Export Bans. Sanctions. Investment screens. The liberal trading order has been weaponized; security, not efficiency, is the new watchword. And yet, 2023 has seen an all-time high of goods traded across borders. Even bilateral trade between the warring great powers, China and the US, was at a record high of $400 billion in 2022. US imports from ninety countries are higher than ever before. In a series of articles at VoxEU, the trade economist Richard Baldwin debunked the “peak globalization” thesis, arguing that the narrative of “fragmentation” belies the fact that trade in goods and services has been expanding.

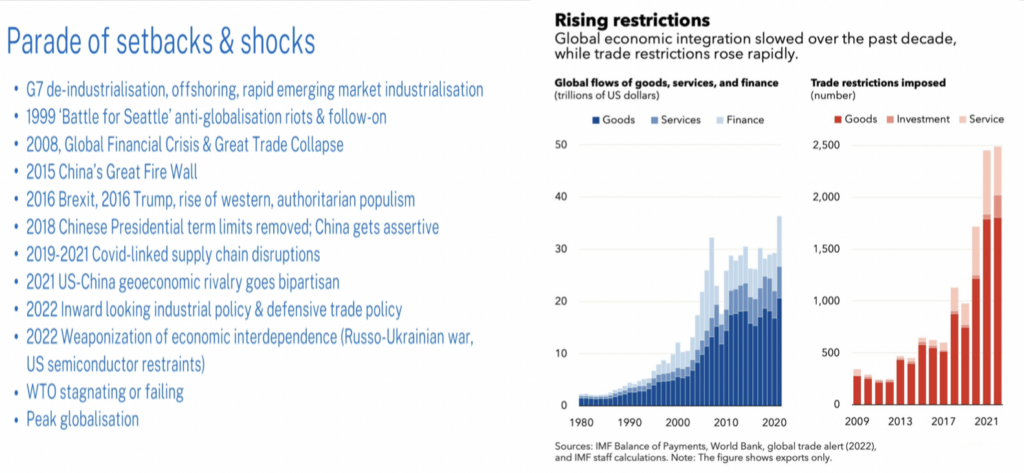

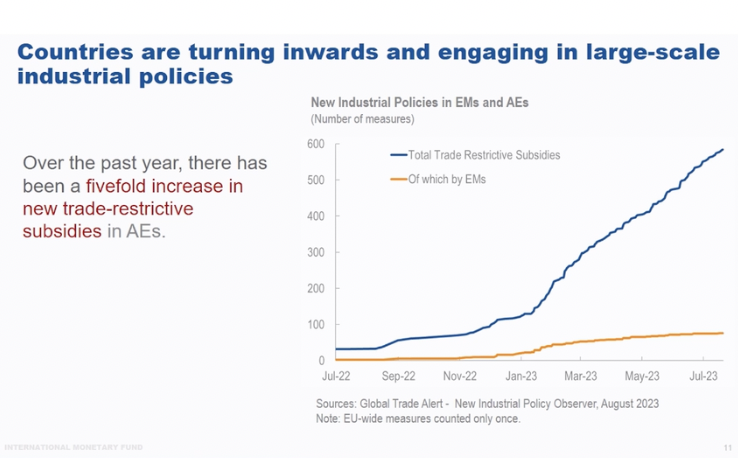

There has indeed been a slowdown in the growth of global trade in goods, which is expected to be “subdued” at 1.7 percent this year, according to the WTO. But growth continues despite the rise in trade restrictions. Those restrictions can be largely attributed to the post-2008 crash and the associated loss in western countries of political majorities that sustained liberal integration of markets. It was Obama, not Trump, who started undermining the WTO’s mechanism of adjudicating trade disputes by not reappointing members to its Appellate Body. After that, Trump’s trade war took the form of tariffs—applied to allies and rivals alike—on countries in Europe and East Asia, all in the name of US national security. The pandemic, Russia’s invasion of Ukraine, and the US chips embargo against China have exacerbated fears of fragmentation. For over thirty years since the fall of the Berlin Wall, what the IMF’s Kristalina Georgieva called a “peace and cooperation dividend” prevailed; now the walls are coming back up.

Continuities

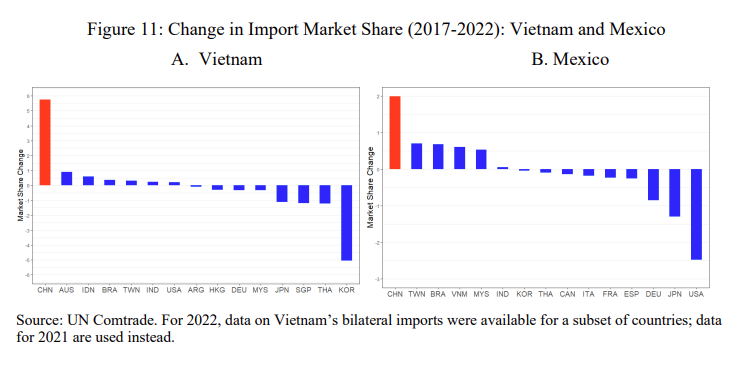

What is the source of resiliency in trade? The first line of defense is hub-and-spoke trading networks that provide alternative supply-chain routes when countries target each other on economic or security grounds. Trump launched a tariff war against China in 2017 but firms on both sides of the conflict were able to flexibly reroute supply chains to avoid those tariffs. A recent paper by Laura Alfaro and David Chor showed that US supply-chain links to China “remain intact,” albeit routed via other countries. Chinese firms ramped up exports and investments in Vietnam and Mexico, and the US in turn boosted Vietnamese and Mexican imports to replace those from China. In response to US tariffs on solar components, for example, Chinese firms established a solar manufacturing industry in Southeast Asia. As for those Chinese products that were spared tariffs—laptops, phones, toys—US imports were over 50 percent higher in August 2022 than four years earlier, before Trump’s trade measures were introduced.

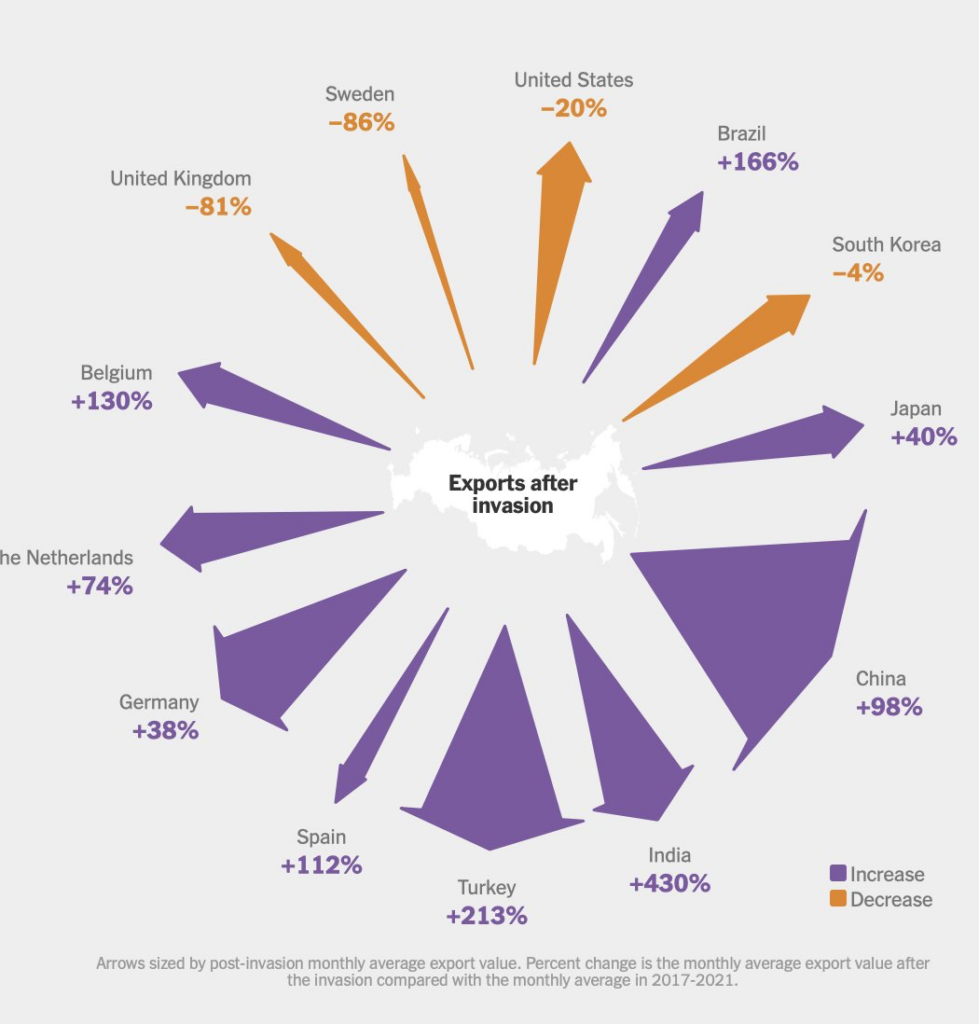

Similarly, Russia’s exports have remained resilient to Western sanctions; food and fuel exports—in terms of both volume and value—have stayed fairly constant since the invasion. The difference is that exports are now going to different buyers in the South and East. India and China are importing Russian crude oil in record volumes and re-selling refined petroleum and diesel to the West.

Identifying drivers of aggregate trade is not straightforward. The notion that globalization has reached its end, according to Baldwin, largely stems from the drop in commodities prices after about 2010. The resilience of global trade may also have something to do with the fact that US firms are producing more than they used to, as production is expanded to keep pace with increasing aggregate global demand. A recent report from the Roosevelt Institute finds that for the US “73 percent of all core items, and 66 percent of services, see prices falling with quantities increasing—a sign of expanding supply.”

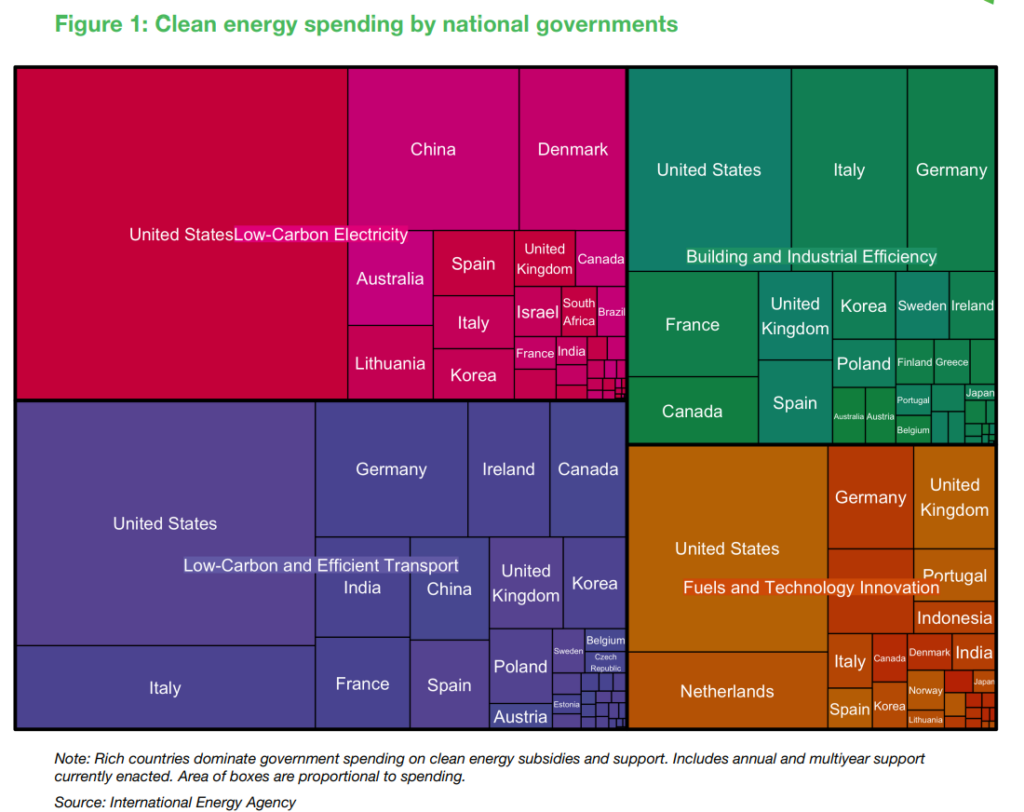

Decarbonization inevitably requires manufacturing—“a billion machines” to replace the stock of polluting ones. UNCTAD estimates that seventeen frontier technologies could create a market of over $9.5 trillion by 2030. So far, rich countries are seizing most of that value. How and where the manufacturing and supply chains of these goods evolve will shape the political economies of virtually every country in the world. The return of industrial policy is necessarily a contest over profit-driven commercial competition, the global division of labor, and distribution of economic power.

Green protectionism and its discontents

For years, climate pledges by countries were expected to include a levy on greenhouse gas emissions, but there is growing recognition that carbon pricing is politically untenable, a development that has coincided with the abandonment of the logic supporting free trade in the global north. The US has left behind the view that free trade is an unabated good. “Market access is a privilege, not a right,” Jennifer Harris, formerly in the Biden administration, said in April.

As a bipartisan consensus in the US pivots on free trade, and China persists with advanced manufacturing, Europe has been caught off balance. Germany’s car manufacturers, having for years successfully slowed EV-friendly policies, are now seeing their sales in China significantly eroded by local EVs. Moreover, Chinese vehicles—primarily electric—are quickly gaining share in the European market, rising from zero to eight percent between three years ago and now. The industry is so alarmed that the European Commission says it will probe Chinese EV subsidies and is threatening to impose tariffs.

In contrast to the US and China, Europe has done relatively little to nurture new climate-aligned manufacturing sectors. The EU has sought, however, to protect incumbent industries from the trade-related effects of its own carbon pricing. The EU Carbon Border Adjustment Mechanism begins operation next month; it paves the way for levies on imports such as steel from countries that don’t have carbon pricing. When the financial penalties are phased in, this could cost African exporting countries as much as $25 billion a year.

Enacting meaningful climate policies in democratic countries often means accommodating the demands of certain domestic industries. For instance, the EU has given over €100 bn in excess emissions permits to favored industries such as steel and cement. The challenge is to avoid driving actual fragmentation that would undermine collaboration and trade. Protecting domestic manufacturers of green goods can undermine decarbonization, either directly, by limiting availability of the lowest cost clean technology, or indirectly, by encouraging tit-for-tat, “race to the bottom” tactics feared by globalists and climate advocates alike.

Technology transfers

For decades, developing countries have relied on a strategy of importing machinery, production processes, and technology licenses from advanced countries. The understanding that climate mitigation and adaptation would require the transmission of technology from north to south was institutionalized in 1992 at the beginning of UN Climate negotiations. The Rio Declaration states that newly developed technologies must be “in the public domain” and made accessible to developing countries “at affordable prices.”

China’s success in assimilating industrial knowhow and, especially since 2008, innovating and leading green technologies, has changed the picture of G7 countries holding the tech required by the rest of the world. Other examples include: South Africa’s synthetic fuels, Brazil’s agricultural technologies, and India’s pharmaceuticals. The growth of BRICS will mean more technology transfers between countries in the global South, and indeed from countries in the South to the North.

| Donor → Recipient country | Technology Transferred | Terms of agreement |

| US → India | GE fighter jet engines; thin film solar manufacturing | GE-HAL co-manufacturing; DFC |

| China → Indonesia | High pressure acid leach to make battery grade nickel | Metallurgical Corporation of China-Indonesian govt |

| EU → Kenya EU → Chile | Green Hydrogen; Sustainable mining | EU global gateway; EU global gateway |

| China → Brazil | Wind turbine manufacturing | Goldwind-Bahia |

| China → US | Iron Phosphate batteries (LFP) | Ford- CATL licensing in Michigan |

| South Africa → Germany | Synthetic aviation fuels | Sasol-HZB joint R&D |

| EU → India, Brazil, South Africa , Bangladesh, Indonesia | mRNA vaccines | WHO Hub program funded by EU, Canada, France. African development bank coordinates transfer to 6 African countries |

Transferring technology is no easy task. It requires patient collaboration between firms and workers to transfer “process knowledge.” Behind every complex product is a community of skilled workers who have tacit knowledge in their minds and hands, which can only be transferred in a process of “learning-by-doing.”

Moreover, technology transfers have to be mandated at a state level and then imposed on firms that will be reluctant to comply in both originator and recipient countries. China has traditionally forced foreign firms to share their tech in return for market access. A key question for all participants is whether new technology will be manufactured in the recipient country or simply assembled there. The recipient country has an interest in maximizing the local value added with its domestic suppliers; the firm from the donor country has an interest in minimizing the value added in local supply chains, allowing it to keep a larger chunk of profit.

A North-South pact?

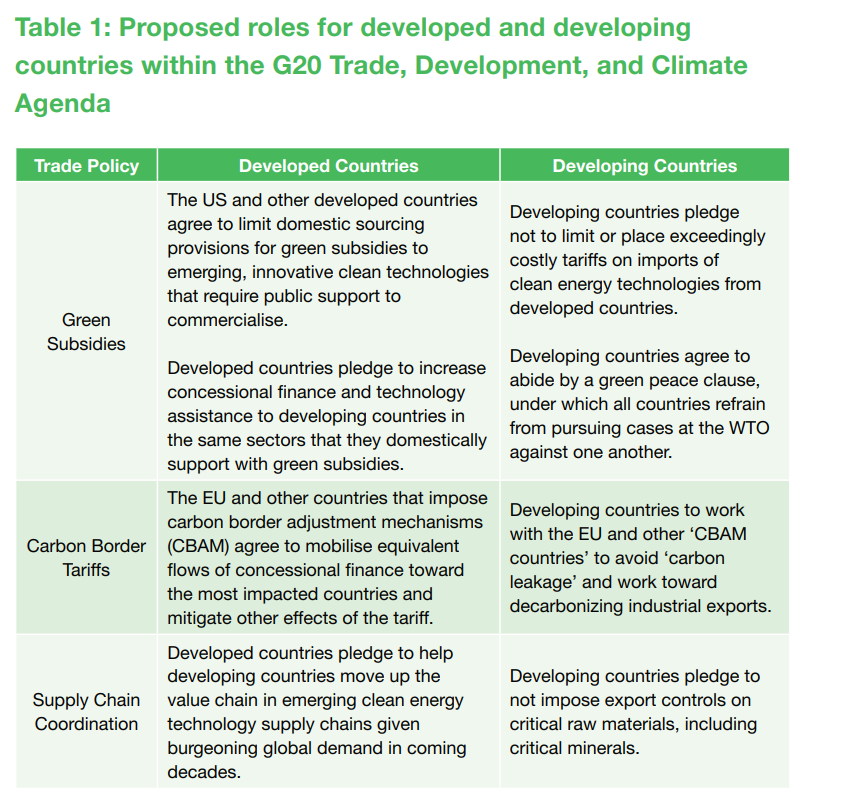

An increasingly broad interplay of industrial policy, development, climate, and geopolitics is now animating trade politics, well beyond the long-fought questions of which goods can be defined as “environmental.” A paper prepared by Shayak Sengupta and Sagatom Saha for the T20 think-tank program ahead of this year’s G20 proposed a pact of sorts between north and south, in which developing countries refrain from putting tariffs on imports or imposing expert controls, while developed countries agree to limit the use of subsidies that favor local companies.

At first glance, this proposal seems far-fetched. Europe is proceeding with schemes to impose a Carbon Border Adjustment Mechanism and has shelved plans to route the proceeds towards developing countries. The US has allocated subsidies for domestically-produced EVs and components. India is providing production-linked incentives to batteries, pharmaceuticals, and automobiles. Indonesia mandated on-shore nickel processing. China’s domestic manufacturing strategy is well known.

Why would a pact work? If governments in the global north fear its supply of minerals being choked off by governments in the south (thanks to export bans or nationalized firms), the latter have fears, too—such as retaliations of capital flight, international arbitration, or sanctions. If one fears polluting industries being offshored or kept alive, the other demands clean technology transfers.

Relations between the US and India bear out some of this logic. Over the past two months, India has dropped all seven of its WTO cases against the US. In return, the US has offered more tech transfers, for example enabling Indian production of parts for GE fighter jets. This allows the US to maintain its local content requirements in clean tech, and preferential subsidies for domestic firms, while India receives transfer agreements in defense and green technology for local manufacturing. Market access wins were declared for exporters, including US agriculture and Indian steel and aluminum.

Mercantilist industrial policy stances can still facilitate the collaboration needed for decarbonization, albeit in a chaotic way. Today’s solar PV technology owes some of its prediction-defying cost declines to the combination of German and Spanish feed-in tariffs and Chinese state-supported manufacturing. In Europe, the cheap EV genie unleashed by Chinese automakers will be difficult to put back in the bottle, not least because of extensive integration between German and Chinese automotive companies. (A similarly intricate level of integration might account for why, more than a decade ago, Germany’s solar manufacturing industry did not mount a strong campaign against cheap Chinese solar.)

The green transition is going to involve conflict. Industrial policy is often said to be about “governments picking winners” but often “losers pick governments,” with ailing incumbent industries vigorously contesting policies that might threaten them, even to their detriment. (For instance, part of why European car manufacturers are being bested by Chinese rivals is that the former has for years sought to hold back and water down EV rules in favor of diesel, e-fuels, or more efficient ICE vehicles.) Trade policy has always involved fierce political struggle between industries/workers/regions that prosper and coalitions who find political champions in legislatures.

In the view of liberal organizations like the IMF or WTO, all restrictive measures and subsidies are net negative. But just as they can help build domestic support for climate policies, these interventions can also be constructive in balancing interests for cooperation among nations.

Filed Under