessed on June 25, 2019); Daniel Arbucias, “Resource nationalism and asymmetric bargaining power: a study of government-MNC strife in Venezuela and Tanzania,” Cambridge Review of International Affairs 10 (2020):1–21.

↩Guyana, Ministry of Natural Resources, “‘Guyana will jealously guard its resources’—Minister Trotman,” 2015 https://nre.gov.gy/2015/06/25/guyana-will-jealously-guard-its-resources-minister-trotman-in-response-to-venezuelas-new-claim/.

↩This marked the third time Guyana participated in the exercise in the past twenty years. Guyana participated in 2004 and 2009, and its 2019 participation was the first after the oil discovery. (Derek Seifert, “Exercise New Horizons 2019 concludes in Guyana,” 12th Air Force Public Affairs (August 26, 2019). https://www.12af.acc.af.mil/News/Article-Display/Article/1943818/exercise-new-horizons-2019-concludes-in-guyana/; US Department of State, Bureau of Western Hemisphere Affairs, US relations with Guyana, 2021. https://www.state.gov/u-s-relations-with-guyana/.)

↩US Department of State, Bureau of Western Hemisphere Affairs, US Strategy for Engagement in the Caribbean, 2020.

↩ExxonMobil, 2019 Financial and Operating Data.

↩

Filed Under